|

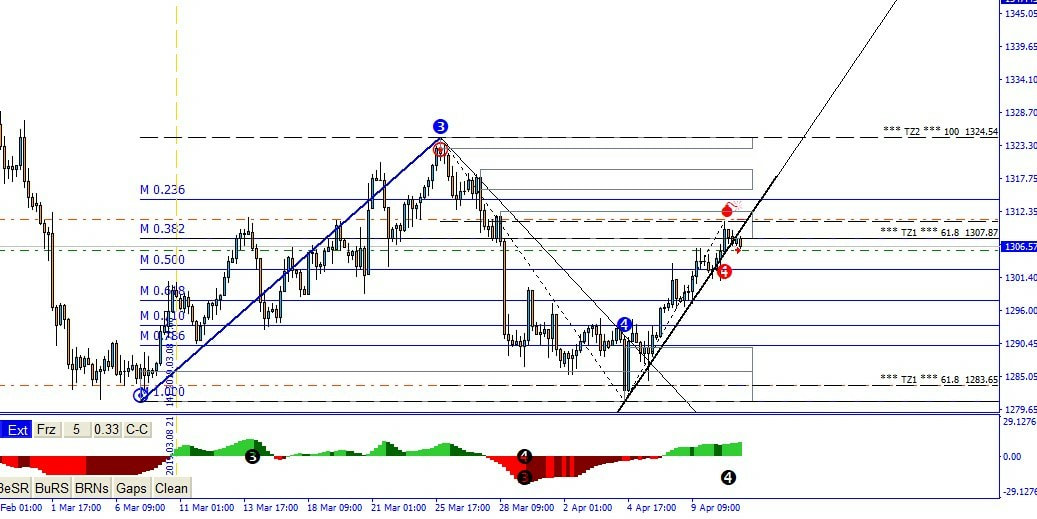

