|

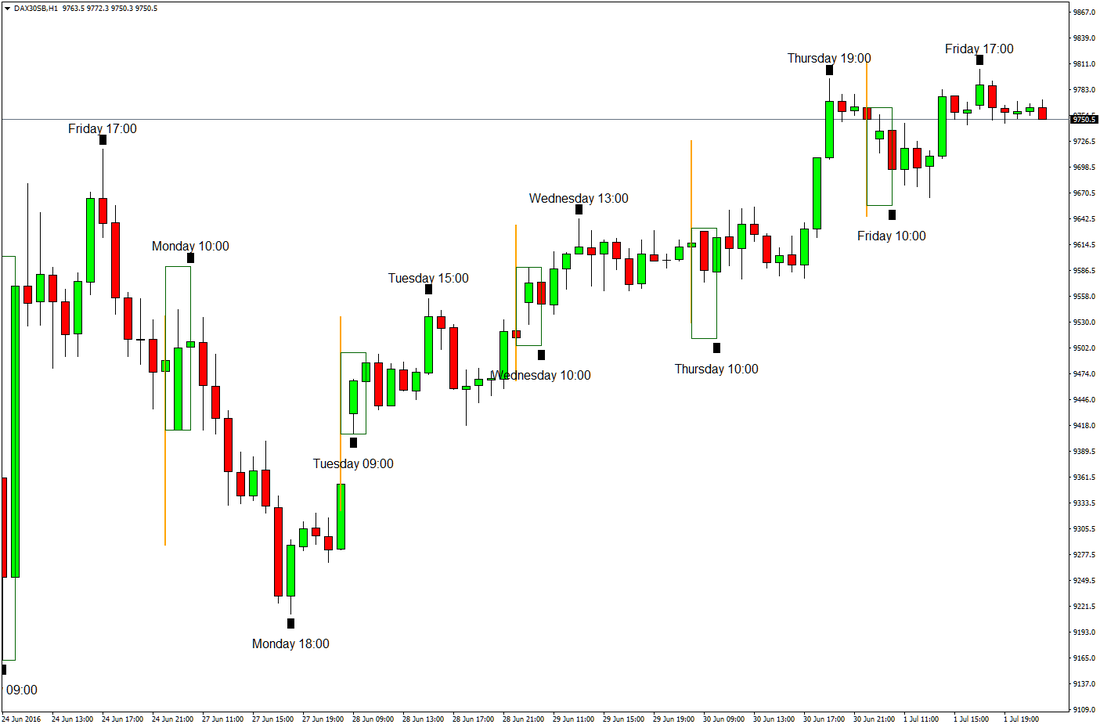

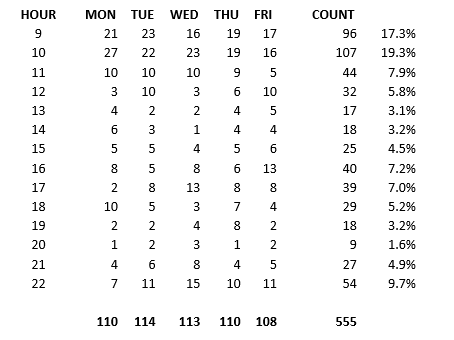

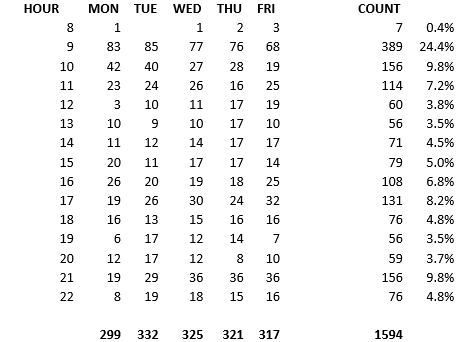

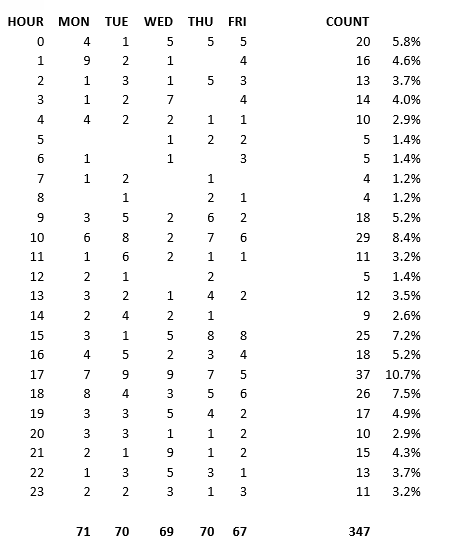

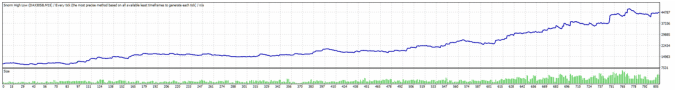

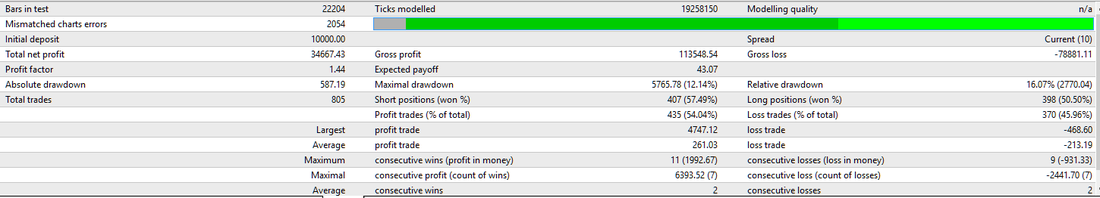

Most traders know that the best times to trade are when the major players are in the office: generally, from the London Open, around 8am to 17:00 UK time, taking some time off for a couple of hours at lunch time. However, few intraday traders that I know of give much thought to the success of their own trading at times of day and days of week. Do you keep a journal of your trades and note the times of day and days of week where you were most successful and least so? If not, you should. Armed with this important information you can cut down on your trading hours and focus on the times that best suit your strategy. I wrote a little program to scan charts and produce a spreadsheet with times where the highs and lows were formed on any given day. To give you an idea as to the importance of time, 50% of the high/lows on DAX H1, this past week, were formed on the first two H1 bars of the day. That provides a remarkable edge for any intraday DAX trader … FIFTY PERCENT !! Of course, that is just the past week but see for yourself: - Unfortunately, it’s not such a high probability if we look back further in time: 17.3% of the time, the high/low will be on the first H1 bar; 19.3% on the second. Combined that gives 36.6% probability of the high/low being formed in the first two hours: still a great edge and a very good reason to get up early to trade the DAX. Here’s the full analysis of hour and day of the week (I’m using GKFX data which is GMT+2 – so 9 would be 7am UK time. Note also, some days may have a double top/bottom so the high/low could be counted twice.): Similar results can be seen on the FTSE100: Forex is a bit different but you can still keep an eye on just a few consecutive hours of the day for a 25% probability of the high/low being formed. This is EUR/USD (don’t forget it’s GMT +2): And I could go on but making pivot tables, cutting and pasting is a bit laborious for a sunny Sunday when I should be out mowing the lawn; but you get the idea. So how can this information be best used, apart from knowing when to be in front of your charts and when not to be? A simple EA can easily make good use of this, so I wrote one and the results surpassed expectations, albeit these are strategy testing results. Trading DAX M15 with a starting balance of £10k, the net profit after a 17 months (from January 2015 to now) is £34,667, risking just 1% per trade. No indicators – just trading the high-probability daily high/low times.

I’ll give some thought to releasing this EA after some forward testing - there is no proof of anything until a robot has been let loose on a live account. There is clear evidence that the time of day can have an obvious impact on your potential trading success, so don’t ignore this most important of variables in your trading and reviewing of trade journals. As for the UEFA EURO 2016 … well let’s not talk too much about that :) If your country is still in it, unlike England, then I wish you the best of luck.

13 Comments

AC

3/7/2016 12:39:02 pm

Fantastic piece TC.

Reply

Steve

3/7/2016 12:41:35 pm

Glad you enjoyed it AC :)

Reply

Spyros

3/7/2016 01:17:14 pm

Great piece of work Steve, as always.

Reply

Steve

3/7/2016 01:53:22 pm

Σας ευχαριστώ Σπύρος

Reply

Pedro Sampaio

3/7/2016 02:23:00 pm

Nice one Steve! keep up the great work!

Reply

Brige

4/7/2016 12:01:36 am

Good analysis Steve. Keep up the good work.

Reply

Ralf

4/7/2016 08:10:29 am

Thank you Steve for this very interesting reading! Keep up the great work!

Reply

Pankaj

4/7/2016 10:50:28 am

Really valuable analysis Steve. Thanks

Reply

Steve

4/7/2016 06:09:03 pm

Thank you all for the positive feedback on this post, in your comments and emails. I'll try to do some more statistical analysis in future posts. In the meantime, I have begun forward-testing the EA on a live account - let's see how that performs for a few months. I will let you know if there is anything worth shouting about; or stay quiet if it's rubbish :)

Reply

Peter

13/6/2019 11:45:19 am

So the moral of this story : Why would you work for $5 an hour during 14 hours a day if you can make $40 per hour the best 2 hours a day!

Reply

Steve Norman

13/6/2019 11:54:04 am

Spot on Peter ... less is more :)

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed