|

A text-book example of eWaves in action on Gold at the end of this week.

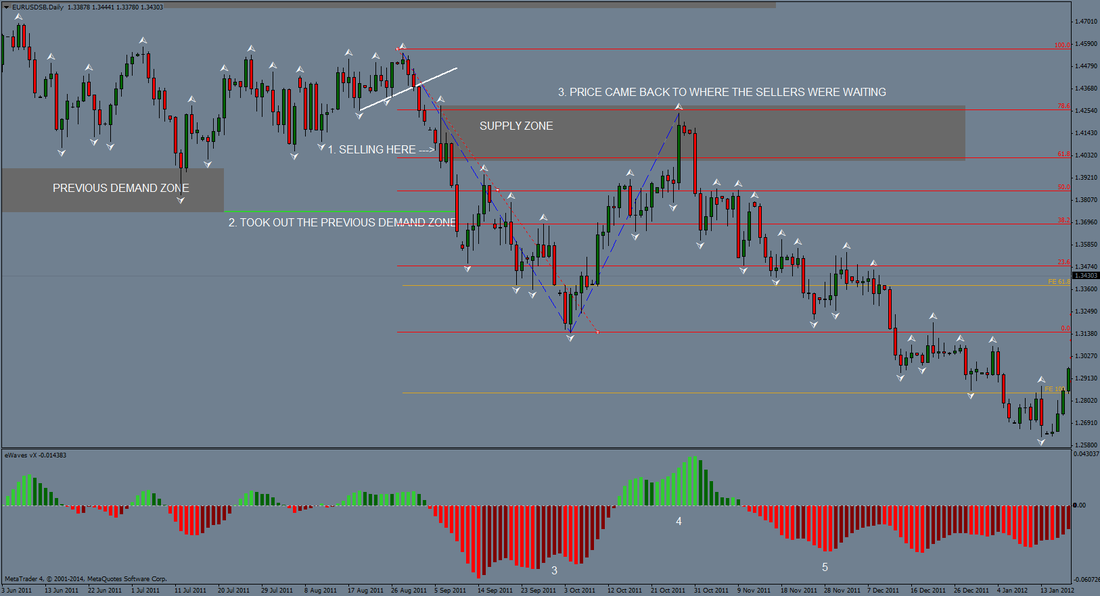

A clear eWaves 3 was formed on the 27th, taking out previous highs. Price then retraced 62% into a demand zone, forming the eWaves 4 where old resistance became support: an ideal place to go long. Price then went 150 points up to the TZ2 level. With the daily trend down, we'd be looking for some short opportunities and where better than a level with so much confluence: eWaves 5 in a strong supply zone, 50% retrace of the bigger down-move and the TZ2 level. 100 more points to be had. eWaves with supply & demand confluence ... could trading be any simpler?

0 Comments

I get to work with some terrific people in the Forex world and top of the list is Kor, of Kor Harmonics fame and TradingArsenal.com. We've been collaborating on some harmonics quizzes over the last few weeks (though I should point out that my input has been mostly word-smithing, rather than technical).

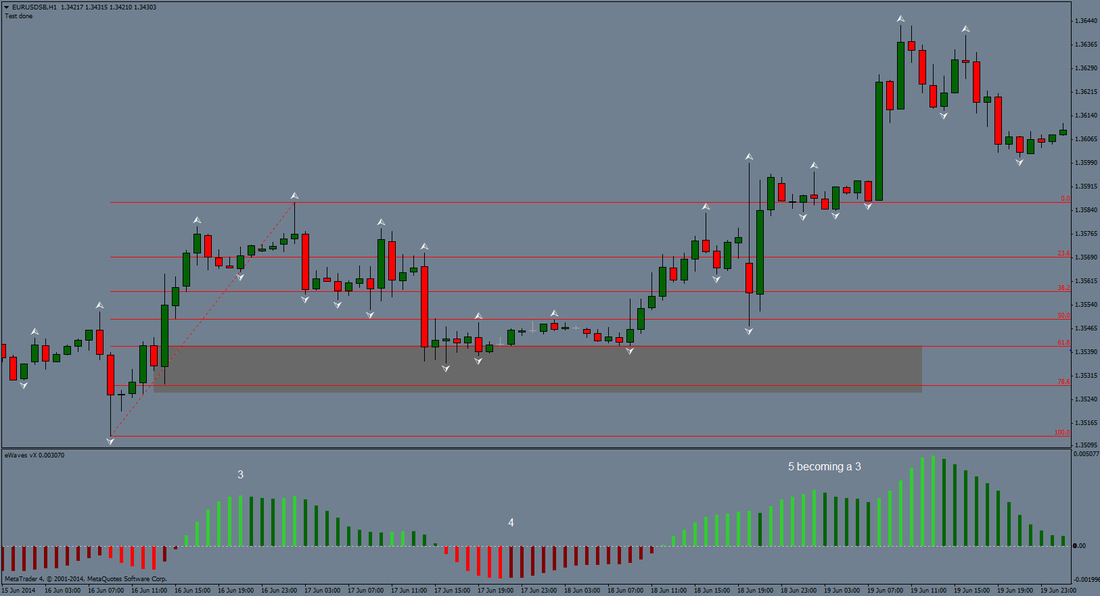

Think you know all there is to know about the Butterfly and Gartley harmonic patterns, or perhaps would like to know more? Try these quizzes: Gartley pattern basic : http://quiz.tradingarsenal.com/gartley-pattern-harmonic-trading-en1 Gartley pattern intermediate : http://quiz.tradingarsenal.com/gartley-pattern-harmonic-trading-en2 Gartley pattern advanced : http://quiz.tradingarsenal.com/gartley-pattern-harmonic-trading-en3 Butterfly pattern basic: http://quiz.tradingarsenal.com/butterfly-pattern-harmonic-trading-en1 Butterfly pattern intermediate: http://quiz.tradingarsenal.com/butterfly-pattern-harmonic-trading-en2 Butterfly pattern advanced: http://quiz.tradingarsenal.com/butterfly-pattern-harmonic-trading-en3 Good luck! eWaves 4 (that is the wave 4 as shown by eWaves) provides a great opportunity to trade the correction, at the best possible price, in the direction of the main trend, created by the Wave 3. Establishing the best possible price to place trades at the end of Wave 4 can be achieved with support & resistance, Fibonacci retracements and supply & demand zones. Below is a similar example but in reverse and on the H1. You see where the buyers were that started the up-move? You see how price was pushed back into the demand zone for the remaining buy orders to be filled? The big down-move into the demand zone would have sucked many small traders into selling to the in-the-know buyers. Trading eWaves 4 can be very rewarding if you look at where the big moves originated from; the moves that took out previous S&D or S&R. The big-money traders leave clues all over the place …

|

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed