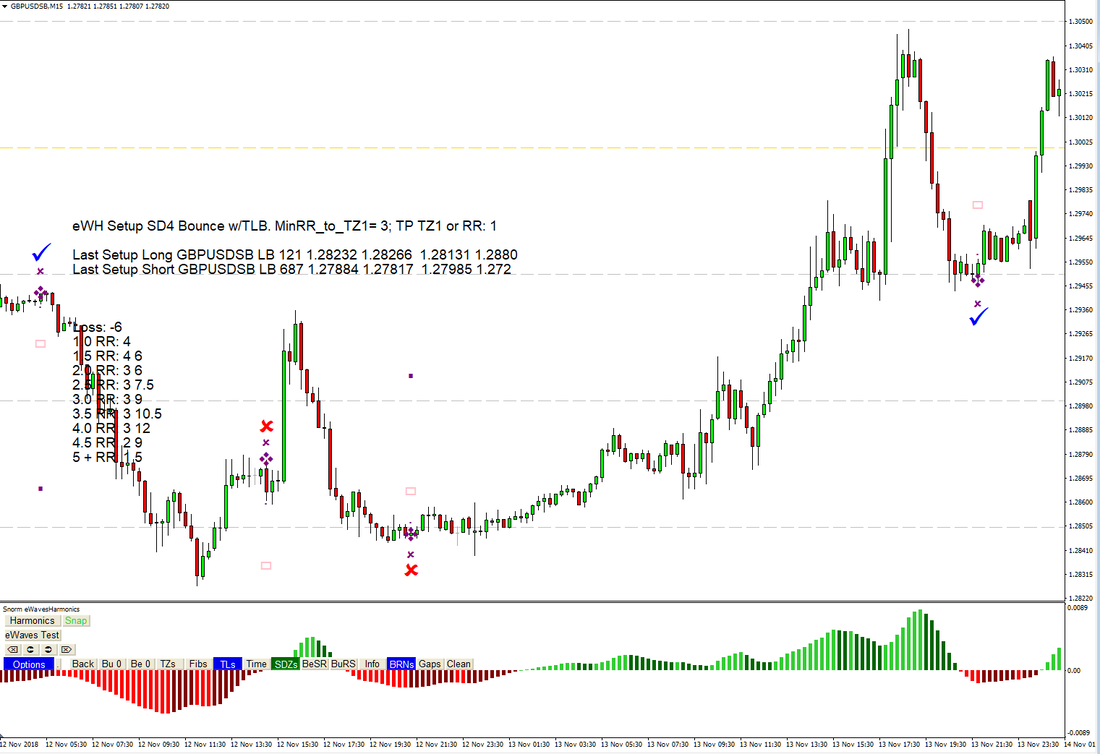

We all want trade signals that alert us to high-probability trade setups, removing the need for in-depth analysis of the many variables that yield profitable trades. There are hundreds, if not thousands, of so-called ‘trade signals’ available from scammer sites - with false claims of guaranteed success – but they offer no easily-verifiable statistics to support the claims of greatness. I get many requests for trade alerts or buy/sell signal indicators and, over recent months, have been working hard on some ideas; It’s no easy task though. As traders, we consider some, or all, or more, of the following variables: trends (although I dislike that term – more on that in another blog post), support/resistance; supply/demand; time of day; higher timeframes; lower timeframes; fundamentals – including news releases, recent and planned; most-recent price bars; relatively-recent price bars; trend lines; gaps; patterns of all types and shapes; symmetry; balance; projections (time and price), Fibonacci levels, wave counts; etc. And … let’s not forget the plethora of technical indicators that could form a part of the decision making. The human brain, trained from years of charting, can do this in seconds, or less. Programming a computer, to consider all (or, at least, the most relevant) of these variables, is a considerable undertaking. The fewer of the aforementioned variables that are considered, the more random the trade signals will be – likely yielding, at best, a break-even success rate. Getting good trade alerts is just half the job. In addition to entries, we need to know where to put our stop loss, where to take profits and how to manage the trade. An alert on its own is useless, if you don't know what to do with the trade or what the best place to take profits is. With eWavesHarmonics (eWH), we have visual representations of, what I consider to be, the most important trading variables: the technical elements that I look at for trading, plus some extras for those that like them. Presented with the many critical elements of technical trading, on the chart in view, our brains can easily focus on good setups. So, it goes without saying, that eWH is my focus for the trade signals and there are a myriad of options and setups to choose from. Currently being tested is a setup, that anyone who has done the free trading course should know: SD4 bounce after a W4 TLB. This is a logical approach to finding the end of a correction and getting a high RR trade. The picture, at the top of this post, is an example from GBPUSD M15 since 1st October: The blue ticks shows successful trades, reaching the minimum target of 1R.; the red cross shows losing trades (the first would have been avoided, when manual trading; the second one was only just stopped out). Putting eWH into Test mode, I let the chart auto-scroll and the setup indicator records how many wins/losses and what RR could have been achieved. In two months, you could have ‘blind-traded’ (i.e. not given any thought to other factors) this particular setup: 10 trades, 6 losses, 3 x 4R wins for a net gain of 6R … that’s very acceptable. Would the average trader, who wants to blind-trade, be happy to suffer 6 