|

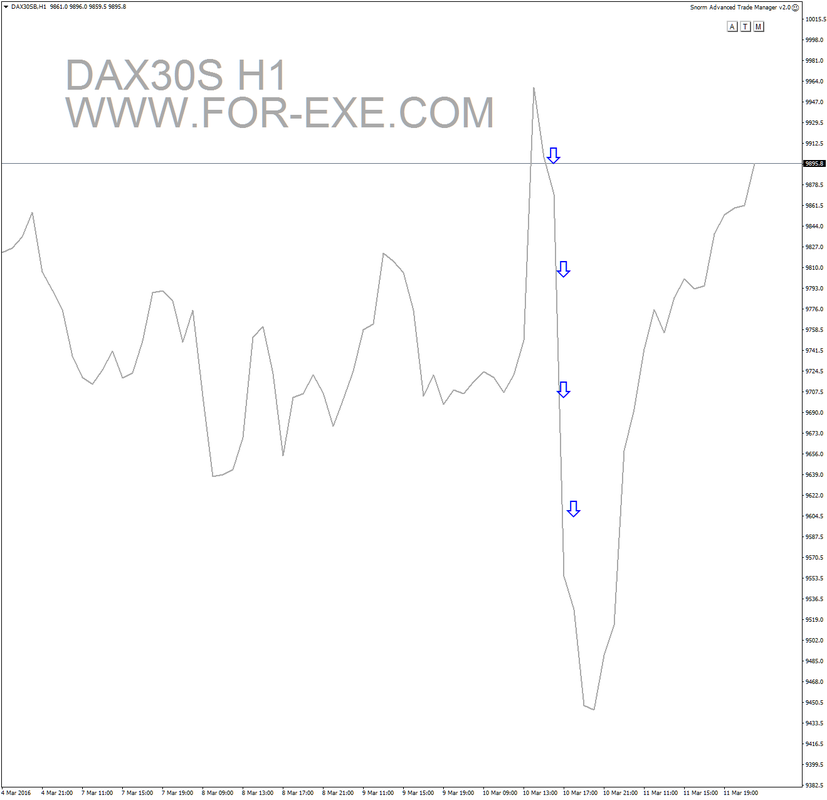

Thursday saw the DAX fall in value by 600 in the space of a few hours, following the ECB's decision to drop the minimum bid rate to zero percent. Crazy stuff but a fantastic opportunity to bolster the trading account if you're careful; or to wipe it out if you're not. We're all told to be wary of trading the "falling knife" - and quite right too. Look at the H1 chart below and you might well ask how anyone could possibly know how to short where the arrows are shown. Apart from being able to short the top, after the news,, there were four or five superb shorting opportunities that were low-risk high-reward but not very obvious using the H1 chart. Now add a BRN indicator (there is one for free in the Free Indicators page - help yourself) and drop to the M1 chart - you might just kick yourself if you were sat on the sidelines on Thursday watching price drop like a bomb without getting a slice of the action. The ,move started with an eWaves W5 at the 10,000 level - the BBRN (Big Big Round Number). Then price plummeted providing further opportunities to add on and join the sellers, as simply as this ... Who says trading has to be complicated?

Who says the M1 time frame is just noise? It started with an eW5 at the 10,000 BBRN and finished with an eW5 at the 9400 BRN. And that's pretty much why eWaves is the only technical indicator that I use for trading.

5 Comments

Ofer Edry

13/3/2016 11:18:45 am

Waww! This BRN indicator working super!!!

Reply

Steve

13/3/2016 11:44:41 am

Sorry Ofer, I only use (and work with) MetaTrader :(

Reply

I'm ready to pay for converting the Snorm ewave alone to ninjatrader, if you agree that

15/3/2016 03:44:54 pm

Reply

Steve

15/3/2016 04:13:11 pm

Perhaps I will look into a version for NinjaT when I've finished my latest version of eWaves. Hopefully later this year. Seems like quite a few people are interested in that.

Reply

Ofer Edry

20/3/2016 12:21:31 pm

Thank you very much

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed