|

I’ve had a few emails, in recent months, asking if the Advanced Trade Manager (ATM) hides stop losses and take profit levels from the broker. To save me time in replying with the same responses all the time, I am inspired to write a blog posts that I can refer anxious traders to.

The simple answer to the question is: NO. My question is: why do you feel the need to hide stop and take-profit levels? If you think your broker manipulates price to stop you out of trades, or prevent you from reaching your take-profit level, you seriously need to find a broker you can trust: one that is registered with a well-respected financial regulator, such as the FCA (in the UK) , CFTC or NFA (in the USA). Reputable brokers make their profits on spread or commission charges; they shouldn’t be making money from your losing trades. If you think otherwise, then you seriously need to withdraw your money – if they’ll let you. A good broker will be happy that you’re a successful trader – the more you succeed, the more profit they will make through your continued trading. You’re no good to them if you lose all your trading funds. A dodgy broker will be happy to clear your trading account, hoping that you’ll continue funding through over-stretched credit cards – like the many binary-trade brokers (regulated by dodgy gambling bodies – which should tell you all you need to know) that are now, mostly and thankfully, in the dustbins of history. What are ‘hidden stop losses’ anyway? They don’t really exist but an EA can initiate a buy/sell order, to close your trade at the equivalent of your stop-level. That’s risky … what happens if your platform/computer shuts down when you have an open trade? A non-hidden stop loss is an instruction that’s already with your broker; therefore, there is zero risk to your trading account from your computer failing you. Some people say they can prove that their broker has manipulated price to stop them out. I ask for some chart examples, so I can compare the price bars with my own charts but, to-date, have never received such ‘proof’. It’s simple enough to check price bars from one broker against other brokers. If your broker appears to have spiked a price, where others haven’t, then you need to lodge a complaint with that broker. Repeated occurrences of price-spiking justifies a formal complaint to their regulatory body, if they have one; at the very least, you should change brokers in a hurry. Widening of spreads might also account for some inexplicable stop-outs, for which comparing price bars won’t help much. Again, if that’s something that happens too often, at your stop levels, then send your broker a snotagram and dump them. For most traders who suspect their broker of trading against them, the chances are that they’re just not very smart with their choice of stop-levels. I’m confident enough with my broker that I can put my stop-loss (not hidden) a few pips below what I believe will be the start of Wave 1, for example. This is something that I do often and have never felt hard-done by if I get stopped – it wasn’t the start of Wave 1 after all (this is explained in the Trader Training Course). ATM does offer one 'hidden' feature, in that you can instruct it to move your stop loss (t0 break-even or via trailing-candles/fractals) and take partial profits, at a predefined level. The broker won't see that instruction until they receive it when price reaches the level. This doesn't do away with an almost-obligatory requirement to have a stop loss sitting with the broker already, in the event of a catastrophe on your computer. Be smart with your choice of brokers, you need to be able to trust them like you would your family doctor. Also, be smart with your stop-losses and give price room to breathe.

0 Comments

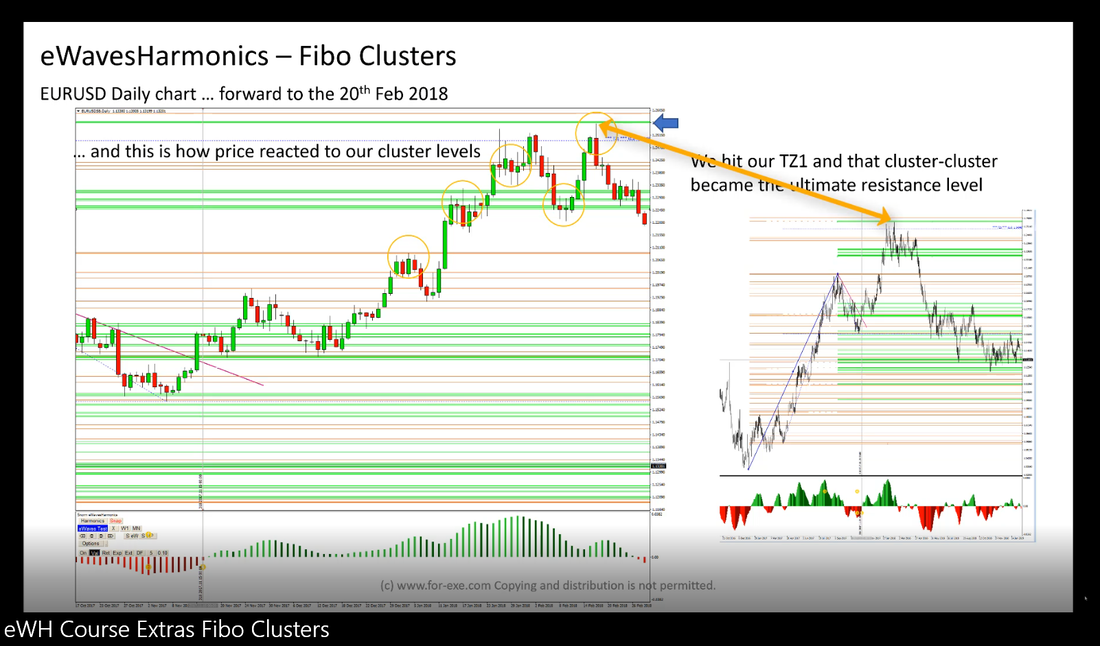

The plan was to make Snorm Fibo Clusters a separate indicator but given its usefulness, it seemed more sensible to integrate it into eWavesHarmonics; so that's what happened.

I've also made a video, for the Training Course, on how to use and trade with Fibo Clusters

eWH version 2.0 is available for download - currently as a beta upgrade. If you have already downloaded the upgrade, you might want to check again - the version uploaded today allows for three degrees of freezes (some eWHers will know what I'm talking about). . Version 2.9b Beta Upgrade is available for download.

New features: - Spread Filter - for traders with variable-spread-brokers ... you might find this handy to stop you entering new trades when the spread gets too large. You can set the 'Max Spread' in the 'Configurable EA Options' panel. I'm using it to switch off DAX trading, outside of London hours, since my broker doubles the spread then (I'm not paying them more than I need to for a trade). 'Third Off' Button can be redefined - to whatever percentage you like, in the 'Button Options' panel. You might prefer 10% or 25%, for example, rather than the previous fixed 33.33%. BE Level for multiple trades - you can choose to hide this now, from the 'Configurable EA Options' panel.. Looking for something else with ATM? Send me an email and I'll see what I can do -providing it's likely to be of benefit to other traders as well :) |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed