|

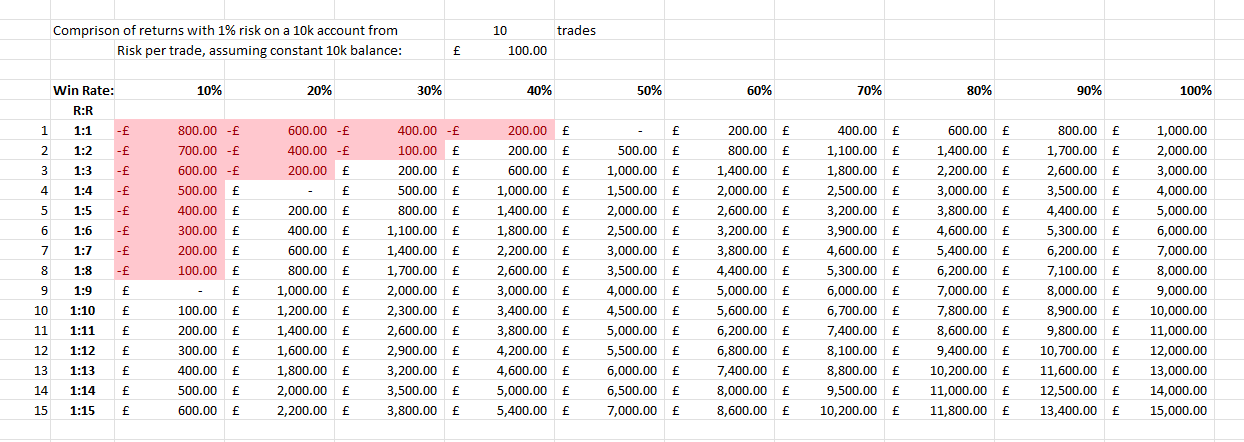

If you’re diligent enough to keep a journal, or at least review your trade history on a regular basis, you will know what your ratio of winning to losing trades is. When you know this (rather basic) information, you’ll have a pretty good idea of what sort of R:R trades you should always be aiming for; avoiding trades that don't offer at least your minimum required returns. I recently received an email from a wonderful lady, who is a long-time customer, asking if I could make a change to ATM to place automatic stop losses; effectively making the stop loss wide enough to reduce the number of stop outs / losing trades. ATM can already do stop loss placements using custom indicators, as well as auto-entering a trade, so of course the request could be accommodated. However, such a request begs the question: is it a good idea to go with a wider stop loss, to reduces stop-outs whilst also reducing the potential profitability of a trade? That’s assuming you’re risking a percentage per trade, rather than fixed lots, of course. As I’ve discussed in previous blog posts, I’m a big fan of looking for very low pip/point risk (VLPR) trades, with the goal of achieving at least 5R but seeking 10R or more; this really isn’t hard when taking trades on the lower timeframes. This approach allows for more losing trades but, in my experience, greater profitability. It also makes trading that much more interesting – and challenging – although it might not be everyone’s cup of tea. I’ve done some calculations, to compare profitability based on average win-rate – over 10 trades – compared with average R:R per trade. This table assumes 1% risk per trade on a constant balance of £10,000; in reality that balance would fluctuate after every trade, but I’m trying to keep it simple. (click on the table to enlarge it). With my average R:R per trade being 5, I need only be right once in every 5 trades to make a profit. If I’m right 40% of the time, I can make a healthy 14% profit with 10 trades.

On the other hand, by widening your stop loss you’ll reduce your R:R. So, let’s say I’m now looking for 2R trades … I would need to be right 50% of the time, just to make 5% profit from 10 trades; or find 80% winners to make 14% profit. Making 8 profitable trades in every 10 is a very big ask – not impossible, but extremely challenging. Personally, I’d much rather feel comfortable about having a losing trade: it’s no big deal when you’re always aiming for a 5% return on a trade. Something to think about but at the end of the day, every trader needs to find their own comfort zone with win/loss ratios and average R:Rs.

2 Comments

|

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed