|

In my book “Predicting and Trading the News” (ref previous blog post), there is a chapter on trading a certain type of gap, that’s often seen around big news events, as well as during normal trading hours – eWavesHarmonics highlights these gaps very nicely (there was a super one on DOW M1, earlier today).

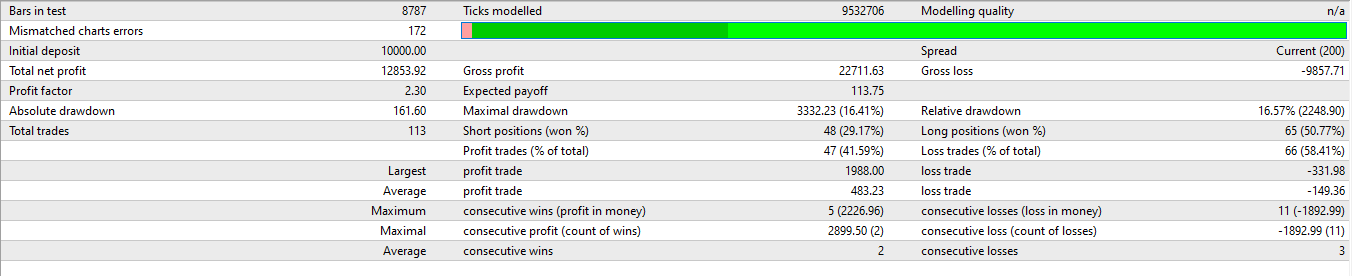

I’ve spent the past month writing an Expert Advisor to trade these specific gaps and back-testing has confirmed just how useful they are. Obviously, like all things to do with technical analysis, nothing works 100% of the time. However, with a good average R:R, you don’t need to have that many winning trades, as can be seen from the above picture. In reality, the win rate from manual trading would be significantly higher but it’s much harder to code a computer to analyse as efficiently as the human brain. The above picture shows the back-testing results for NASD on the M15 chart with a 10k account: 128% return for 2023 to date, with a maximal draw-down of 16.69%. We’re about to start forward-testing now, with a reasonably high degree of confidence that similar results will be seen. Similar returns are being seen on some other instruments, such as DOW, but there are far fewer trades on the main FX pairs, that tend to see less of these gaps. Now you know why I love trading these gaps so much, and why they should play an important role in every trader’s life. It’s too early to say if EA will be made public, when the forward-testing has completed (that needs at least 3 months; ideally a whole year). If you are interested, please subscribe to my mailing list so you don’t miss out. If you want to know what gaps I’m trading, you’ll need to get my book or do the free trading course 😉

0 Comments

|

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed