|

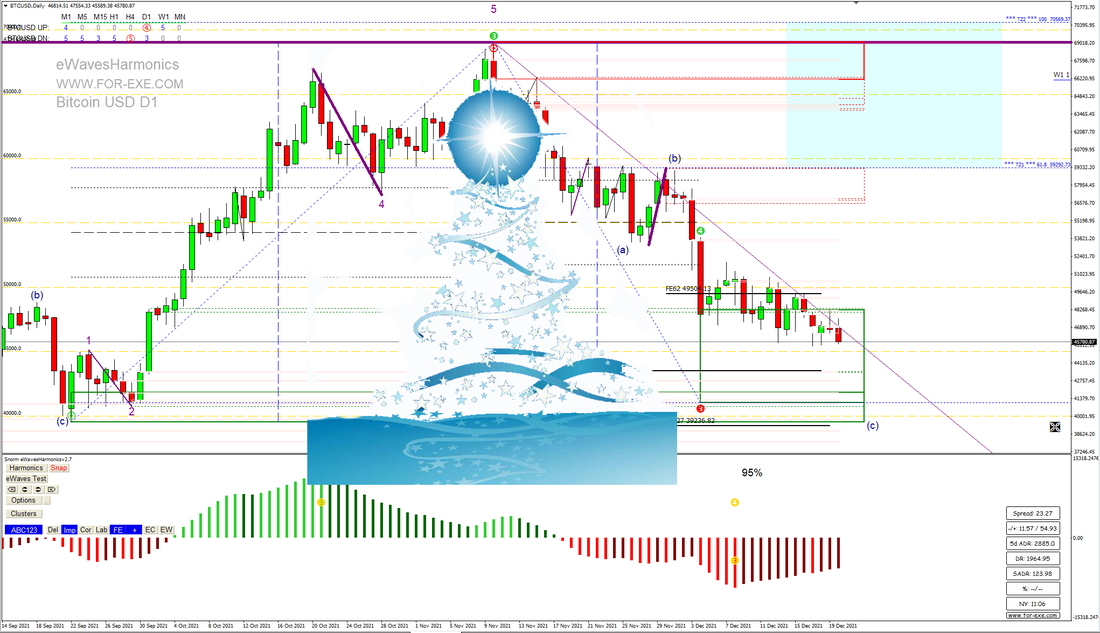

To all my many trading friends around the world, whatever you celebrate at this time of year, I wish you and yours a very merry festive season.

As it's that time of year, something for free: I've improved the Wave Labels indi with a semi-automated function, to make the labelling of waves quicker and easier. There's a very short YouTube video here that shows it in action. Free to download from the eWavesHarmonics page , so help yourself if you fancy it. You probably know that I don't offer specials or promotions, as everything on the website is already free or incredibly inexpensive, but since we've had such a terrific year's trading, and it is the time of year for giving, I'd like to offer an extra free year for licence extension/renewals on ATM and eWH, when purchased between now and the end of 2021: two years for the price of one, that will be added to whenever your licence is due to expire, providing your licence is still active. Get in touch if it has expired and we'll see what can be done, with the festive season in mind. As always, thank you very much for your support, kind words and success stories, throughout the year. I hope 2022 and eWavesHarmonics. continue to bring you ever more success in your trading,

0 Comments

It's not often that I'll post examples of winning trades but it's not a rare thing to bank some big Rs on the one minute charts; there are plenty of opportunities for them on most days of the week.

Here's one example from yesterday morning, that was called in our Skype group before the London Open. It's my favourite kind of trade, not just because of the nice result but it was easy to manage and required just a one-bar stop loss. There were plenty more in the afternoon session as well - very liquid markets this past few weeks. There is no special secret to these trades, nor do you need squiggly-line=based indicators, you just need to be aware of the following: - 1. (and always first) where might price be heading to? What are the strongest price magnets that will be pulling price? Find as much confluence as you can before going to the next step. If the magnets aren't obvious, then don't move on until you find them, later in the session or the next session. 2. Where might price want to start that move? Look back to recent history where price previously found support or resistance; where the buyers or sellers previously found a reason to trade the big money. Look for more confluence with fibs, session times, basic Elliott Wave theory, whatever else you like to use, etc. 3. Zoom in to find the best possible entry around your predetermined price levels and watch how the bars are formed: can you see in a one-minute bar whether the bears or bulls are dominant? If it's not clear during the bar formation, it should be when the bar is closed (after all, a price bar doesn't tell the full story until it is closed) but you'll often see clues in the ticks. 4. Get your stop loss and order ready and go. I used a market order in the above and the ATM swing lines for my stop loss, then clicked the Buy MO button on the bar close. It takes some practice, of course, but it really isn't complicated or particularly clever: just reading the price action and key levels, pure and simple. If you want to learn more then all is explained in the Trader Training Course and discussed everyday in the Skype Group (restricted membership for those who have completed the Training Course).. Keeping it stupidly simple. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed