|

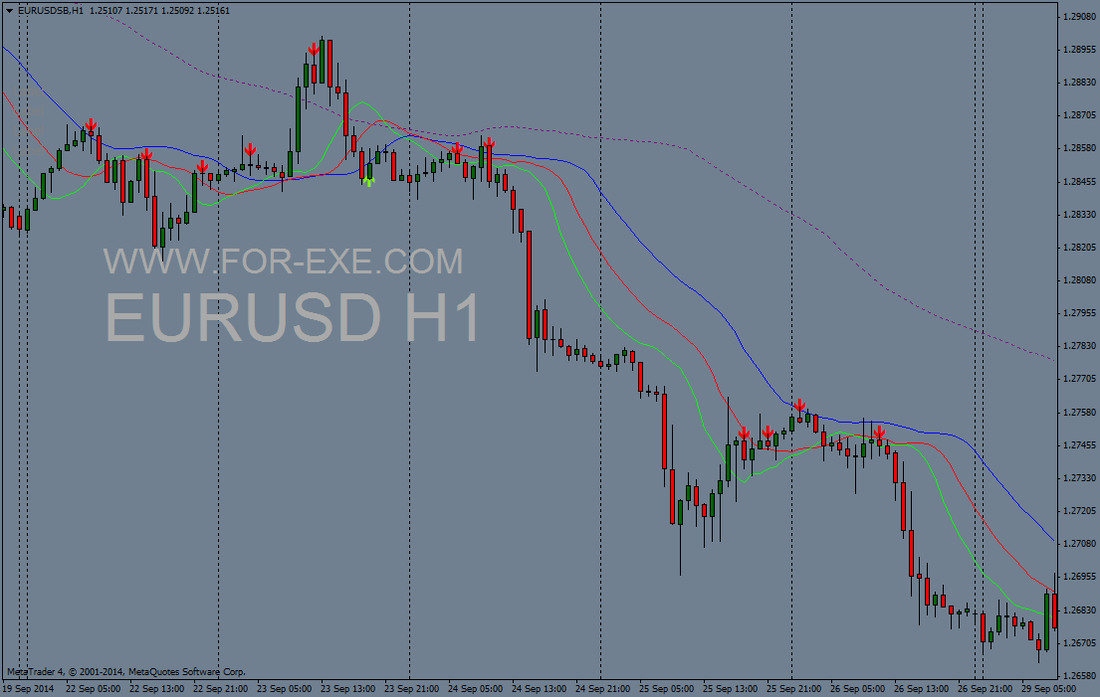

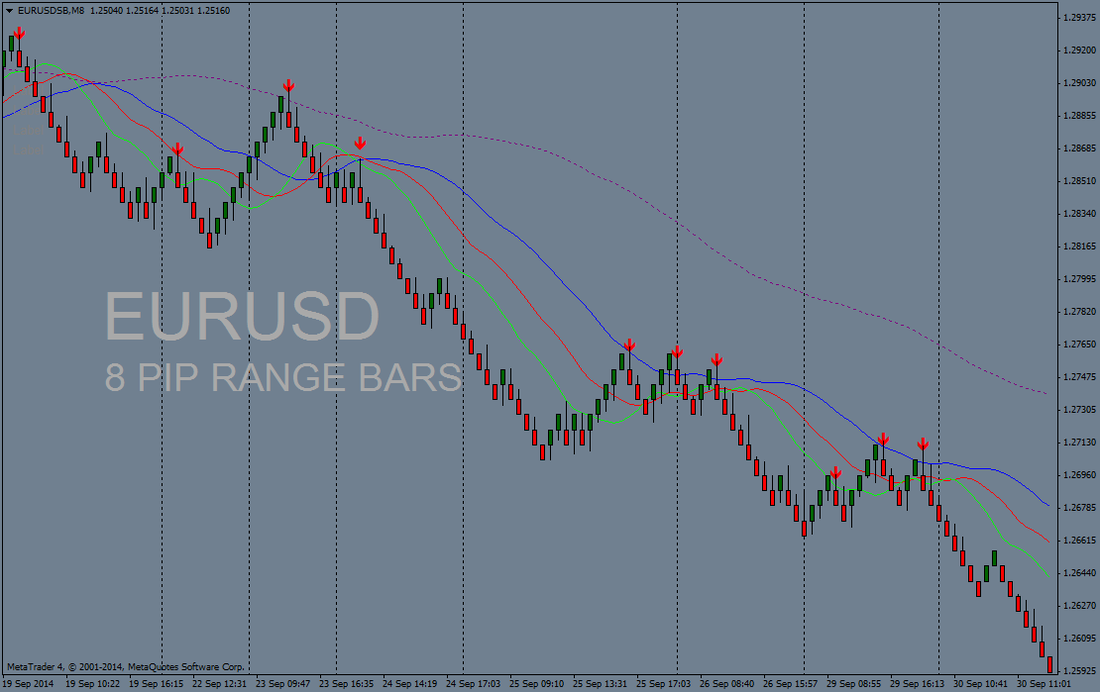

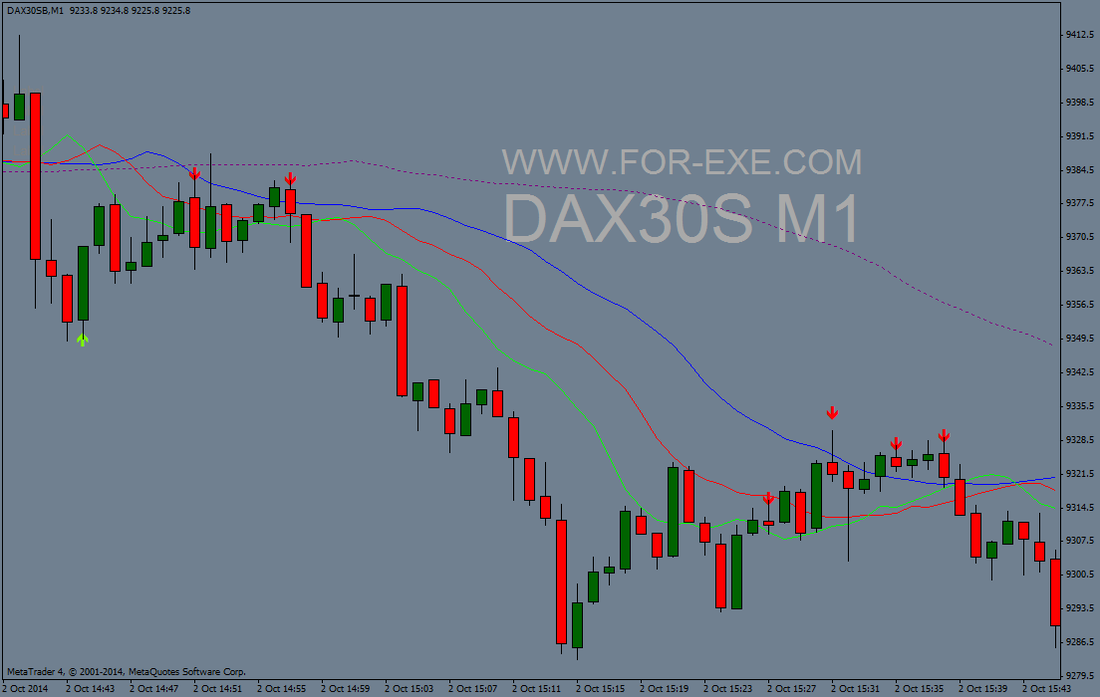

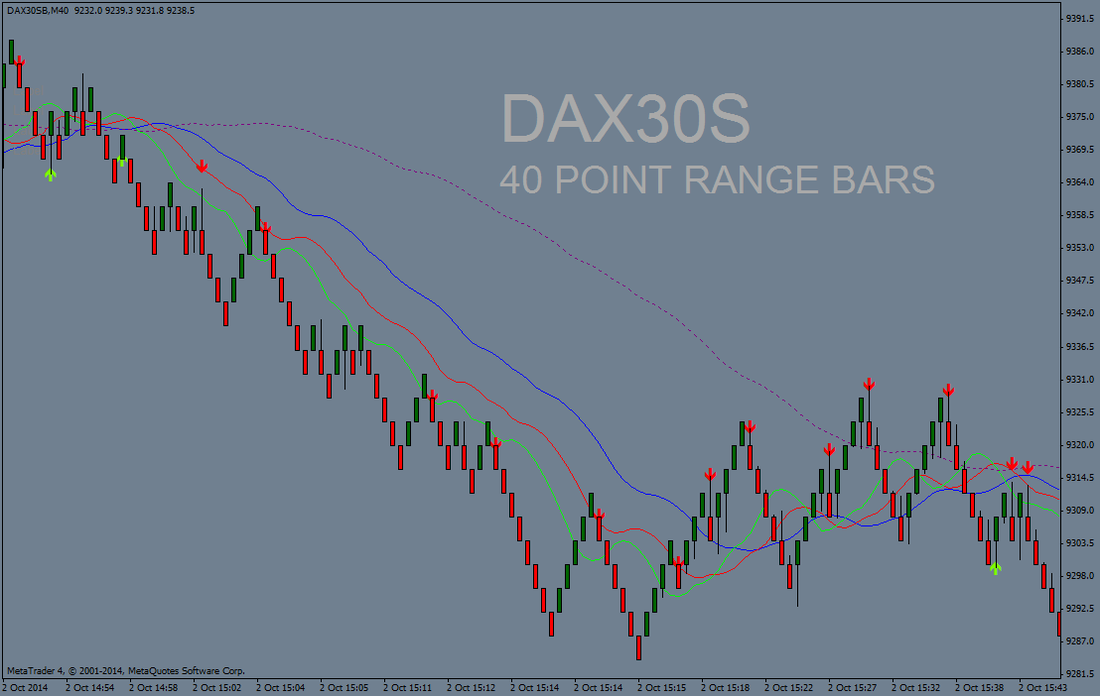

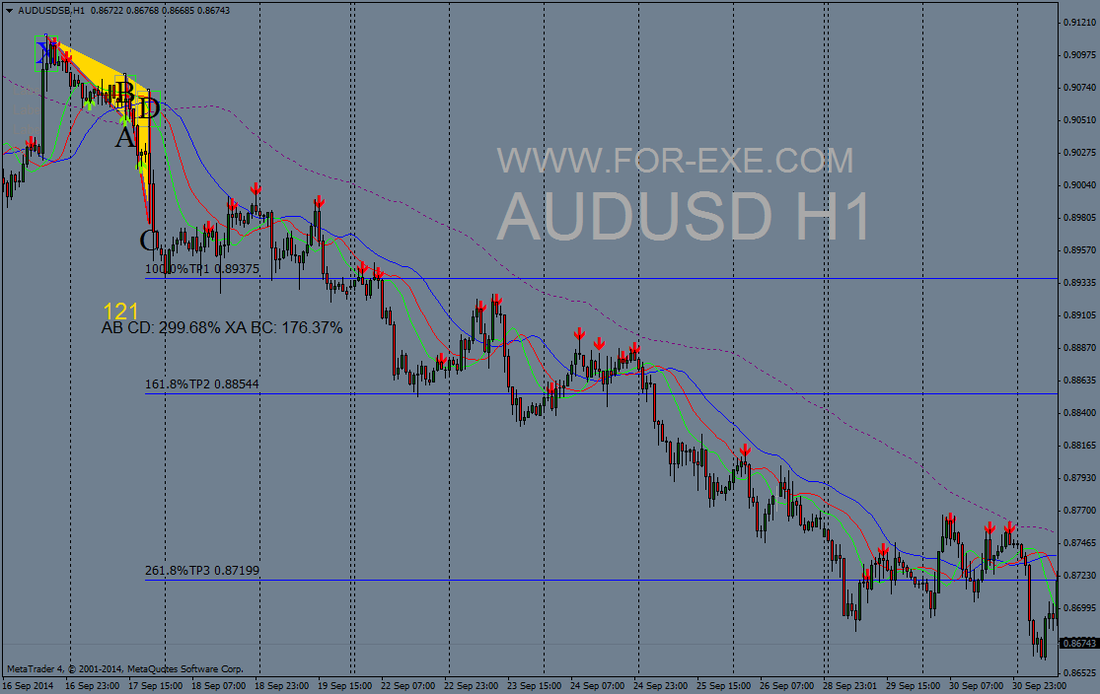

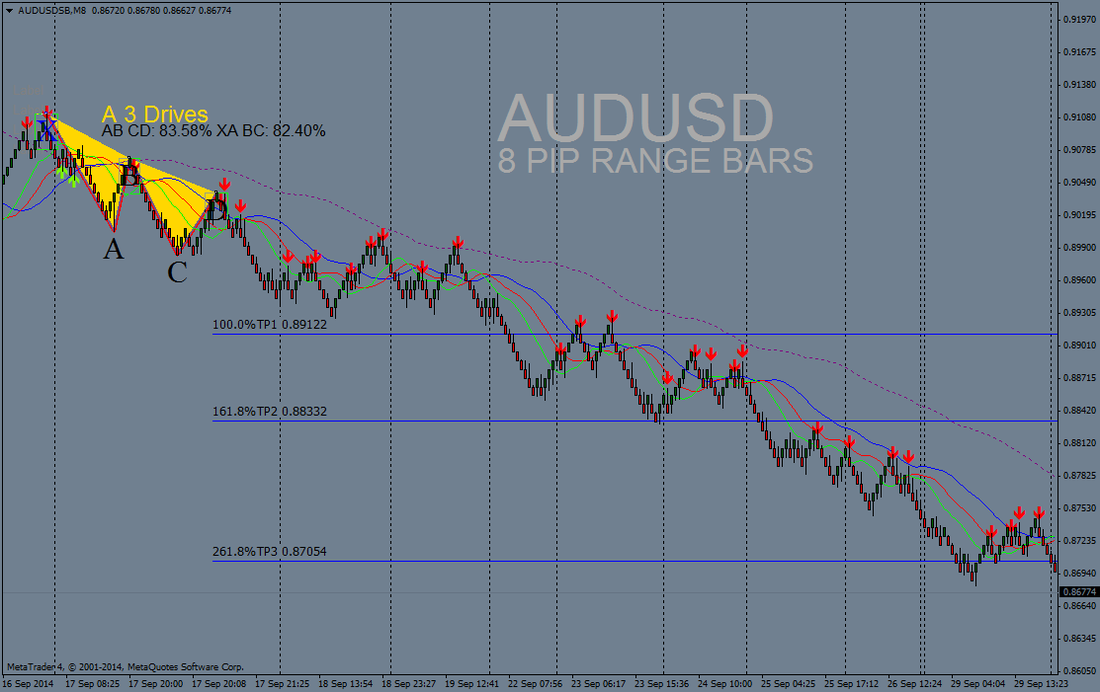

The For-Exe R&D department (sounds a lot more impressive than it really is) has spent the last week testing and trading range bars - a most profitable week it was, mostly from scalping the DAX. If you don't already know, range bars differ from normal price bars in that they only create a bar when price has moved X number of pips. Time is not a consideration, just price, giving rather clean looking charts without the 'noise'. It is purported that various indicators such as moving averages, RSI, Ichimoku, etc are more effective on range bars - something that our research seems to agree with. We also found that harmonic patterns are easier to spot and the drawing of supply/demand zones just a bit more objective. We created a little indicator to generate buy/sell signals using the Alligator. The pictures below shows the signals generated over the same period. The potential profitability of the range bar signals is self-evident. It should be noted that a couple of nice trending periods were selected for the above pictures - not all periods will be so easy to trade but all-in-all it's fair to say that trading range bars 'with the trend' should do you well. We will continue our research.

0 Comments

Leave a Reply. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed