|

Seasons greetings to everyone, I hope you all had a great Christmas yesterday. I managed to spend the entire day without turning on my computer but made up for that today. The fruits of my labour are briefly shown in this video. Lots of work still to be done but if you like trading harmonic patterns, I really hope you will like this new indi when it is eventually released in the new year. Wishing you all a very prosperous 2015.

2 Comments

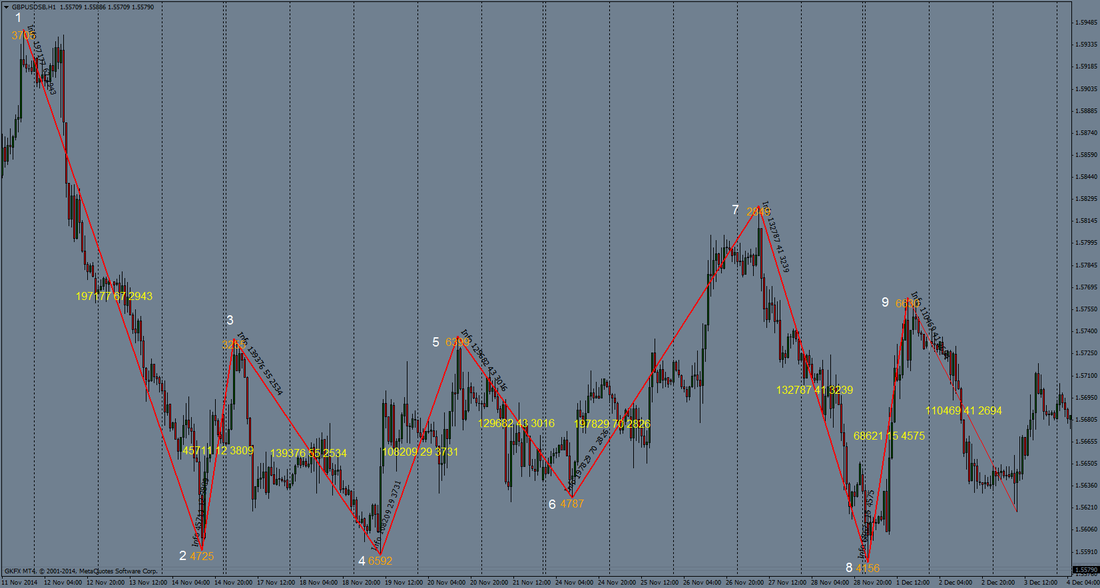

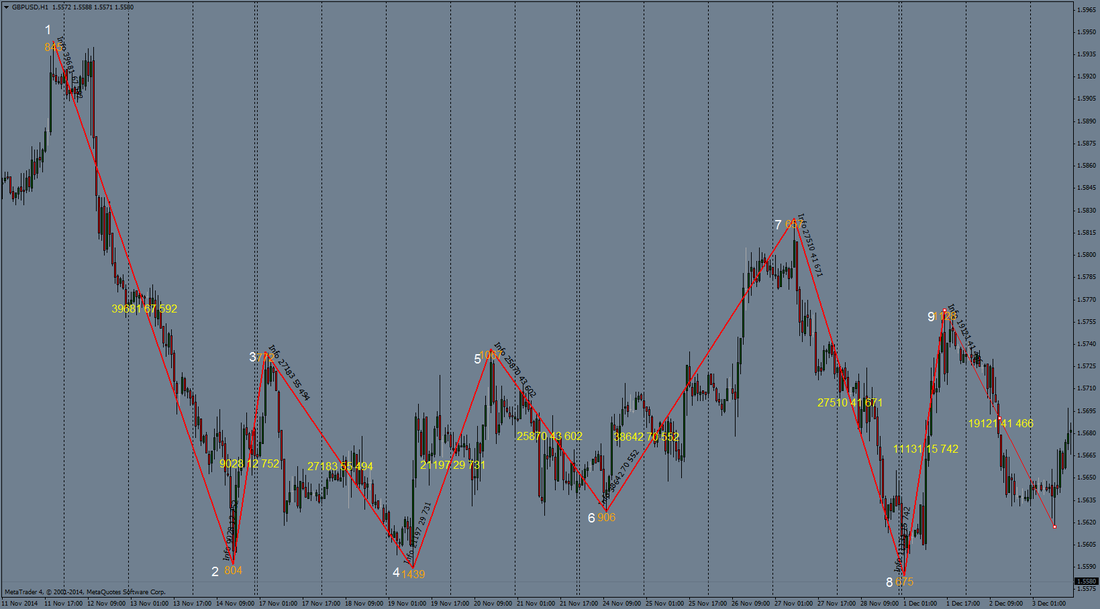

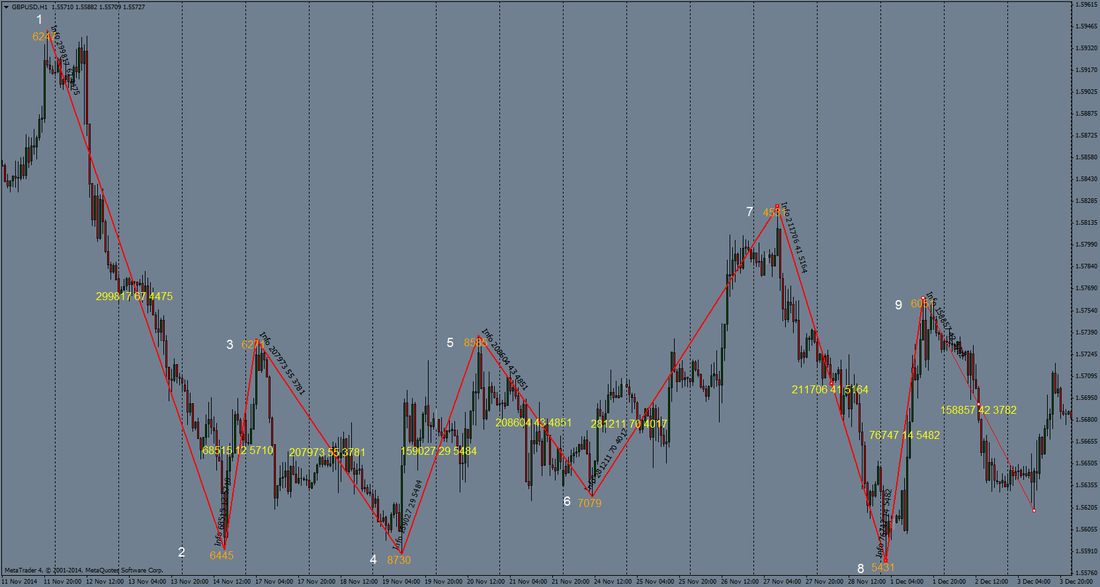

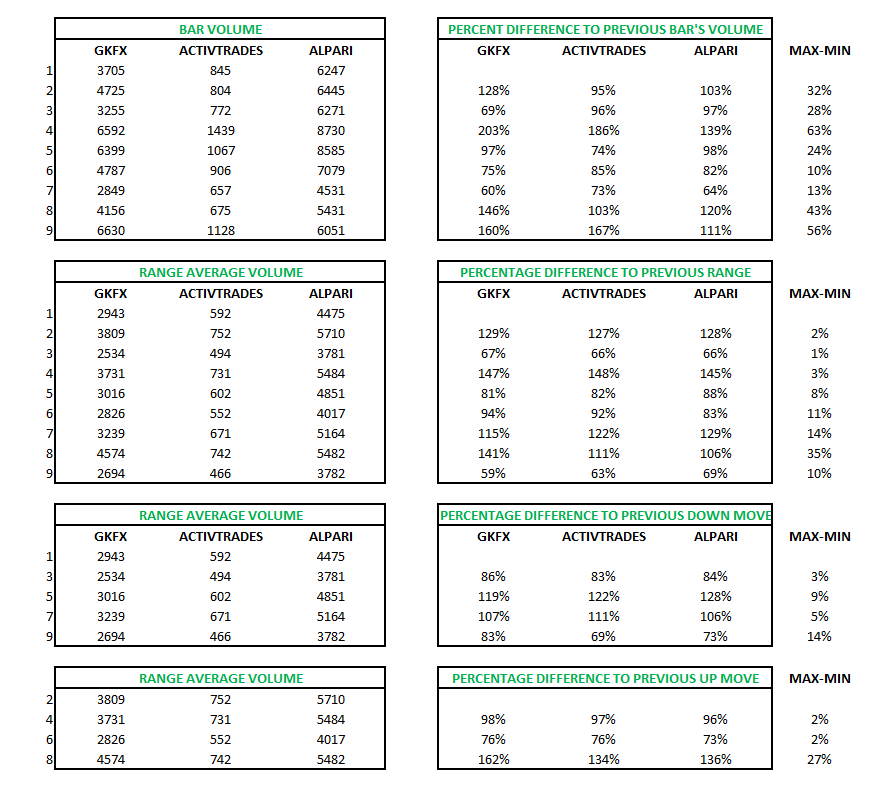

Since the spot forex market is not traded through a central point of exchange, getting real volume information is no easy task; in fact, it is impossible to obtain the total dollar amount of transactions for any currency pair. We can get volume information for options and futures. We can get volume data from some spot forex brokers. It is even possible to get aggregate volume information from a number of sources but the real total volume just isn’t available to us. So those clever people at MetaQuotes came up with ‘Tick Volume’ for MetaTrader (though they just call it ‘volume’) – something that many will tell you is as good as the real thing but is it? Tick Volume represents the fluctuation of quoted prices. The theory is that price will change whenever there are transactions and the more transaction there are, the more price will change, the greater the apparent ‘volume’. This is very different to the volume information that you would get from equities or futures. For many years I have heard from traders, or read in forums, about how important volume is for making informed trading decisions. There are countless threads, websites and (often very expensive) courses on volume-spread-analysis. There is no doubt about the worth of true volume information but I thought I’d see for myself how useful the MetaTrader volume really is and whether it could be used as an aid for trading spot forex: the results were not what I expected and hence the reason for this blog post. We know that the volume information would be different across the brokers, as they provide the prices and the tick data, but the key thing for any trader is that the relative volume data should be very similar, if not the same, across all the brokers; otherwise volume-traders would trade very differently according to the broker they use. I wrote a simple little indicator to test this out – something to display volume data of a chosen bar and of a range when a trend line is drawn. The pictures below (click on each one to make bigger) shows this indicator in action, on recent GU H1 charts, from GKFX, Activtrades and Alpari. The orange numbers show the volume of the bar from where the trend line was drawn; the yellow numbers show total volume, number of bars and average volume of the range. The tables below show the data from each of the charts – I hope it makes sense (I entered the numbers manually so let me know if you spot any errors). The table on the top right shows the percentage difference between individual bar volumes on each chart, so for example, bar 2 on GKFX has 128% more volume than bar 1; bar 3 has 69% of bar 2, etc. We would expect that to be roughly the same across all the brokers but not so … bar 2 has only 95% of the bar 1 volume on Activtrades and 103% on Alpari. How can bars on an hourly chart have such a different amount of ‘volume’ data across the brokers? The Max-Min column shows the largest difference between the brokers – up to 63%.

The average volume data of the selected moves was also substantial – up to 35%. Same direction move comparisons had a difference of up to 27% across the brokers. Conclusion: I really can’t see that tick volume is of any use for making informed trading decisions from relative data (bar-to-bar or range-to-range) when there is such a variance across the brokers; I would go as far to say it’s a waste of Bits. I would however love to meet anyone who thinks otherwise and is consistently profitable from trading with the MetaTrader 'volume' data. Every now and then I get a really nice email from a trader who appreciates the value of eWaves. With Paul's permission, I'd like to share his kind words below ... Thank you for taking the time to email me Paul, it's always good to hear from traders who appreciate eWaves as much as I do.

Hello Steve. I have been in the game for many many years and have been pretty much all over every indicator and strategy Buying an indicator over the internet can be a bit of a fools errand, as you well know......... However, with your indicator I thought that I might be in for a pleasant surprise..... but all I can say is WOW! Your eWave indicator is the BOSS and the edge it provides for me is in mapping out the underlying structure of the time frame that I am trading on... Please see the attached EURUSD M1and the trade I took on a confirmed measured move on wave 5, confirmed by a double bottom also reinforced by a shs gave the trade away (and with a tight 2 pip sl.) Again easy measured move trades could have been shorted down wave ABC. See how the fib timing also confirmed the Elliott Wave Thank you for your stunning software! Kind regards, Paul |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed