|

How many emails do you get from marketeers of trading systems telling you how many pips their fantastic system made? I received three, this week alone. None of them said what the risk to reward values were on their trades - did they risk 100 pips to make 50? Or perhaps 200 to make 10? Who knows. They're just pip-braggers telling a meaningless story, in my very humble opinion.

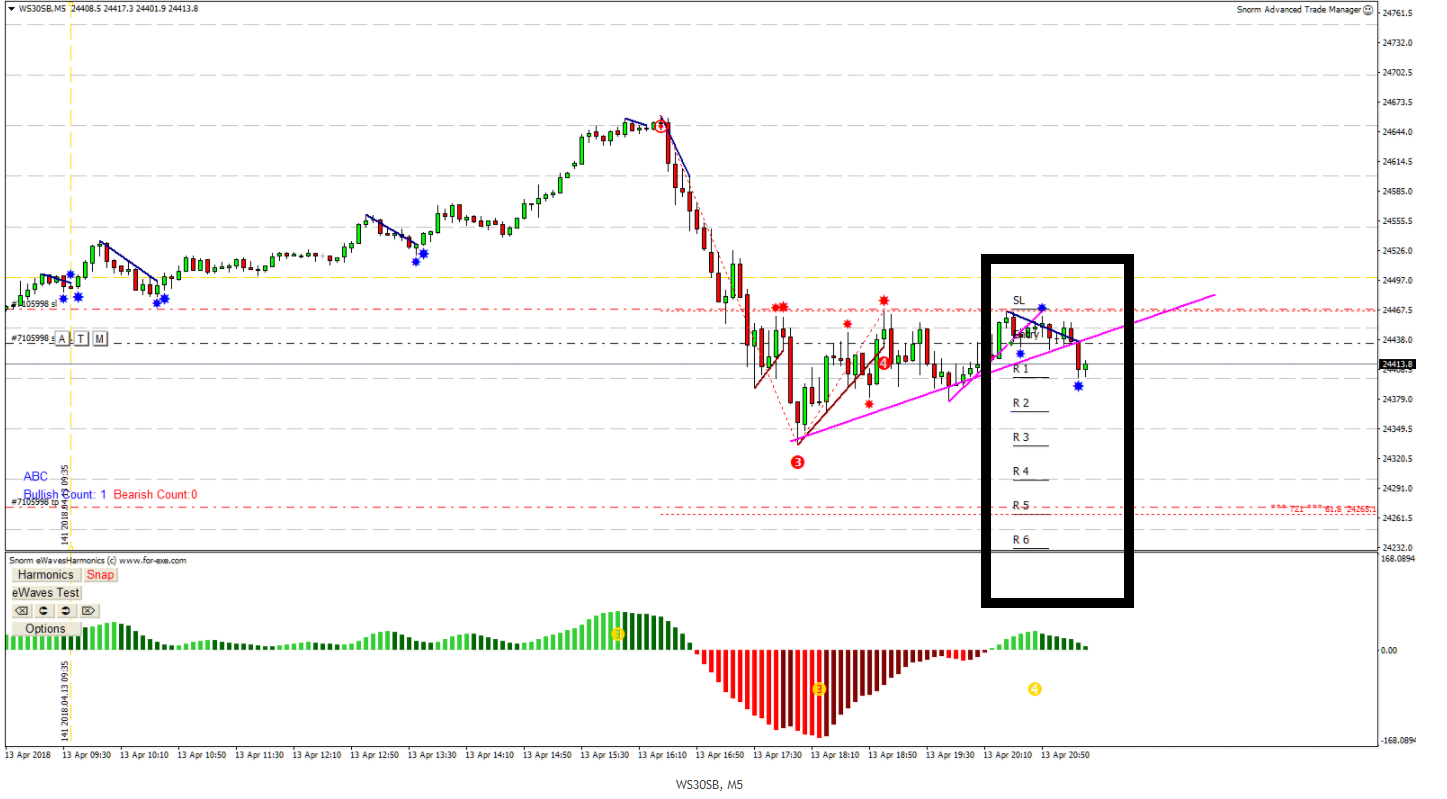

What we really want to know, is what sort of return will we be getting on the investment of our trade risk. Take a look at the above pic - you'll see R levels that denote the risk/reward values of the trade I took; a late one on the DOW M5 (I don't usually trade so late in the week but didn't have much chance to trade during the day).. My target was the TZ1 level set by eWavesHarmonics; (eWH) and my Trade Levels indicator showed it was a 5:1 trade. We don't really care how many pips or points that is but getting a 5R trade opportunity is not to be sniffed at. For me, that trade opportunity was a 1% risk for a 5% return; for some it might be a 2% risk for a 10% return, etc. This is the information that matters in trading - we're always looking for the best R:R trading opportunities. The Trade levels indicator that draws the R levels is available free to anyone with a valid Advanced Trade Manager (ATM) licence, on the installation page. ATM and eWH Updates. For the last few months I've been working on a new licence management system. This gives me the opportunity to do remote upgrades, so you don't need to keep checking for the latest version (I haven't tested it yet but the theory is great). The PC Code licence management is also much improved, so you don't need to send me the PC Code of your computer (if that's the type of licence that you have) or worry about Windows upgrades changing the code. Existing ATM and eWH licence holders: please download the latest versions when you get the chance. The old ATM should be deleted before installing the new. When everyone has transferred to the new licence system, I can set about adding some new features that I'm certain you will enjoy. A note about the chart picture above. Don't ask me what the stars are - this is something that I've been working on with Grant, with the intention of generating some trade alerts for when you're not paying attention. It's still very much in development. The reasons for entering the trade are explained in the training course. Some of you might recognise that there was a P5 setup at blue TZ1 W3 supply on the M1 chart - a terrific reason to go short. You can check for yourself, on your charts, how well that trade worked, if you're interested - I'm not going to be a pip bragger :).

1 Comment

|

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed