Fibonacci Numbers and Ratios,

for Technical Analysis and Trading

There seems to be a distinct lack of a definitive guide to Fibonacci numbers and ratios on the web, for the purposes of technical analysis and trading, so this guide has been created to fill that gap. Plenty of sites talk about Fibonacci numbers, some of those have non-Fib ratios that have no meaning at all; some just don't go into enough detail. We hope this page will provide sufficient information for all traders. It doesn't go into the background on the marvellous Leonardo Bonacci or how Fib levels can be seen in nature - visit the Wikipedia page if you're interested in all that.

First things first, the Golden Ratio is 1.618 (1.6180339887499 if you want more digits). This is also known as the Golden Mean

The conjugate of the Golden Ratio is 0.618 (0.6180339887499).

These are the two most important numbers and are derived from the Fibonacci number sequence as follows (there should be two 1s to start but I've left the first one off): -

The conjugate of the Golden Ratio is 0.618 (0.6180339887499).

These are the two most important numbers and are derived from the Fibonacci number sequence as follows (there should be two 1s to start but I've left the first one off): -

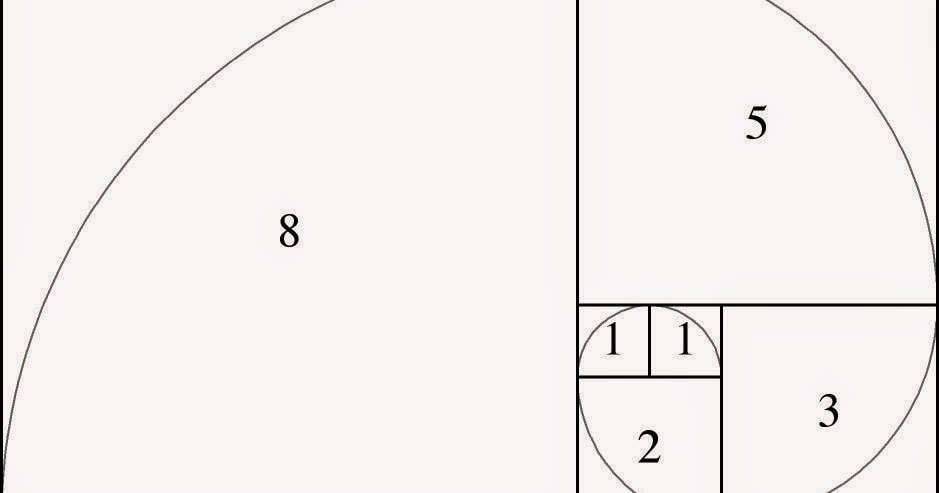

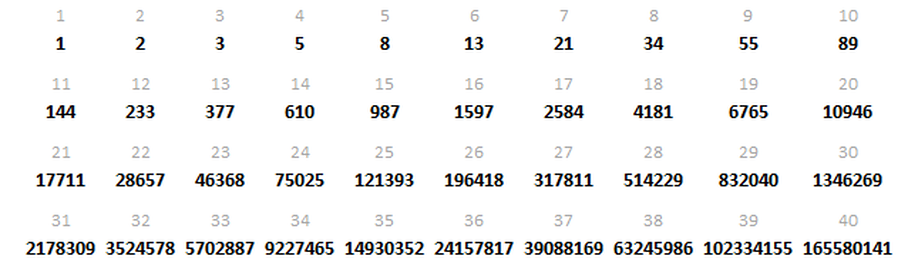

The sequence is formed by simply adding the two previous numbers: 1+1=2; 2+1=3; 3+2=5; 5+3=8; 8+5=13; 13+8=21; etc.

Apart from the first few numbers, it can be seen that the larger number is the Golden Ratio of the previous: -

21/13 = 0.618 and 13 x 1.618 = 21 - that is so for all the subsequent numbers, ad-infinitum.

Apart from the two most important numbers, you will most likely have seen a myriad of other numbers being used in trading, so we'll look at how those have been determined.

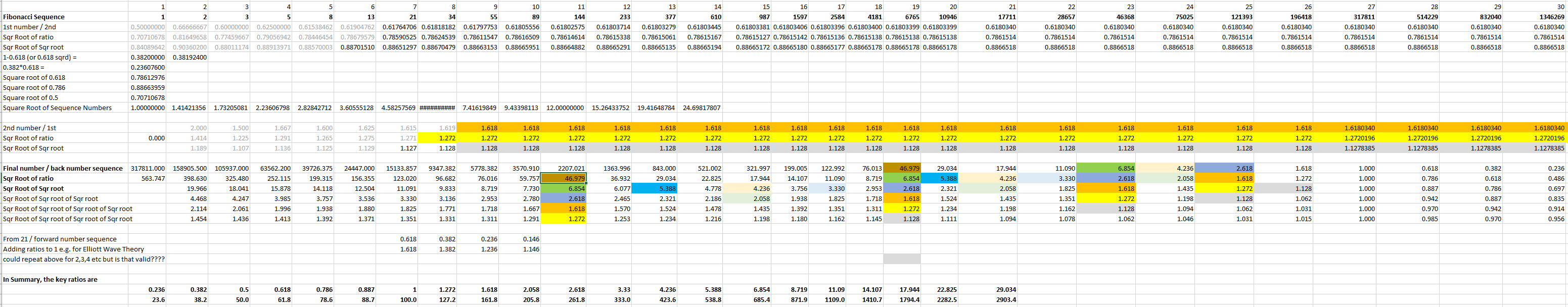

0.382 is the square of 0.618 and also 1-0.618. Further, it is the ratio of one number in the sequence divided by the number two places forward, e.g 9th number which is 55 divided by the 11th number, 144.

0.236 is 0.382 * 0.618. It's also the ratio of one number in the sequence divided by the number three places forward, e.g. 55 divided by 233

0.786 is the square root of 0.618. This is a bit of an odd one because when you multiply or divide any of the numbers in the sequence by 0.786, the results do not appear as any other numbers in the sequence. Nevertheless, it's a commonly used ratio, so we'll included it in our trading ratios - a self-fulfilling prophecy, if you like, because other traders are using it and it evidently works as a potential reversal zone. And so it is with some of the other numbers ...

0.886 is the square root of 0.786

1.272 is the square root of 1.618

1.128 is the square root of 1,272

There are some other key ratios that work with the number sequence and, again, work very well as potential reversal zones and price magnets on the charts ...

2.618 is derived by dividing a number in the sequence by the second number back, e.g. the 27th, 317811, divided by the 25th, 121393. It's also the square root of 6.854

4.236 is derived by dividing a number by the third back, e.g. 317811 by 75025

6.854 by dividing by the fourth back, e.g. 317811 by 46368

11.090 by the fifth back

17.944 by the sixth back

29.034 by the seventh back

46.979 by the eighth back

etc.

You can then take the square root of these key ratios ...

Sqr Root of 2,618 = 1.618 the sqr root of which is 1.272

Sqr Root of 4.236= 2.058 the sqr root of which is 1.435

Sqr Root of 6.854= 2.618 the sqr root of which is 1.618

Sqr Root of 11.090= 3.330 the sqr root of which is 1.825

Sqr Root of 17.944= 4.236 the sqr root of which is 2.058

Sqr Root of 29.034= 5.388 the sqr root of which is 2.321

Sqr Root of 46.979= 6.854 the sqr root of which is 2.618

.You now see some of our key ratios being also derived by the square root of other key ratios. You can do square roots of square roots of square roots to get some mid=point ratios and you'll again see some of the key ratios appearing, like 1.272 being derived from 6.854

0.5 and 1.0, or 50% and 100%, only appear as ratios by using the first and second number but these are clearly extremely important in trading, so we include them in our list. You could also include the numbers themselves: 2,3,5,8,13, etc. Since price often moves in similar price ranges, the 1.0 is particularly important, especially for simple ABC zigzags, where the C is equal to the A.

Elliott Waves, Harmonic Patterns and many traders use ratios that are derived by adding ratios to the whole number, so whilst some of these don't appear in the above list, they can also be extremely important ...

1 plus 0.382 = 1.382

1 plus 0.618 = 1.618 - well that's the Golden Mean, so if that works there is an argument for the adding of 0.382 to 1.

3 plus 0.618 - 3.618 - used, for example, by Harmonic pattern traders for the Crab pattern

You can also do the same with the other whole numbers to get 2.382 and 2.618; or 3.382 and 3.618, etc. Personally, I would rather use the square root numbers, where the whole number + ratio additions are close, e.g. I prefer 3.330 to 3.382, or 5.388 instead of 5.236 but it's ultimately a trader's choice. Do your own testing and see what you think works best.

There is one other commonly-used ratio that seems to be useful: 0.707 - this is the square root of 0.5,

To summarise then, the Fibonacci ratios are, in order of relevance to the Fibonacci number sequence, or square root calculations (in my humble opinion): -

0.618 and 1.618

0.236, 0.382, 0.5, 0.786. 0.887, 1.0, 1.272, 2.058 (or just 2), 2.618, 3.33, 4.236, 5.388, 6.854, 8.719, 11.09

1.382

2,3,4,5 and also with ratios 0.382, 0.618 added e.g. 3.618

0.707

The rest you can decide for yourself, based on the above :) Perhaps you might like to do the Trader Training to see how you can use all these numbers for trading. eWavesHarmonics allows for any of the Fib numbers to be used, or your own non-Fib numbers if you prefer, for automatic plotting of retracements, expansions, extensions and clusters.

Apart from the first few numbers, it can be seen that the larger number is the Golden Ratio of the previous: -

21/13 = 0.618 and 13 x 1.618 = 21 - that is so for all the subsequent numbers, ad-infinitum.

Apart from the two most important numbers, you will most likely have seen a myriad of other numbers being used in trading, so we'll look at how those have been determined.

0.382 is the square of 0.618 and also 1-0.618. Further, it is the ratio of one number in the sequence divided by the number two places forward, e.g 9th number which is 55 divided by the 11th number, 144.

0.236 is 0.382 * 0.618. It's also the ratio of one number in the sequence divided by the number three places forward, e.g. 55 divided by 233

0.786 is the square root of 0.618. This is a bit of an odd one because when you multiply or divide any of the numbers in the sequence by 0.786, the results do not appear as any other numbers in the sequence. Nevertheless, it's a commonly used ratio, so we'll included it in our trading ratios - a self-fulfilling prophecy, if you like, because other traders are using it and it evidently works as a potential reversal zone. And so it is with some of the other numbers ...

0.886 is the square root of 0.786

1.272 is the square root of 1.618

1.128 is the square root of 1,272

There are some other key ratios that work with the number sequence and, again, work very well as potential reversal zones and price magnets on the charts ...

2.618 is derived by dividing a number in the sequence by the second number back, e.g. the 27th, 317811, divided by the 25th, 121393. It's also the square root of 6.854

4.236 is derived by dividing a number by the third back, e.g. 317811 by 75025

6.854 by dividing by the fourth back, e.g. 317811 by 46368

11.090 by the fifth back

17.944 by the sixth back

29.034 by the seventh back

46.979 by the eighth back

etc.

You can then take the square root of these key ratios ...

Sqr Root of 2,618 = 1.618 the sqr root of which is 1.272

Sqr Root of 4.236= 2.058 the sqr root of which is 1.435

Sqr Root of 6.854= 2.618 the sqr root of which is 1.618

Sqr Root of 11.090= 3.330 the sqr root of which is 1.825

Sqr Root of 17.944= 4.236 the sqr root of which is 2.058

Sqr Root of 29.034= 5.388 the sqr root of which is 2.321

Sqr Root of 46.979= 6.854 the sqr root of which is 2.618

.You now see some of our key ratios being also derived by the square root of other key ratios. You can do square roots of square roots of square roots to get some mid=point ratios and you'll again see some of the key ratios appearing, like 1.272 being derived from 6.854

0.5 and 1.0, or 50% and 100%, only appear as ratios by using the first and second number but these are clearly extremely important in trading, so we include them in our list. You could also include the numbers themselves: 2,3,5,8,13, etc. Since price often moves in similar price ranges, the 1.0 is particularly important, especially for simple ABC zigzags, where the C is equal to the A.

Elliott Waves, Harmonic Patterns and many traders use ratios that are derived by adding ratios to the whole number, so whilst some of these don't appear in the above list, they can also be extremely important ...

1 plus 0.382 = 1.382

1 plus 0.618 = 1.618 - well that's the Golden Mean, so if that works there is an argument for the adding of 0.382 to 1.

3 plus 0.618 - 3.618 - used, for example, by Harmonic pattern traders for the Crab pattern

You can also do the same with the other whole numbers to get 2.382 and 2.618; or 3.382 and 3.618, etc. Personally, I would rather use the square root numbers, where the whole number + ratio additions are close, e.g. I prefer 3.330 to 3.382, or 5.388 instead of 5.236 but it's ultimately a trader's choice. Do your own testing and see what you think works best.

There is one other commonly-used ratio that seems to be useful: 0.707 - this is the square root of 0.5,

To summarise then, the Fibonacci ratios are, in order of relevance to the Fibonacci number sequence, or square root calculations (in my humble opinion): -

0.618 and 1.618

0.236, 0.382, 0.5, 0.786. 0.887, 1.0, 1.272, 2.058 (or just 2), 2.618, 3.33, 4.236, 5.388, 6.854, 8.719, 11.09

1.382

2,3,4,5 and also with ratios 0.382, 0.618 added e.g. 3.618

0.707

The rest you can decide for yourself, based on the above :) Perhaps you might like to do the Trader Training to see how you can use all these numbers for trading. eWavesHarmonics allows for any of the Fib numbers to be used, or your own non-Fib numbers if you prefer, for automatic plotting of retracements, expansions, extensions and clusters.

Here are my calculations that I used to get the ratios (click to enlarge) ...