|

Here’s a great quote, from Mark Douglas:

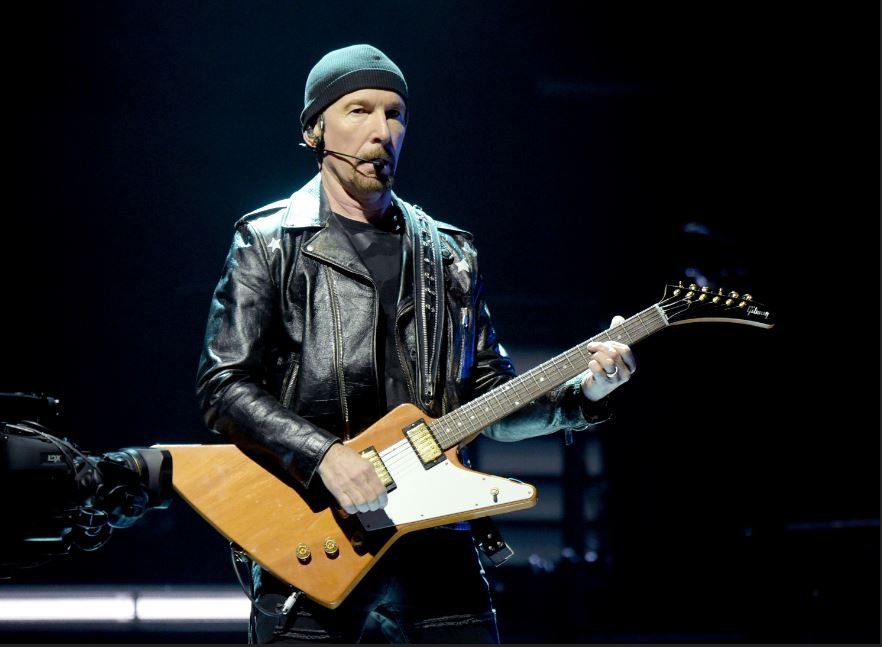

I AM A CONSISTENT WINNER BECAUSE: 1. I objectively identify my edges. 2. I predefine the risk of every trade. 3. I completely accept the risk or I am willing to let go of the trade. 4. I act on my edges without reservation or hesitation. 5. I pay myself as the market makes money available to me. 6. I continually monitor my susceptibility for making errors. 7. I understand the absolute necessity of these principles of consistent success and, therefore, I never violate them.” Great stuff, but what is an ‘edge’, as regards trading? Simply put, an edge is what contributes to you being a profitable trader: from having a good trading plan to the way you enter and manage your trades. It’s what sets you apart from most wannabe traders who struggle to make a profit. Asides from the requisite psychological aspects of being a trader – e.g. patience and discipline – the most important edge is what triggers a trade; the ‘setup’. What makes you willing to risk your money to make a profit? Your edge prevents you from random trading and helps you to focus on repeatable patterns that are proven, over time, to have a good chance of success. In our Skype Trading Group we have well over 20 different setups that give us the edge. These are setups that allow us to buy the dips and sell the rallies, often getting in at the start of Wave 1 with the lowest possible pip risk. This edge frequently generates more than 5x the risk in returns; 10R or 20R trades are less common but happen most weeks. Having such an edge helps you to accept losses with a pinch of salt, so you can keep acting on the edge without reservation or hesitation, as recommended by Mr Douglas. So, we have an edge with our setups, an edge in being able to identify high-probability price magnets before pressing the buy/sell button, an edge in being able to identify high-probability turning points that provide the ultra-low-pip-risk entries and, just as important, an edge in being able to manage a trade through to conclusion, banking excellent returns. Just knowing these things gives you the necessary confidence to succeed as a trader. If you’re struggling as a trader, set about documenting what your edges are. Again, as Mr Douglas says, you should objectively identify them, such that there is no ambiguity. Make a point of fine-tuning your edges with the experience and results of trading them. This will give you the advantage in the highly competitive world of trading. P.S. The picture? That The Edge from U2, in case you didn't know. He certainly has the edge when it comes to playing a guitar.

2 Comments

La Kiwi

11/1/2023 12:37:37 pm

Great article to kick off the new trading year, especially like the bit about fine tuning your edge which i constantly do with the use of journalling and re traaining and reviewing

Reply

Steve

11/1/2023 02:07:04 pm

Thanks La Kiwi :) Glad you enjoyed it ...

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed