|

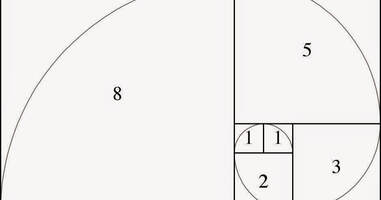

There is often much debate about Fibonacci ratios and which should be used for trading purposes. Try searching the web and you'll be lucky to find a definitive list from a site that is 100% accurate or doesn't have pop-ups and click-bait all over them. I'm often having discussions with my trading friends about which are the correct numbers, so with all that in mind, thought it would be a good idea to create a page dedicated to the subject; that also provides a one-stop reference point without the pop-ups and click-baits and, most importantly, explains how these numbers are calculated.

Here's the link: https://www.for-exe.com/fibonacci-numbers.html

0 Comments

Ethereum USD is in an interesting spot at the moment - looking very much like an ABC back to the 4. Thanks to Sergio, in our Skype Group, for pointing this one out on Friday,

The pink horizontal lines, to the right of the chart, are Fibonacci retracements clusters (using the Clusters tool that comes with eWavesHarmonics) going back to 2016 - they act as nice support zones. I've used the ABC123 indicator, for the corrective move, along with the Fib Expansion and Fib Multiplier (a new addition that's in testing and showing remarkable results) to project the price-magnet clusters: the purple horizontal lines. BTCUSD is in the bottom window - you can see how nicely correlated these instruments are and how BTC is also at support. So we have ABC FE100 back to the 4, price is in the 'golden zone' of the up wave - the 50/62 - and it's at the demand zone: several factors for confluence. Plus it looks like that's a possible small exhaustion gap to the cluster-cluster. If ETH (or indeed the BTC) breaks current support, we can look to the FE127, right at the end of the 4 of the up-move, then the orange zones but, at least for now, this is looking like a nice discounted price to add some Ethereum to your portfolio. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed