|

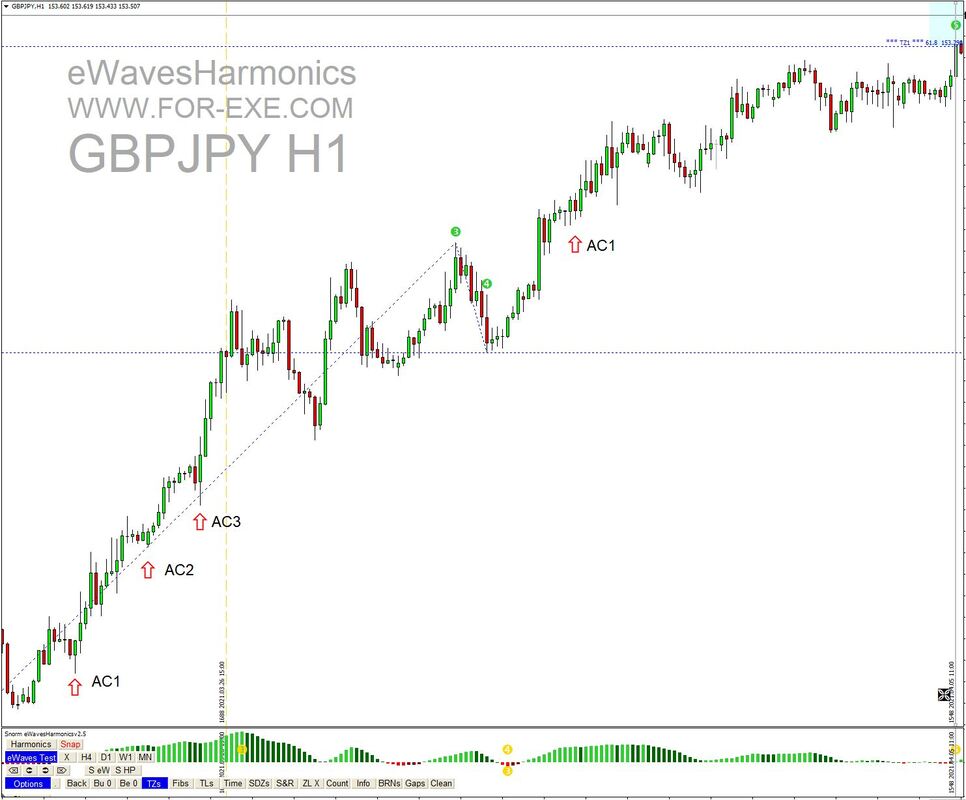

The Wave 4, identified by eWavesHarmonics (eWH) and the original eWaves, has been a long-time favourite way to buy the dips and sell the rallies, looking to get into the next impulsive move for some good R:R trades. You’ll often see that price makes one or more corrections, during an impulsive move or at the very start of it, long before a W4 is formed through a zero line cross (or near to the zero line, as is often the way). By using the eWH histogram and applying some fairly strict rules, we can easily identify such setups and have a point of reference for trade discussions, as we do in the Skype Trading Group.

By using these setups, you can often join a Wave 1, 3 or 5 (or even A and C waves), reasonably early - sometimes very early – for some terrific low pip-risk high-reward trades. They also allow you jump in on a wave when you might have missed the early part of it, or to do add-on trades. These useful setups occur frequently (much more frequently than the W4) on every timeframe and every instrument and form a key part of our trading plan – as they should for every trader. As with all setups, we need some rules and we need to know what to look for, particularly as confluence to support our trading decisions. To that end, I’ve created another course video for the free trader training course, that’s just been uploaded and available for viewing. Hope you enjoy this module and find the AC setup as useful as we do for profitable trading.

4 Comments

|

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed