|

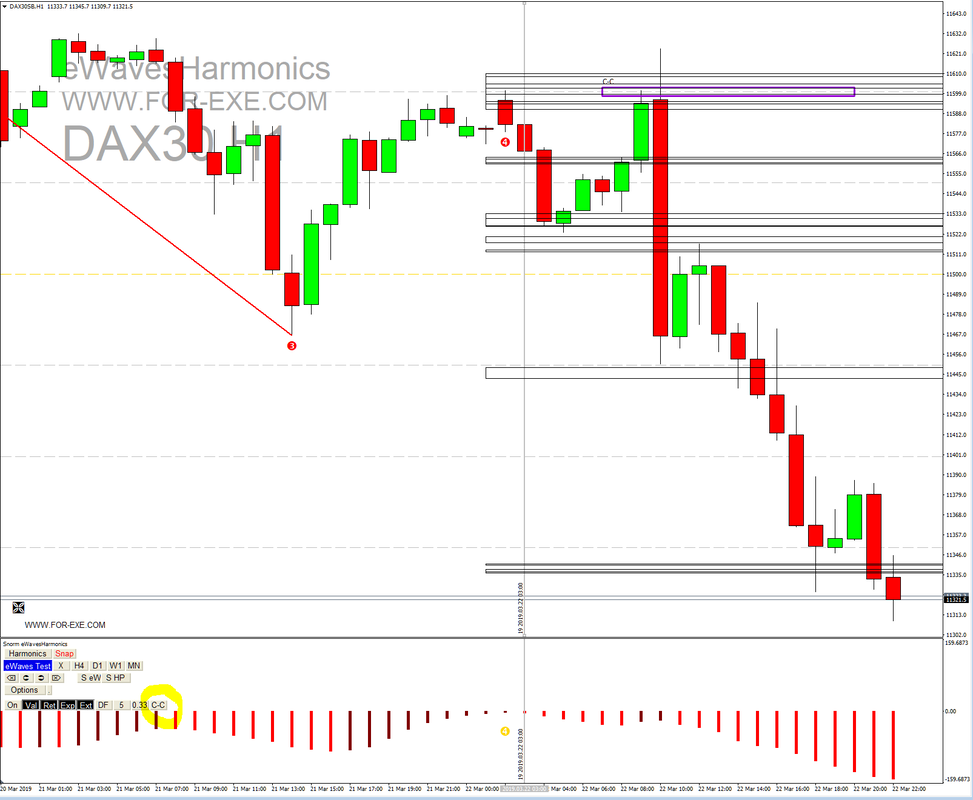

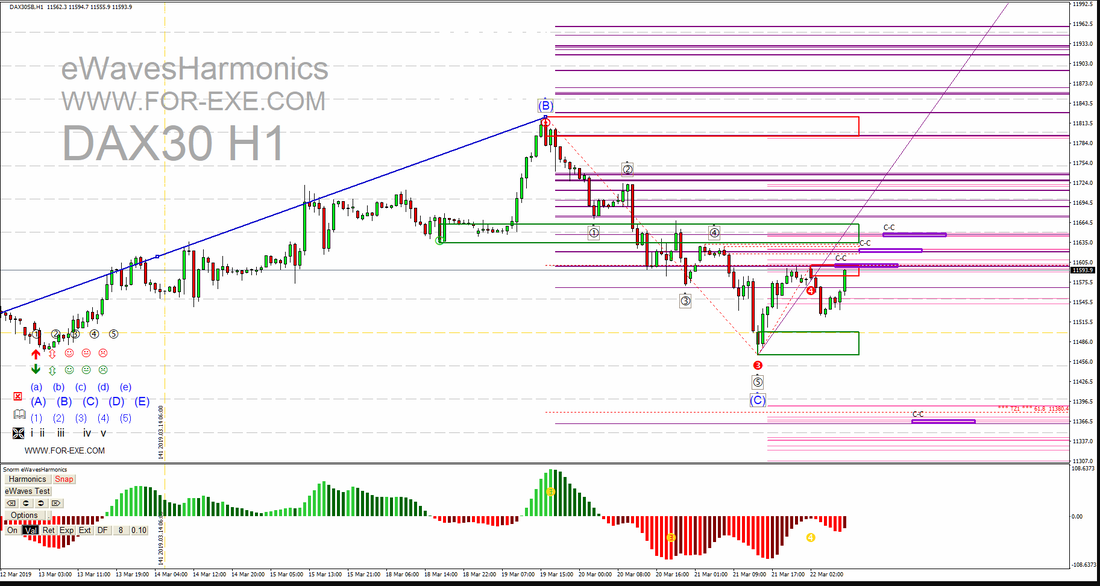

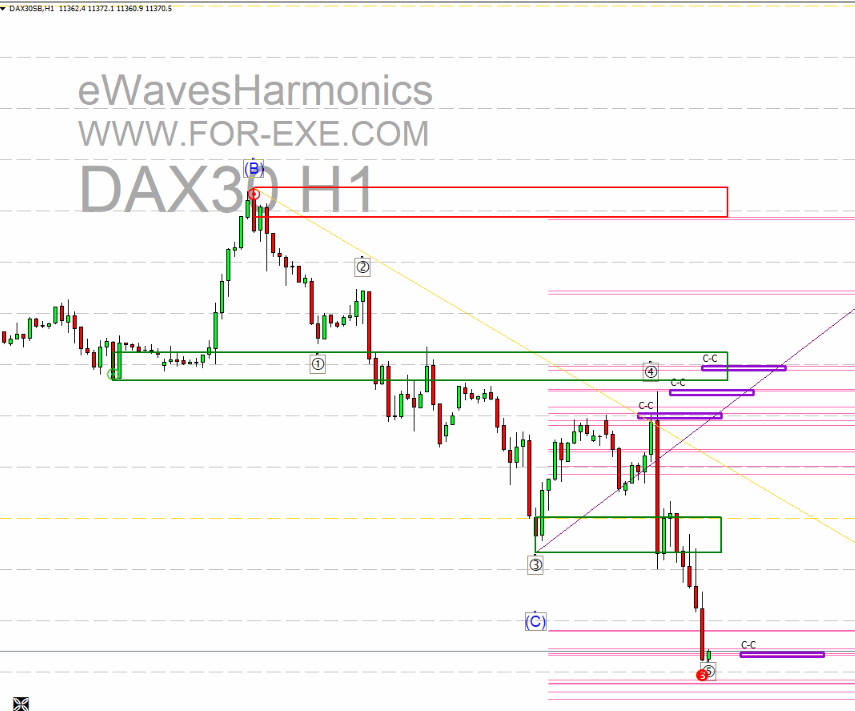

It was a terrific day for the Index Bears yesterday, with some 'there for the taking' shorting opportunities on most of the main indices. Without knowing what the day had in store for us, I posted the above DAX H1 chart before the London Open, showing some 'cluster-cluster' zones that would likely provide resistance above and a price-magnet below. The middle C-C above price was the most interesting, as it aligned nicely with the wave 4 level, as labelled. About half an hour after that chart was published, we were expecting German PMI results; if those results were below expectations, we would likely see one of the clusters acting as resistance, if price got there before hand. The PMI results were much lower than forecast and this is how price moved throughout the day ... from C-C to C-C.  The first two resistance C-Cs held price and the lower magnet C-C pulled price down nicely - and that's pretty much where it settled around the London Close. Over 250 points ...an easily-achievable RR of 20:1.if you had shorted the M1 news bar. Looking for cluster-clusters is a part of my daily routine, so getting some more help from eWavesHarmonics, to reduce the time-spent on mundane tasks, has to be a good idea. Whilst we will never make the human eyeball redundant, an extra button is being added to the Fibo Clusters to scan clusters and draw the C-C zones. This is how the DAX would have looked using the new feature (the first originally-drawn C-C has been left on the chart for comparison) ... It's not too bad, as it stands - these zones were plotted in test-mode at the time of the vertical line, not retro-fitted to price after the event. I'll be doing some more tweaking over the next few days to see if it can be improved and will do another blog post when the update is available for download.

In the meantime, keep an eye open for these cluster-clusters, on whatever instruments and timeframes you prefer to trade; they can be almost magical. If you don't have a clue what cluster-clusters are then you really should take a look at the training course. - it is still free for owners of eWH and ATM. Where next for the indices? Well, we appear to be seeing some strong impulsive bearish moves with more likely to come. DAX daily has recently had a TLB - might 10210 be calling? Very possibly, if the bears remain in control, but there are some C-Cs on the way.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed