|

I get many requests from eWaves users to post examples of how to trade with the indicator. Here is a perfect recent example of how you could have made 60 pips with a 30 pip SL.

Price formed a clear Wave 3 then pulled back to the BRN at 1.1100 and bounced straight back up, to form what eWaves sees as a Wave 4. Further confluence for support was provided by the D1 SR level (in white). With the clear down-side rejection at Wave 4 and double support levels, we had a high-probability trade staring us in the face. Entry just above the bar shown, with TP set a few pips below the TZ1 level. Reward twice the risk and a stress-free trade . You could also have traded the Wave 5 short for another 30 or so pips. Happy days :)

6 Comments

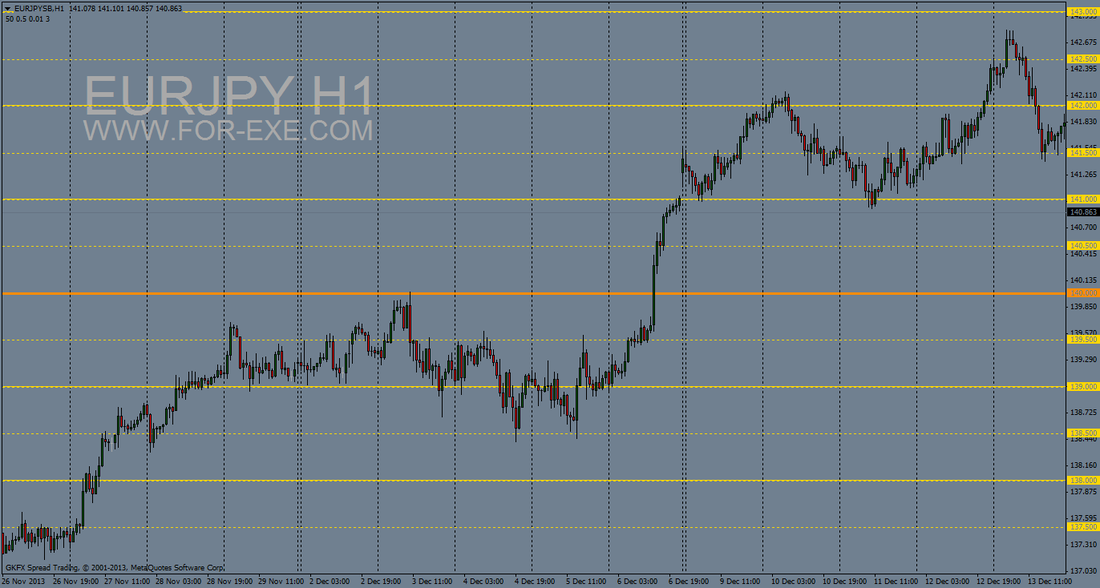

Here's another freebie for you, should you be interested - SNORM BRN indicator. You can load it as many times as you like, for different levels e.g. 50, 100, 500. Choose your preferred colours and line thickness, or styles, then set the 'visualization' options to not show, for example, the 50 and 100 levels on the weekly and monthly charts. 500 levels seem to work particularly well on the weekly charts. Some basic price action trading, around the right BRN levels, can provide for some great low-risk/high-reward trades, as you can see from the picture below.

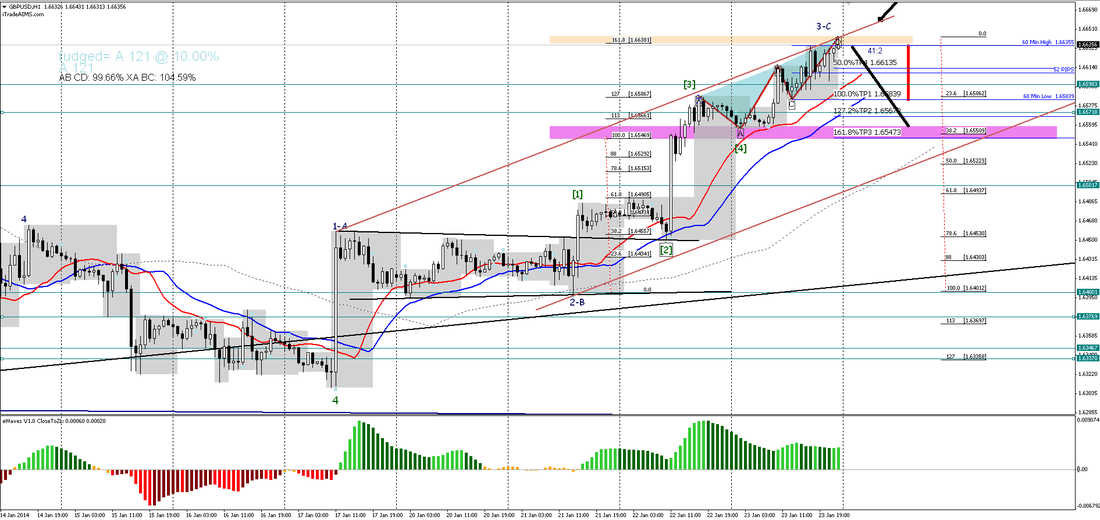

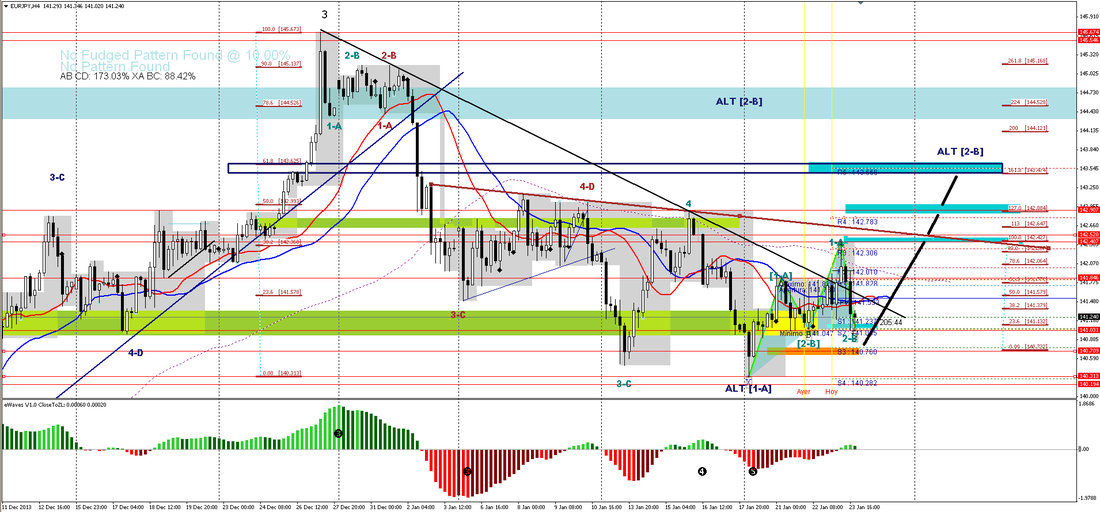

David is a bit of a whiz when it comes to Elliott Wave and Harmonics. Here are some of his latests thoughts (we hope to make this a regular thing in future)

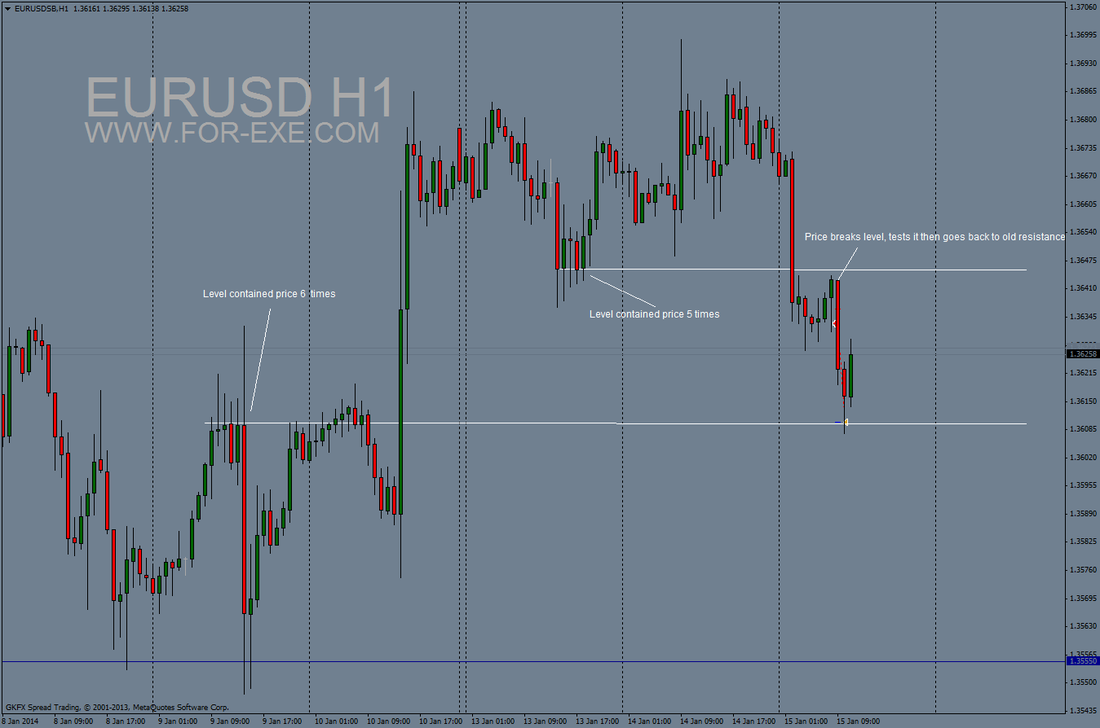

Does trading have to be any more complicated than this ...? Price action at support and resistance levels really can be the 'holy grail' of trading any market.

This is great news for us MAC users - you can now run Metatrader on a MAC without Parallels or other Windows emulators. I've just installed it, loaded some of my indies and experts and am very happy to see that it all works well.

Take a look: http://www.gkfx.com/EN/metatradermac and |

Archives

May 2024

|

||||||

|

Website design by Snorm

|

RSS Feed

RSS Feed