losses and only 3 x 4R wins though, even if the overall returns were very good? I suspect not, so now I need to code some of the extra variables that I would consider before trading this type of setup, then run more tests: across multiple instruments and timeframes. I’ve done some recent testing using customised and well-known harmonic patterns for eW4 corrections (anyone with eWH can do this for themselves, if you don’t mind manual-recording). I’ll give you a clue, from my automated testing, as to which patterns make for the best end-of-W4-correction trade alerts: Bat, Gartley and quite a few of my own custom patterns. I don’t trade with harmonic patterns but if they can provide reliable trade alerts, while I’m not watching the charts, then they’ll have a place in my trading plan. I'm making slow progress with the trade signals and will keep you posted when I have something good to share. In the meantime, it’s far better to trade with the Mark 1 Human Eye Ball indicator (any bets on how many emails I’ll get asking for that indi ?).

14 Comments

Kyle

30/11/2018 09:03:19 am

As always, looking to help others. Fantastic work. Hopefully, the good karma is finding you

Reply

Steve

30/11/2018 09:08:07 am

Thanks Kyle :)

Reply

Ac

30/11/2018 09:49:43 am

How much for the mk 1 eyeball indy please..

Reply

TTC

30/11/2018 10:13:53 am

The sum total of what Arsenal players and management get paid each year + VAT

Reply

Spyros

30/11/2018 10:12:35 am

Another great piece of magic from Steve.

Reply

Steve

30/11/2018 10:14:56 am

Thanks Spyros - me neither :)

Reply

Esio Uweh

2/12/2018 06:29:37 am

How much is this please or is it the new features of the harmonic software? Thanks

Reply

Steve

2/12/2018 09:05:20 am

Hi Esio. How much is what? I talk about quite a lot of things in the blog post. The indicator that I've written for testing setups is not available to purchase, if that's what you mean. I might make it available in the future though. Harmonic patterns (which can be user-defined, if required) are a free part of eWH and they can be tested manually, using the eWH Test mode. The W4 TLB SD4 bounce can be easily seen by the human eye, using eWH - these setups are explained in the course and can also be manually back-tested with eWH. The automated alert is being developed and tested - release and pricing undecided. I'll only release something if it is really good :)

Reply

Jas

3/12/2018 02:18:48 pm

This is great stuff, thanks Steve!

Reply

Steve

3/12/2018 02:25:59 pm

Hey Jas. I hope so ... :)

Reply

Amaechi

11/12/2018 06:49:53 pm

Nice job Steve. I 've been visiting your blog site but yet to purchase any of your products , but I've been impressed so far. great job once again

Reply

Steve

11/12/2018 06:55:00 pm

Thanks for visiting and your kind words, Amaechi. Perhaps you should treat yourself to something nice, like eWH, as it’s that special time of year :)

Reply

Faysaladan

22/4/2021 04:32:43 am

Is their any new course about the eWH

Reply

Steve

22/4/2021 09:01:26 am

I haven't made a new course, Faysaladan but the existing training course is still very relevant https://www.for-exe.com/trader-training.html

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed