|

Last week (ending 5th October 2018) provided some terrific trade opportunities on DAX and DOW one-minute charts, so it seemed like a good idea to share some of my best trades, to show how eWavesHarmonics can be used on the lower timeframes and the thought process behind taking and managing each one.

The video explains the logic for entering and managing the DOW trade, referred in the last blog post, as well as many others on DAX, that offered amazing returns. 'M1 Trading in One Week', was uploaded to the ‘Extras’ section of the Trader Training Course this morning. Feedback, so far, has been even better than I’d hoped for - I hope you enjoy it too.

0 Comments

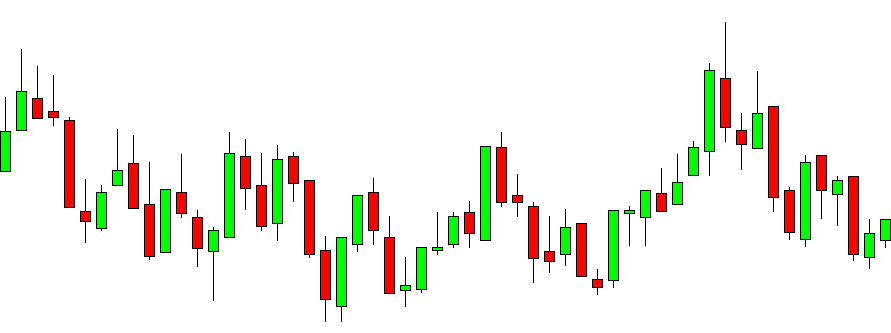

Where is price going to next? Guess correctly for a 15% return on investment - in just 13 minutes.3/10/2018 There is probably enough information, in that picture alone, to tell you that the market is bullish but it would obviously help to see what price was doing to the left of the picture. Sadly, I think it would be fair to say, the majority of retail traders would just see that as congestion and wait for price to break out of the range; which is a safe option but it won't give you the best possible risk to reward. A range-break trade, with stop loss on the other side, could have returned an R:R of 1:1 or, if you held the trade to its peak, 3:1, Not a bad return but if you went long on the very next candle, with stop below the previous, you could have easily gained at least an R:R of 7, just by using ATM's T-Candle, or even double that if you managed the trade yourself, allowing for some corrections. This is a real trade from yesterday, on the DOW 1 minute chart ... That trade was closed by moving the stop loss to the Target Zone 2 level (plotted by eWavesHarmonics - eWH) when price had closed above it. A return of 7.5 which, if 2% was risked, as many traders do, would have given 15% profit. If anyone had wanted to hold the trade longer, a 30% profit could have been realised. I'm a firm believer in the adage - bulls get fed, bears get fed and pigs get slaughtered - so banking a 7.5R trade, like in this example, is a nice stress-free way of trading.

eWH helped to not only show where the buyers and sellers were (the zones have been removed from the above picture, to keep it clean) but presented logical price targets to support trading long. With some knowledge of price action at key levels, as covered in the Trader Training, plus some patience, discipline and a no-fear approach to taking and managing the trades, anyone can benefit from these setups, There have been a few such examples this week on DAX (check the London Open for some great setups) and DOW M1, as well as the main FX pairs on higher timeframes in the past week weeks., . The important thing, as mentioned in past blog posts, is to look for the best possible R:R trades. You can happily be wrong, so many more times than you're right, with 4:1+ trades. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed