|

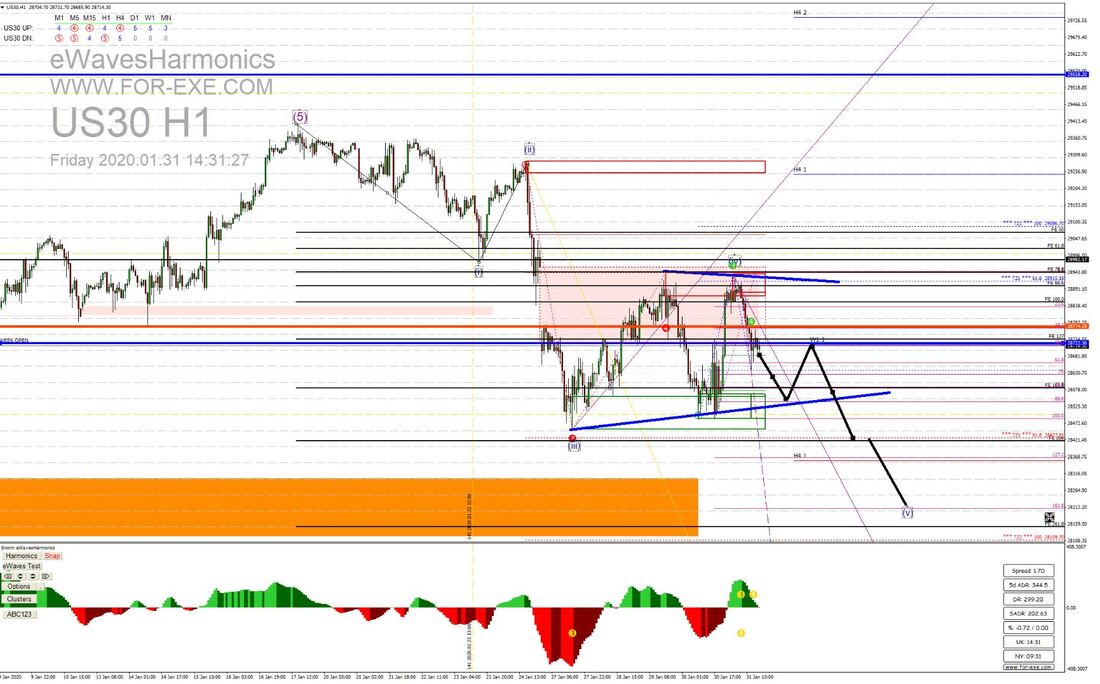

We saw another mammoth move with DOW on Friday and eWavesHarmonics (eWH), along with some simple Fib' analysis, was very helpful in pointing the way. We attempt to predict where DAX and DOW will go, at the start of the London and New York sessions and, for the most part, the forecasted moves work out pretty well. Friday's DOW prediction was nearly right and is a good topic to do a blog post about - I try to do at least one post a month but have been slack in January ... my bad! This was the prediction posted in our Skype group - a fall, a correction, then another fall. That wasn't really rocket-science. eWH had correctly identified the waves 3 and 4, then plotted target zones 1 and 2 for us .. that was enough by itself. For added confluence, I'd drawn the H1 demand zone, shown as the orange rectangle, then did a Fib' expansion of the waves 1 and 2, plus an extension of the last up wave, within the wave 4.. Given the strength of that move up, it was reasonable to expect a bounce off the 4 demand zone to test the week open, before continuing on down to the target zones. The red TZ2 was below our orange H1 demand zone, so the most probable target was between the 1-2 261.8 Fib' expansion and 161.8 Fib' extension of that last move up; the latter labelled as (V) for our fifth wave. This is what followed ...(with the chart cleaned up a little) Price fell over 500 points! It didn't correct, as expected, the bears were far too strong; but it hit our wave 5 target just lovely. We trade the one minute charts in the Skype group and do an H1 analysis of DAX and DOW every day, to get some direction for the session, as well as likely targets and, using the clusters tool (shown below) to understand where price might stall and add further confluence to our targets. A regular higher timeframe analysis is an extremely important process, when trading the lower timeframes. To not do it, at the start of a trading session. is like trying to drive a car blindfolded, without a steering wheel and no idea where you're driving to. If you had used the bearish clusters feature in eWH, with the click of a button when the top of the wave 4 had formed, it would have drawn these levels for you (I added the circles to highlight how price reacted) ... Anyone who already has eWH can put it into 'test mode' and see for themselves how well the clusters worked.

I'm still expecting to see the red TZ2 hit, perhaps on Monday - I don't think the bears have finished with DOW yet. Hopefully, this blog post helps to emphasise the importance and usefulness of a pre-session higher timeframe analysis; particularly for the M1 traders but also for higher timeframe traders. If you have a good idea as to where price is going, it's a lot easier - and more profitable - to look for great setups in the right direction on the lower timeframes.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed