|

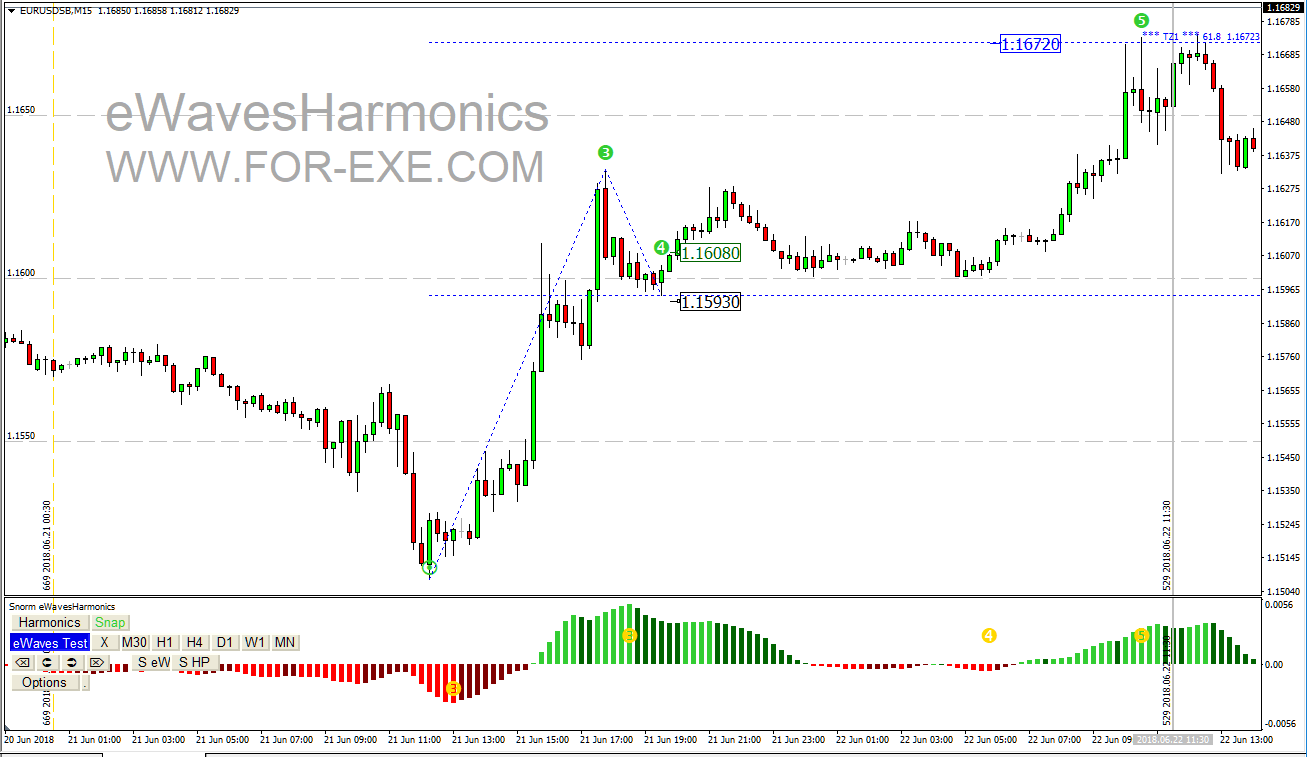

As all traders know, there are several order types. For the avoidance of doubt, I’ll define them : -

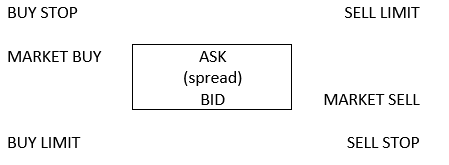

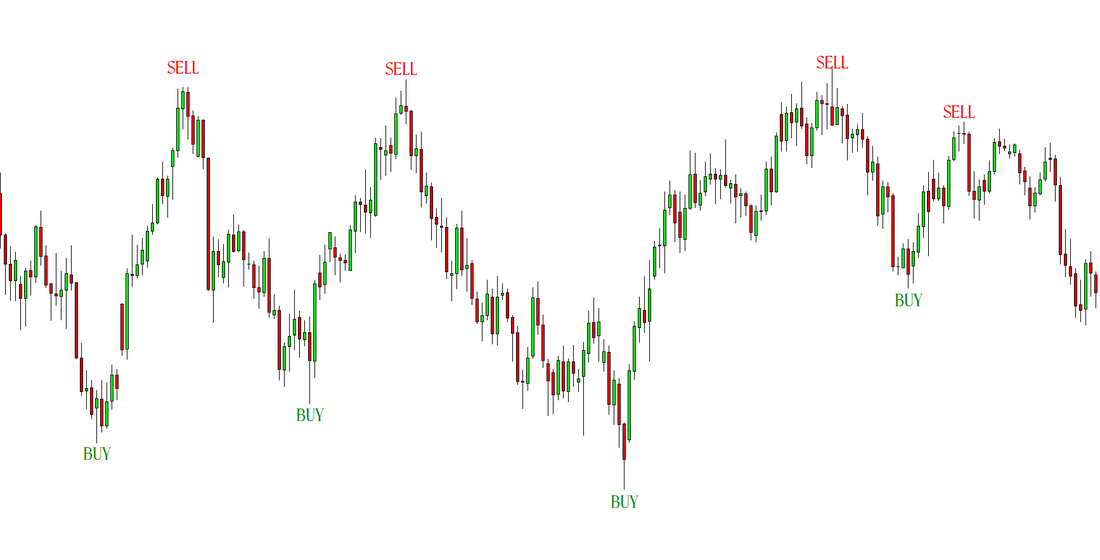

Here’s a quick reference ..… Most of the traders that I communicate with will say they prefer stop orders – they find a trade setup and place buy stop orders just above a key bar; or sell stop orders just below that bar. The goal here is to minimise the number of losing trades by making sure that price really is moving in the favoured direction. There is nothing wrong with that approach; I do it a lot as well. There is however a drawback in that you’ll be reducing the potential risk:reward on a trade. Let’s look at a great eWave4 to eWave 5 TZ1 trade, on EU M15, in June (spread is not factored in the prices quoted). A typical buy stop entry would have been at 1.16080. The stop loss would have been placed at 1.15930 and target price set at 1.16720 (or perhaps a few pips below). Risk is 1.16080 - 1.15930 = 15 pips. Reward is 1.6720 – 1.16080 = 64 pips That’s a healthy R:R of 4.27:1 – a pretty good trade. Of course, if you’d waited for the high of eWave 3 to be broken, at 1.16330, your R:R would have been less than 1 – that’s definitely not a good trade. On many occasions (I won’t quote stats that I can’t back up but it could be around 50% of the time), an impulsive move will retrace to where it originated– back to the supply or demand zone. You can see that it happened at the start of the eWave 3 – that only took 2 bars; and it happened at the start of the eWave 5 – that took about 20 bars and was tested again later before the price really moved. This is why eWavesHarmonics (eWH) draws the zones relatively quickly, rather than wait for them to be confirmed in the traditional sense. Knowing that these zones are often tested (an SD bounce) or can be reversed and tested (an SD flip) we can anticipate where price is likely to go and place limit orders; or, if we’re quick, we can place market orders. Using the same EU example but this time placing a market order (note the BRN confluence for entry) … Risk is 1.16020 - 1.15930 = 9 pips.

Reward is 1.6720 – 1.16020 = 70 pips That’s a healthy R:R of 7.8 to 1 … not far off double your profit. by improving your entry by a mere 6 pips; assuming that your lot size is calculated as a percentage of account divided by pip risk. If you just did a fixed lot size on every trade (not a recommended approach), you’d be risking much less and making a little extra profit, which is not to be sneezed at. There will be times when you could increase your returns by many times more than that – a typical 2:1 trade could easily be 15:1, for example, by waiting for the best possible entry; or much much more. Yes, you risk having more losing trades by using limit or market orders. The upside though, speaks for itself. If you can be getting triple your normal returns, on average, you can afford to have a few more losing trades. Perhaps you might want to mix your order types: a pending order as usual followed by a limit order should price retrace on itself. That way you’ll be covering it both ways, in case price doesn’t come back. Don’t get stuck in a rut with how you place trade orders. Always look for the best possible returns on your investment by being adept with your order types. See the Trader Training course to learn how we trade with eWH, as in the above example.

0 Comments

I’ve just uploaded a new video to the Trader Training course, which shows a trade, that I took last week, where you could have doubled your trading account with one trade by only risking 3% (not that I would risk 3% on one trade, so this is theoretical but very possible). The trade was taken on a DAX 1-minute chart with a risk/reward of nearly 37. Don’t let anyone tell you that the lower timeframes are ‘just noise’ – I really hate that expression. The lower timeframes provide a ton of information that can enable trading at the very best levels with the tightest of stops – as the video shows. The video also shows the importance of not having too-tight a stop loss. The type of setup was a simple W4 TLB– nothing complicated and a setup that happens plenty of times, on all timeframes and all symbols. The following have been updated this week and are available for download: -

I'm always looking to improve the tools, so please get in touch if you have any good ideas for enhancements that you think others will benefit from as well. ATM and eWH have had a couple of minor upgrades this week - nothing too exciting but they are available for download, still as Beta files.

And in other news ... I've made some modifications to Snorm Object Extender script, specifically for eWH, to copy the Supply & Demand zones from one timeframe, so they're available when you switch timeframes. I've used it a lot this week and it's saved me a lot of time. The script has the following options:

This script is free and available in the eWH download page. I hope you find good use for it. Have a great weekend. We all have great ideas and plans, when we first discover the wonders of Forex trading. Dreams soon become dashed, after throwing hard-earned money at scammers and down the drain of brokers who willingly accept new credit-card-funded account applications from the naive. Yet, when things haven't gone to plan and you're unwilling to tell your family and friends that your dreams have been scuppered, you go in search of some trading system or mentor that’s ‘guaranteed’ to give you the financial returns that ‘you deserve’.

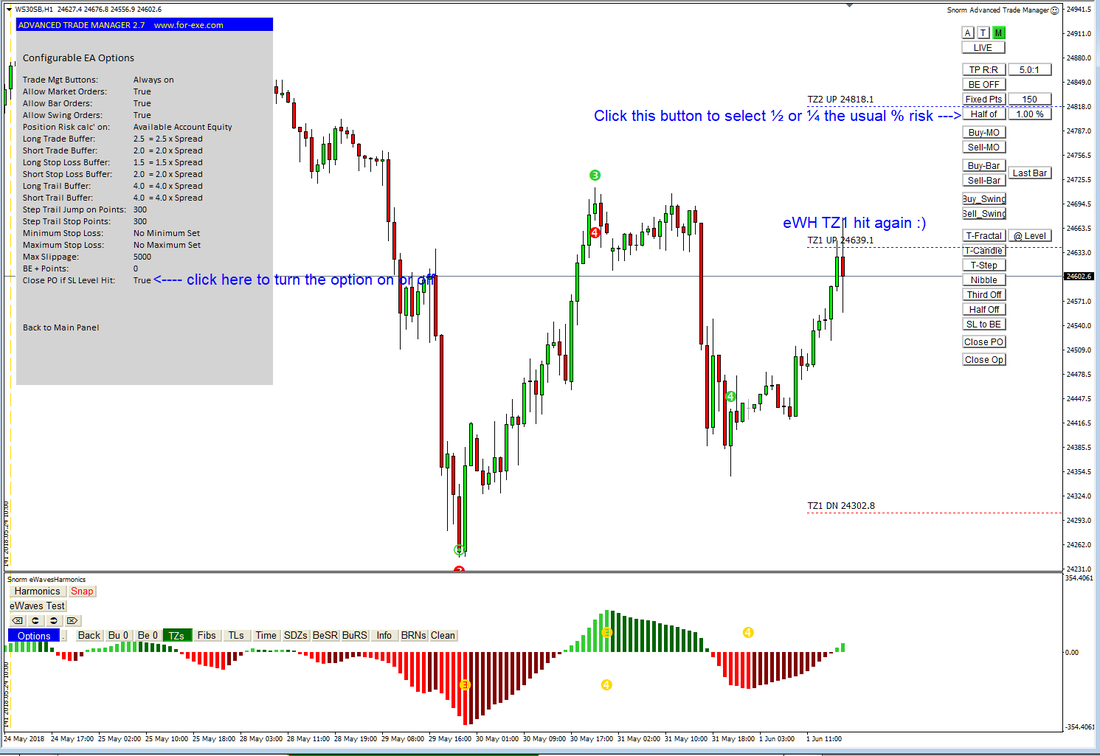

A google search of Forex-related terms will reveal the following … Top of the list will be the Forex brokers; the ones who have the marketing budget to keep themselves at the top of every google search that’s loosely related to Forex but not even close to what you were searching for. Then, there will be a myriad of forums and Forex thieves (‘scammer’ would be too kind a word for them). Forums can be a mixed blessing: you get the occasional genuine and intelligent trader, willing to share some wise advice. You might also get useful information about forthcoming news that might move the currencies. Some of the better forums even offer proper trading advice and education. For the most-part though, you get ignorant people posting stupid trading ideas with a thread that lasts for a few months, at best, sucking in many ardent followers, only to gradually disappear into obscurity; all previously enthusiastic followers have long-since lost interest. The forums are invariably dog shit for hungry flies: a vacuum for ignorant wannabe traders who think they’ll find the golden goose, either by reading every thread going or begging for someone to illegally share the greatest indicator or robot ever made. Forex thieves need no introduction. How many ‘next-best-thing’ $69 indicators / systems / EAs have you bought? How many thousands of bucks have you thrown at so-called mentors / coaches who don’t really have a clue how to trade but are masters at selling their bullshit? How much have you lost by subscribing to trade alerts that promise great monthly returns but deliver only despair? In Forex trading, this adage is most pertinent: if it seems to good to be true, it probably is. Unfortunately, the genuine good guys in this business are few and far between. They might appear on page 26 of your google search, if you’re lucky. In my very humble opinion, a google search for the golden Forex goose is like handing your wallet and credit cards to a heroin addict. But … come on guys, how many of you have gleefully shared an indicator that’s not yours to share; or used someone else’s without paying? Some of you deserve to be scammed by the Forex thieves and don’t cry when you have been, since you’re as guilty as any other thief. How do you really expect to succeed at this game when you have so little regard for what’s right and wrong? I know of no shortcuts to earning the stripes of a veteran Forex trader (or trader of any financial instrument). For many, the learning time will be twice as long as that of a brain surgeon; for most it will be a like trying to build a perpetual motion machine: it just won’t happen, despite all the promises found by a google search. The university of Forex trading is split into three subjects: fundamentals; technical analysis; self. Self? What’s that got to do with it? It’s only the most important part of being a successful trader. It is also the hardest part to get an A+ score in. You might have a doctorate in fundamentals and a first-class degree in technical analysis; but if you haven’t got a masters in ‘self’, you won’t succeed in trading … full stop. What’s the good of first class setups, in the right fundamental conditions, if you’re too scared to risk 1% of your trading account for a 5% return, because you either see ‘something that you don’t like’ or because you want to protect every pip when price moves in your preferred direction? What’s the point of knowing about first class setups when you’re too keen to chase pips from less-than-second rate setups? How on earth do you expect to succeed when you’re trading ‘scared money’: money that you can’t afford to lose or must protect as if it’s the last human child on planet earth? How good is life when you’re addicted to trading like many are addicted to slot machines: you have no idea when to stop due to losses or profits? How useful is the best trading approach in the world when you bin it after three losing trades and go looking for something else or succumb to adding extra indicators in search of those fantastical guaranteed profits? You must master ‘self’ if you want to succeed at trading. You must; you must; you must. It need not be that hard, if you have a trading plan and can abide by it. When do you trade? What do you trade? Why do you enter, manage and exit a trade? When will you stop trading? When will you start trading again? How will you review your trades and improve the rules? etc. etc. etc … If you don’t have, at least, these rules agreed with yourself, you have no chance at all. So, what’s the best advice for new traders? Wear sunscreen … while you’re enjoying the rewards of having mastered self. And … How to get guaranteed success at Forex trading? If you found this blog post by googling those very words, then more fool you. There are no guarantees of success in this business; but covert guarantees of failure and thievery are plentiful. We place trades based on probabilities, not certainties. Having said that, there are approaches to trading (such as those covered in the Trader Training course) that have better-than-average probabilities of success. When you know what those approaches are, and have mastered self, then dreams really can become reality – but it’s not guaranteed. Sorry if you've only just upgraded but I've made some more changes to ATM, that I hope some of you will find useful (I made the changes for my own trading needs, so I'm certain others will like them). You can now temporarily select half or quarter of your usual percentage risk, just by clicking the Percent Risk button. Plus, there is now an option to auto-close pending orders when the stop loss level is hit. This latest version has been uploaded to the download page, for those of you who would like to do some beta testing; it has worked well for me today. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed