|

As most of the regular blog readers will know, I mostly trade DAX and DOW on the M1 charts. It’s a nice way to earn a good living and allows me plenty of time to do other things.

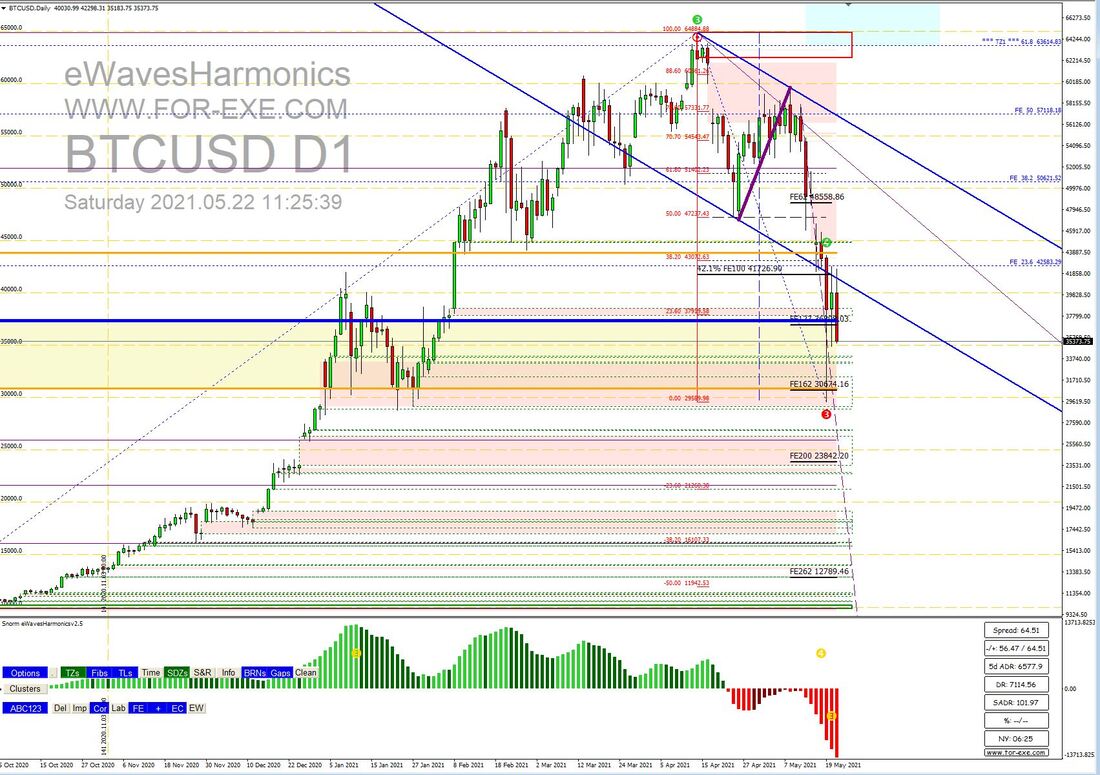

With day trading, you obviously need a certain amount of funds to work with, so what do you do with the rest of your funds, if you should have any spare? You could stick it in a bank and earn less than 1% interest per year; you could invest in managed funds where you might expect anything between 5% and 30+% in a year, if they’re any good (I have invested in such funds and they’re working nicely for me – perhaps a subject for another blog post one day). If you prefer to do things your own way, you can buy equities or trade the daily/weekly/monthly charts on pretty much any instrument that takes your fancy: equities, commodities, forex, indices, etc. For much of this year, I’ve been building a portfolio of cryptocurrencies, as I suspect some of you already have. There is no way I would try to trade them on the lower timeframes – the spread / ADR is ridiculously poor, at least on most brokers that offer them for MT4/MT5; and what they do offer for trading is extremely limited, to a few instruments like BTC, ETH and XRP (all of which are still good for long term investments, in my very humble opinion). I treat cryptocurrencies investments like I would if I were still investing in shares: buy and hold; and most importantly, without leverage. By not using leverage, you have almost no risk – unless the coin is binned of course. What you’ve bought will always be yours and there is no chance that the broker is going to do a margin call on your trades and force-close them. The approach I’ve taken is to look for good value, using some of the basic ideas that I talk about in the trading course (I will add a module on crypto, if there is enough demand). Essentially, as I do for day-trading, I buy the dips – at price levels that I consider to be at, or near, the bottom of corrective waves. Unfortunately, I can’t use eWavesHarmonics on the platforms that I use for analysis, but I do use the same logic that is coded into it. The percentage gains, and losses, that you see daily is often mind-boggling and certainly not for the fainthearted. If you’re not prepared to ride the waves, then stay well away. On one day, you can see a coin increase in value by more than 100%; on another day it can drop by more than 50%. We’ve seen Bitcoin, and most of the altcoins, suffer a massive devaluation these past few weeks, on the back of some Elon Musk bla-bla: from $64k to $30K. Bitcoin seems to be in the news more often that Harry and Megan, which is really saying something. Noob traders panic sell, feeding the bearish frenzy. Us long-term traders just ignore the correction – there have been plenty of such corrections in the past, which have just formed a springboard for new highs. Incidentally, it was so obvious that BTC would fall to $30k just from a basic approach to Elliott Wave analysis (as you might gather from the above chart pic). I think 30K is a fine price to pay, if you’re in this for the long-term – and it’s still very good value, if you fancy it (that’s not investment advice, just my opinion). It could still go lower, we can never really know for sure - we're just looking for discounted prices. You might be wondering what I use to make my trading decisions and investments, if you’ve never traded crypto before. Here’s a very quick summary to get you started … For trading I use Binance and Kraken. I find Binance to be more user friendly for everyday use. Kraken: I just have some very long-term holdings and seldom log into it but it’s still a reputable platform. To find cryptos that I’d like to buy, and to keep track of my portfolio, I use CoinMarketCap. It’s completely free, provides good information on the instruments and I can quickly see the gainers and losers in one place – it’s the losers that get my interest, as a buyer of dips. For technical analysis, I use TradingView. CoinMarketCap has links for viewing any instrument on TradingView, making it the obvious first place to go. I am working on a version of eWaves for TradingView, that (if all goes well) will become a version of eWavesHarmonics in due course. For BTC, ETH and XRP, I just use MT4 and eWavesHarmonics, so that’s nice and easy. There are plenty of good reasons to invest in cryptocurrencies, not least of all their ever-growing market cap and liquidity. I believe they are here for a very long time to come and provide terrific long-term growth potential, that you’re unlikely to see with many other instruments. If you’re looking for some good long-term investments, now might be a good time to go crypto-shopping, given the recent dips in prices across the vast majority of them. Start small, risking money you could burn and be prepared to ride the very big waves.

7 Comments

Just a quick post to let you know that the conversion work, from MT4 to MT5, for Advanced Trade Manager and eWavesHarmonics is going well. Lots of testing required and the inevitable bug fixing but we hope to have release-versions available this month.

Subscribe to the mailing list if you would like to get an early copy - an email will be sent when the first of the two products (probably ATM) is available. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed