|

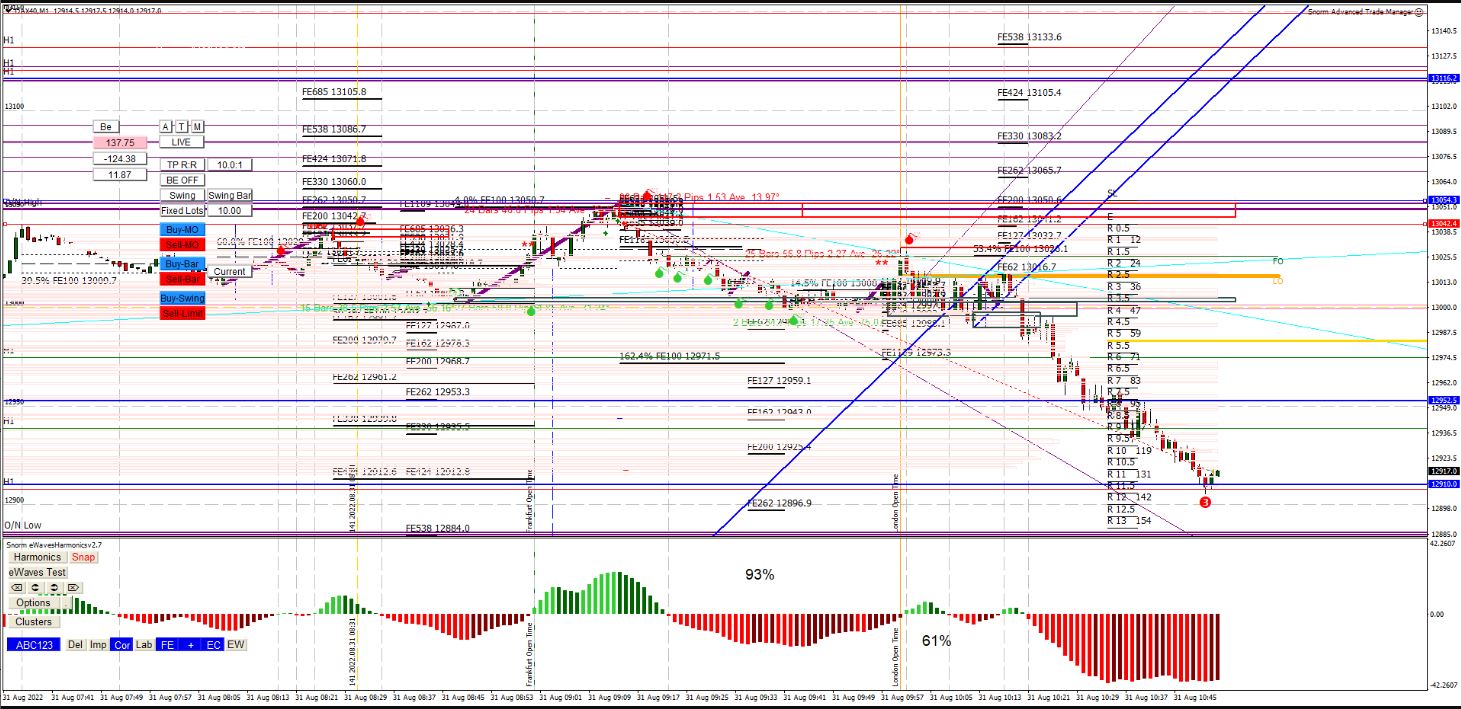

I'd like to give a special shout out to the guys in our Skype Trading group this morning, who had some really nice trades, open and closed in about an hour and all making super profits. It just goes to show what any trader can achieve when working together and keeping a simple approach to looking for low pip/point risk entries. The simple approach, as I've blogged about before, is to identify a high probability target from an impulsive move, then look for the subsequent correction to end, so we can jump on board ,as early as possible, to get into the next impulsive move towards that target. You can aim for the high probability target with a set-and-forget or, as we tend to do, lock some nice profits when they're available and either walk away, for the session, or look for another corrective move to get you back into the money flow. Pigs do tend to get slaughtered, as I discovered when I took only 7.5R from a 25R trade yesterday morning, but it's nice to shoot for the big ones from time to time (I was looking for a crazy 50R in that instance, from a 3 point SL on DOW). Here are the trades, from just some of the traders in the group, to show that we're working together for the entries and trade management.. Well done to Jo (10.5R) , Ray (6.3R, 4.6R, and 3.3R), Michal (8.3R) , Peter (4R) and everyone else in the group - a great bunch of guys and always a pleasure to trade with.. My two trades also shown below. (9.5R and 7.5R) For these trades, we all used: eWavesHarmonics, ABC123 indi, Sessions Indi and, of course, ATM for trade entry and management. If you'd like to know why we do these types of trades, it's all in the (still FREE for ATM and eWH users) Trader Training Course.

2 Comments

There have been a few times when I've not been able to see the ATM 'Swing Lines' due to other lines being in the way, making it difficult to select and move them. Since using the Swing lines is my preferred method of entering a trade with a very tight stop loss, I was compelled to make an urgent change - one that I should have made some time ago.

When the Swing button is selected for the initial stop loss (as opposed to Fixed Points or Bar) a new button is available: "Swing Bar". When pressed, that button will bring the Swing Lines to either side of the current bar and leave them fixed there (not automatically moved when new fractals are formed). To revert back to fractal-based swings, just cycle the stop loss button back to Swing.. To later move the Swing Lines to the latest bar, just hit the Swing Bar button again. The updated ATM is available for download from the installation page. Entering with low pip/point risk trades is now even easier and quicker. I hope you find this new feature useful. Please let me know if you have any more suggestions for improvement. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed