|

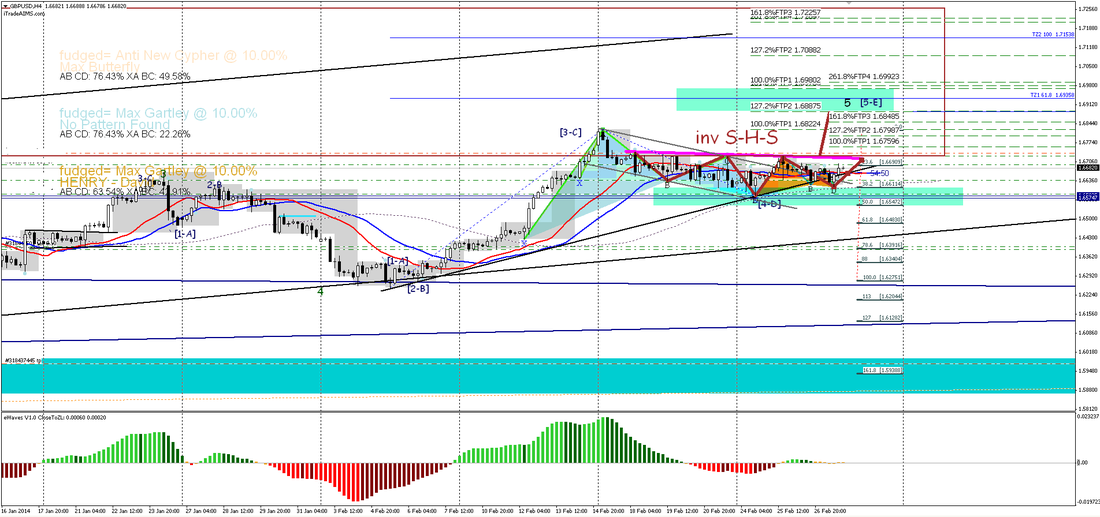

David (the master of harmonics) has these target zones in mind for GU (the harmonics indi can be downloaded for free from the Harmonics tab.

0 Comments

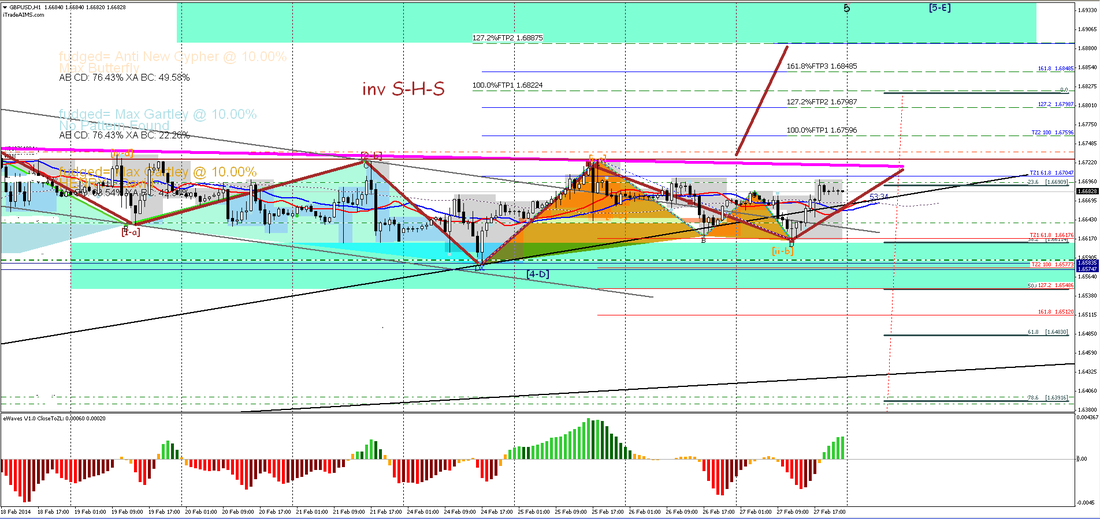

Another nice example of eWaves doing its thing - this time showing a W5 down in a W4 up. The downside rejection with AO divergence provided a low-risk, high-probability entry. Notice how the down TZ1 was hit and provided support. The up TZ2 at 1.676 is at D1 S/R level, providing for a logical target.

Hope that makes sense. As you will have noticed, from previous posts, I’m not one for verbosity; preferring pictures to lots of words. However, I feel compelled to share my thoughts about (what I consider to be) some of the crap ‘the experts’ tell us, as to what we should risk per trade; what the risk:reward ratio must always be and what paltry monthly returns should be our goal.

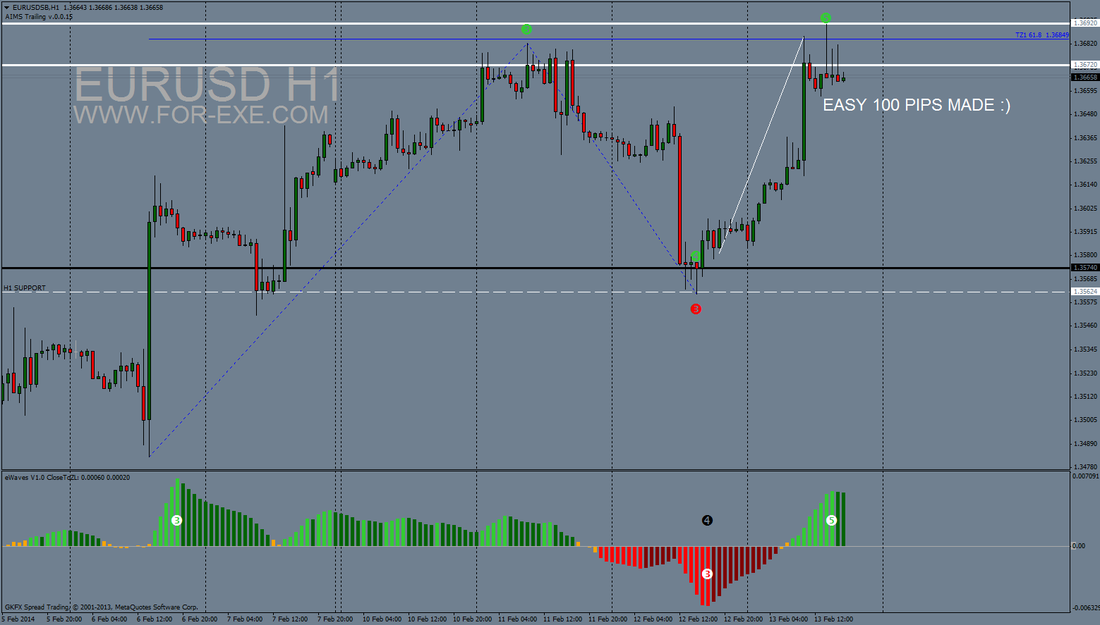

A professional financial adviser is coming to see me on Monday to discuss my pension plans. I don’t know about the rest of the world but here in the UK, we have to complete a ‘Fact Finding Form’ to determine our attitude to risk – there are a minimum of ten questions, each to answer from strongly agree to strongly disagree. A bit overkill perhaps but a logical approach to determining what type of investments an individual should be making. So, with that in mind, on what basis can a typical ‘Forex expert’ tell anyone that they should only ever risk one or two percent of their account on any single trade? Does that ‘expert’ know anything about an individual’s risk tolerance or what percentage of available funds are held in any single account or – and this is a key one – what a trader’s average win/loss rate is over a significant sample? Of course there is a psychological hit, for many people (though not all), to lose ten trades in a row and suffer a significant drawdown on their account. Is the losing of ten or more consecutive trades factored in your trading plan or does your trading plan need a serious review? If it is part of your plan and a ten or twenty percent drawdown is as much as you can stomach, then one or two percent risk, per trade, would be advisable. What if you never had more than three losing trades in a row? Risking one percent per trade and assuming you only have one live trade at any one time, losing no more than three in a row, would mean you will never use the remaining 97% of your account – it would just sit there doing nothing. To what advantage? Would it not be more sensible to increase the risk on that account and/or put the dormant funds into an interest-paying savings account, a managed fund, or a pension, etc.? As for risk:reward on each trade – well, again, this is completely down to a trader’s plan. I’ve been trying out a new system this week: trading daily candles at support and resistance. I’ve not gone for fixed risk, rather a fixed lot size (regardless of stop loss). I’ve not worried about the risk:reward ratio; just made sure there was enough potential return to make the trade worthwhile. This has been on a demo account, just to try the rules out, but had it been a live account of 10k, trading one lot, my profit for the week would have been 2.3k: a 23% return on one week of trading; 11 winning trades and 2 losers. Time will tell if this is sustainable (no doubt I struck lucky) but I have ignored all the sage advice of the ‘experts’ and, at least for this small sample, done very well from it. I will try a fixed risk of 5% next week, just to see how that works out, whilst still ignoring 'expert' advice on risk:reward ratios per trade. Perhaps I'll blow the account; perhaps not. What about anticipated returns per month? The ‘experts’ will tell you not to expect more than one or two percent per month but why? Why not an ultimate goal of ten or twenty percent return per month? If you risk two percent on each trade and only did two trades per day with a 56% win rate at 1:1 R:R, your returns for the month would be a bit short of 10%. That is from being right just over half the time. If your monthly goal is only one or two percent profit on your trading a/c, you probably have very limited risk tolerance and low expectations of your trading system; and/or … you are unwisely storing all your available funds as dormant money in you broker's bank account. ‘Each to their own’, is the best advice any ‘expert’ should ever give on risk and reward. Another example of eWaves doing its thing - the before and after pictures tell all ... It would be remiss of me not to mention Immy of www.itradeaims.com who first introduced me to the concept that became eWaves. This has proven to be a remarkable tool to aid my trading decisions. Immy has made some excellent posts in the AIMS forum, about eWaves and how he trades with it - worth taking a look at.

