|

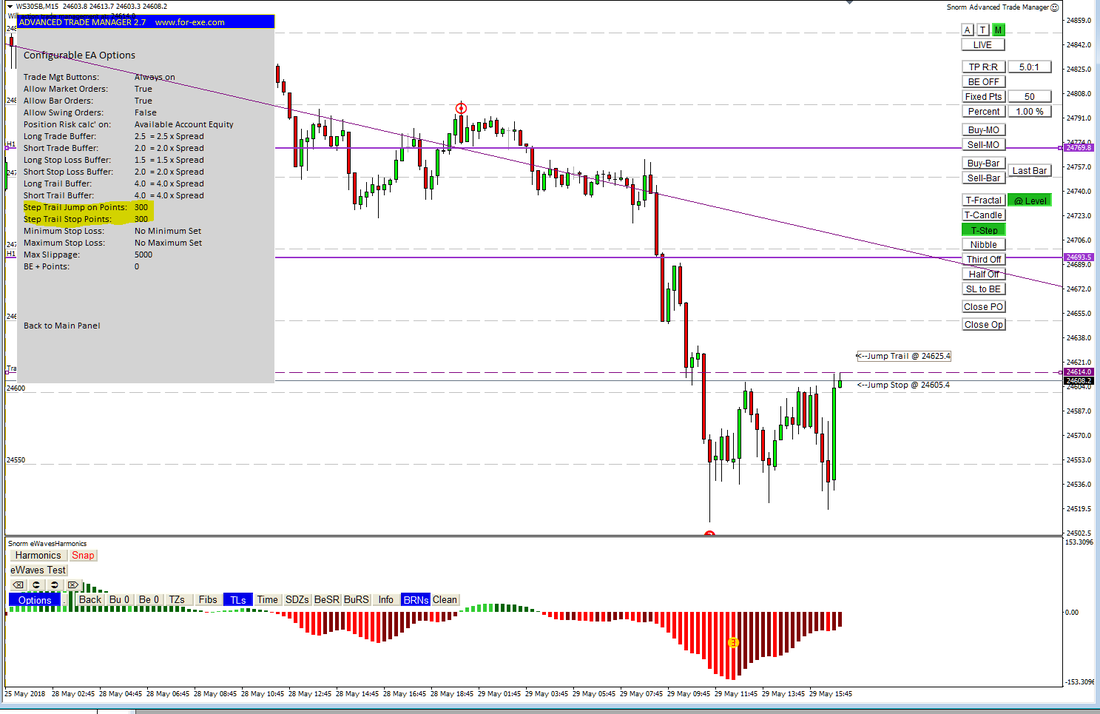

I had a request, just last week, to add jumping (or stepping) trailing stop losses to ATM. The idea is that as price progresses X points, the stop loss is trailed by Y points; the process is repeated, in X steps, until your target price is reached or the trade is stopped.

This approach to trailing stops makes sense as you'll often find price retracing a similar distance, in strong moves; so might be a better way to manage an open trade than to trail fractals or bars. Apparently, this is a feature that many futures traders use, although I wouldn't know about that - I haven't traded futures for more than a decade. You can set the jumping and trail values, for your chosen instrument and timeframe, in the Info Panel, as for any other settings. When you have a trade open (or before it's open, if you use the @Level), you just click on the T-Step button and let ATM take care of the rest. When the markers are placed on the chart, as in the above example, you can move the 'Jump Stop' (the price where the command is issued to move the SL) as you please. You can also still manually move your SL - ATM will only move the stop loss if it is more favourable for your trade. A couple of other changes have also been made to ATM: you can change the colours of the swing and @level lines (also via the Info Panel) . The Beta version of this (v2.7) has been uploaded, if you'd like to test this feature for yourself. I hope you enjoy the new T-Step feature. I used it to manage some trades on DAX and DOW earlier - they worked out very nicely. Let me know if you have other good ideas for ATM - I'll have a go at adding anything that others might benefit from.

0 Comments

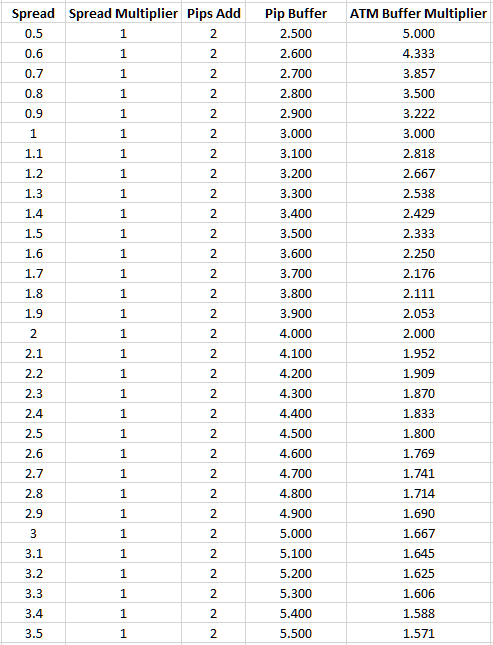

Not for the first time, I had a request this week for an option to be able to add a fixed pip value to the trade buffer options in ATM, for entries, stops and profit trails. There isn't really a need to add another field for inputs, as the same thing can be achieved by using the multiplication that's already there. Take an instrument with a spread of 1.5, for example, and let's say you want to add a fixed 2 pips to the long trade entry buffer where a spread multiplier of 1 is normally used: the multiplier that you'd use in ATM is 2.333. You just add the pip buffer divided by the spread to the regular buffer multiplier - simple. Here's the spreadsheet so you can do your own customer values as you please.

Yes, this is perfect for fixed spread brokers but not so for variable spreads. No problem - just enter a fix spread value in the 'Manual Spread' input of the expert properties.

My personal preference, for trade entry and management, is just to use the spread multiplier without the addition of fixed pips. However, if you like to do things differently, as is your absolute right, then I hope this solution fits your need. Feel free to throw rotten eggs in my direction if you don't like it. If I get pelted enough times, I might concede to adding a fixed pip option to ATM - anything for a happy trader, within reason :) |

Archives

May 2024

|

||||||

|

Website design by Snorm

|

RSS Feed

RSS Feed