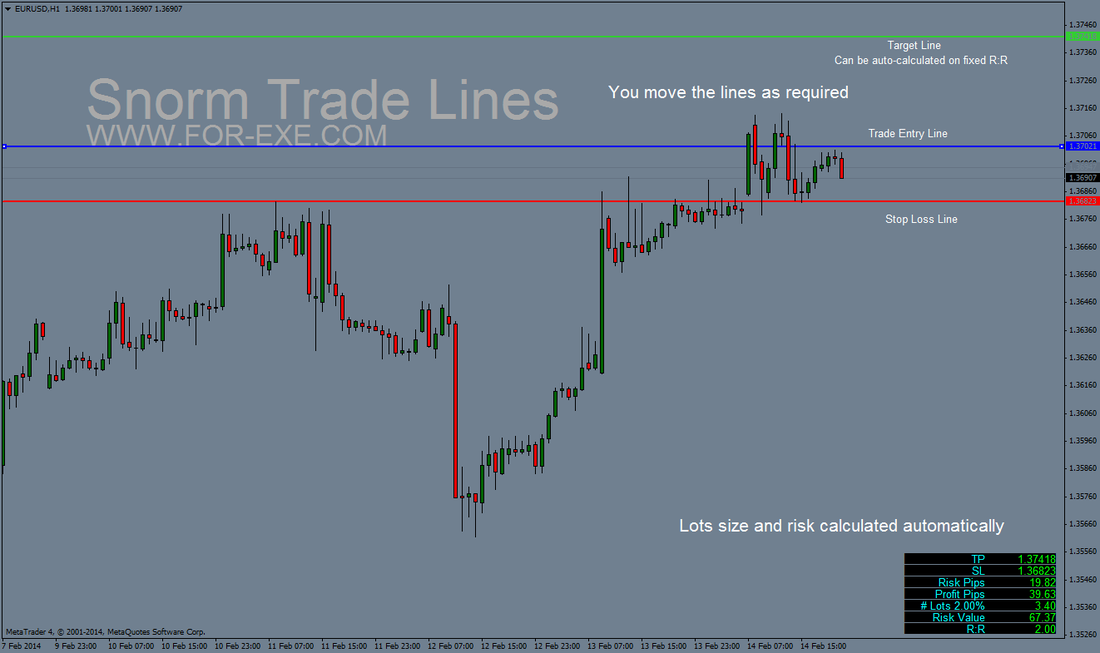

Here's an indicator that you might find useful - Snorm Trade Lines. You move the entry and stop loss lines, to suit your planned trade, the lot size is calculated for you, based on your selected risk % and account balance (or equity or a fixed amount). There is also an alert option for when price gets close to your entry level; as well as an option to move the target line to a fixed R:R based on your stop and entry. It's been tested on a few brokers without any problems but let us know if you find any bugs on your broker. Hope you find it useful ...

I've just created a new page to make for easier access to my free indies - will add more of them as time permits. http://www.for-exe.com/mt4-free-indicators.html

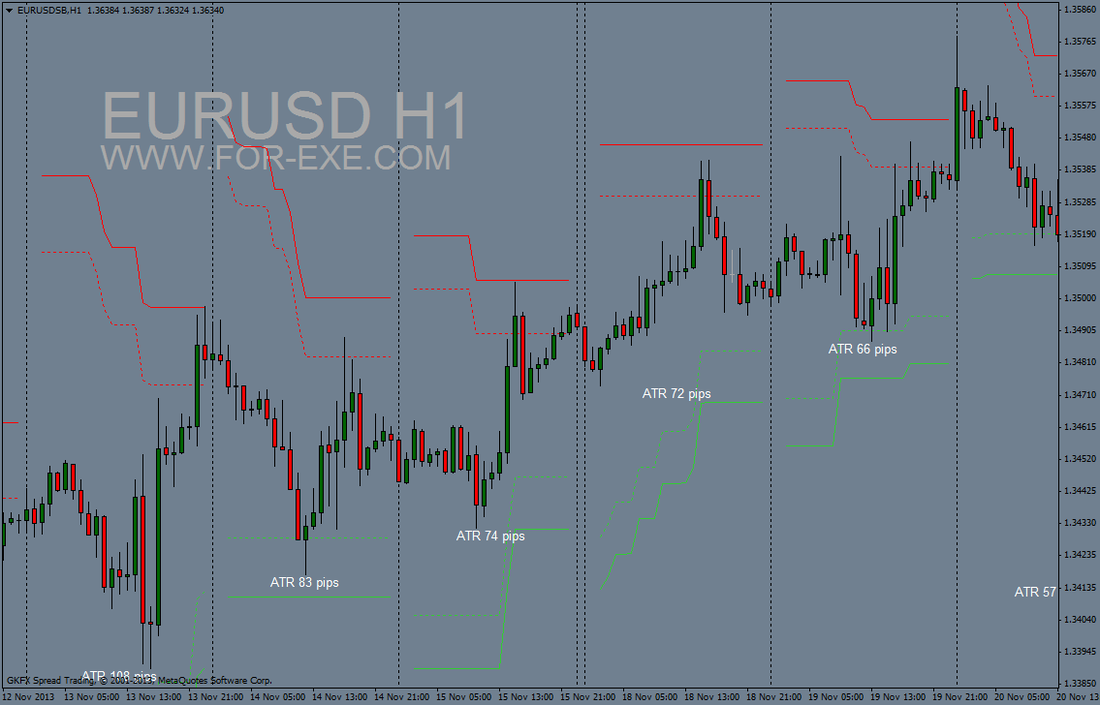

I've just finished this indi and thought some of you might like it as well. In a nutshell, it plots the upper and lower ATR levels (you chose the number of days for the ATR). The bonus is that it also shows a percent of ATR - pic below shows 78.6%: looks rather interesting.

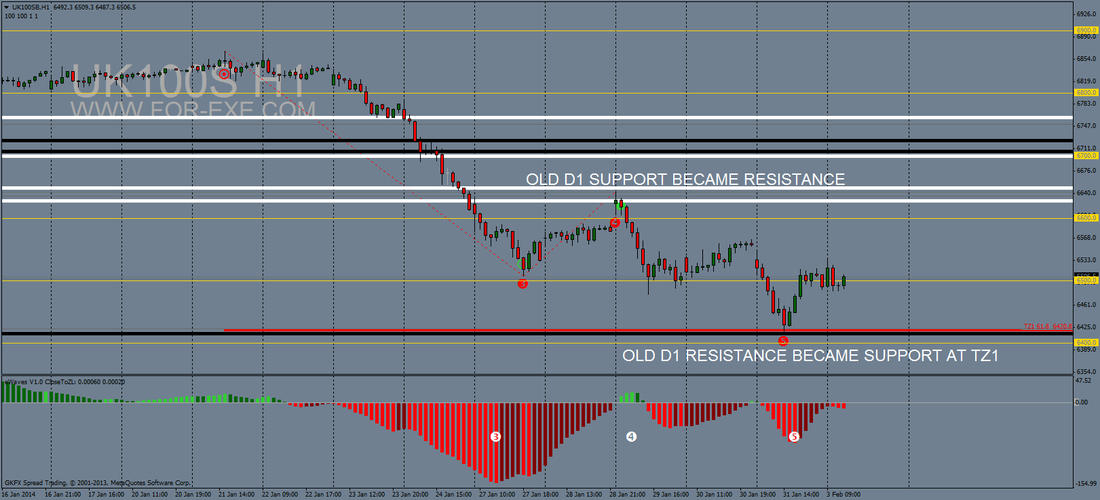

Another recent example of eWaves doing it's thing, this time on the FTSE 100 H1 chart.

W4 top was formed at a D1 S/R level with confluence at 38% retrace. TZ1 would have been forecast, at the time of the W4 top, to 6420 with confluence at another D1 S/R level. With a confluence of S/R levels, fib retraces and expansions, BRNs, etc, there are some great low-risk / high-reward trades to be had, just about every day. |

Archives

May 2024

|

||||||||||||

|

Website design by Snorm

|

RSS Feed

RSS Feed