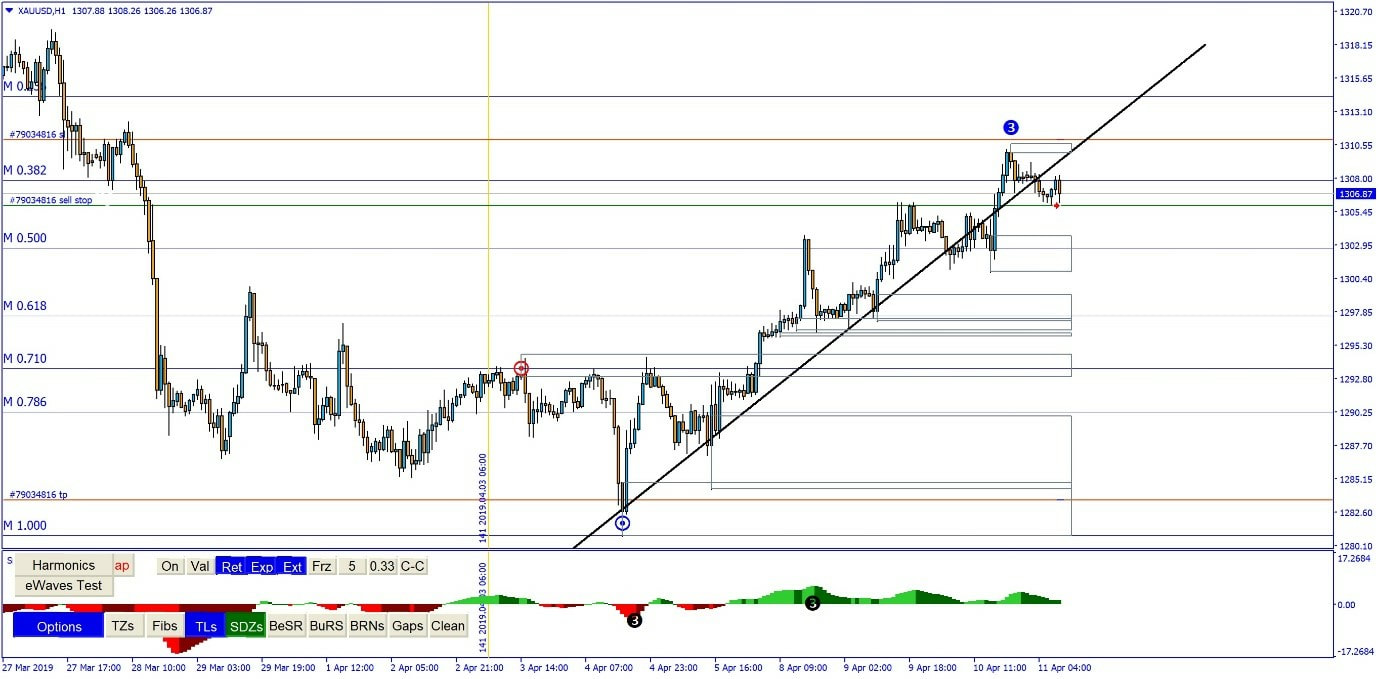

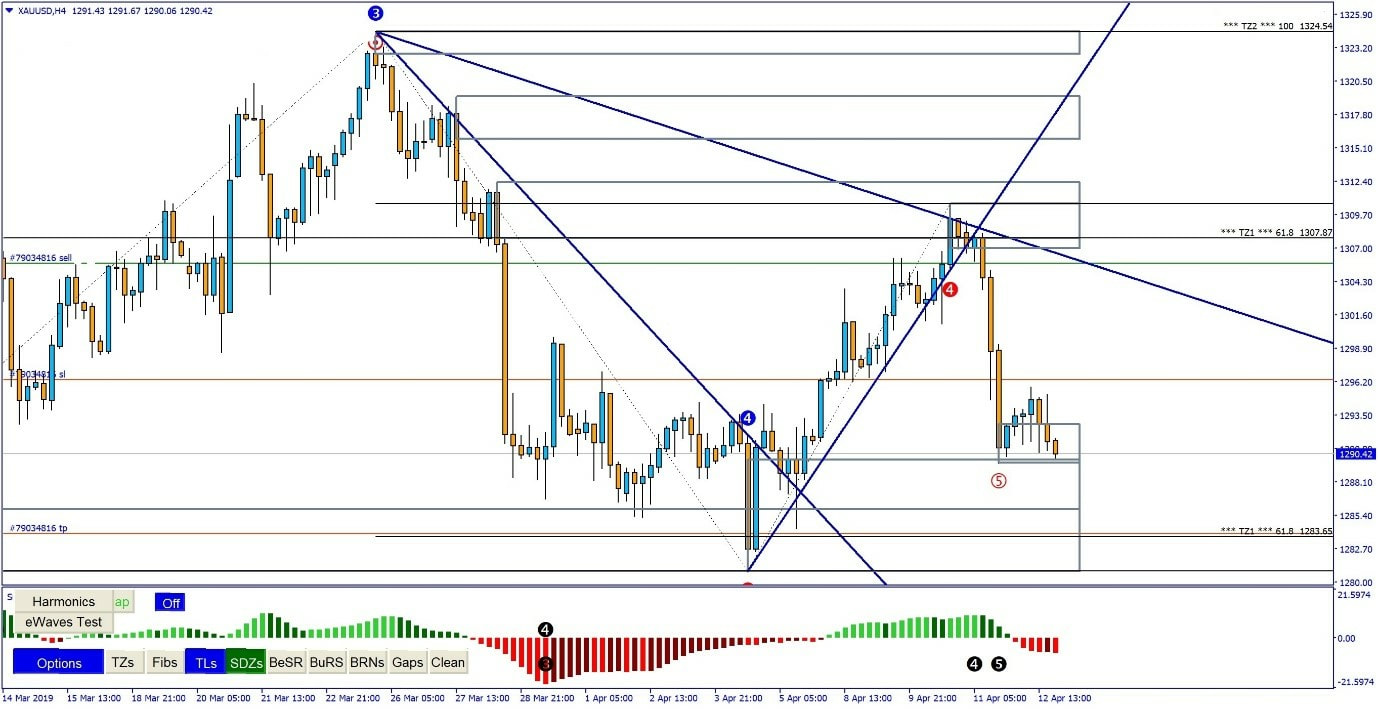

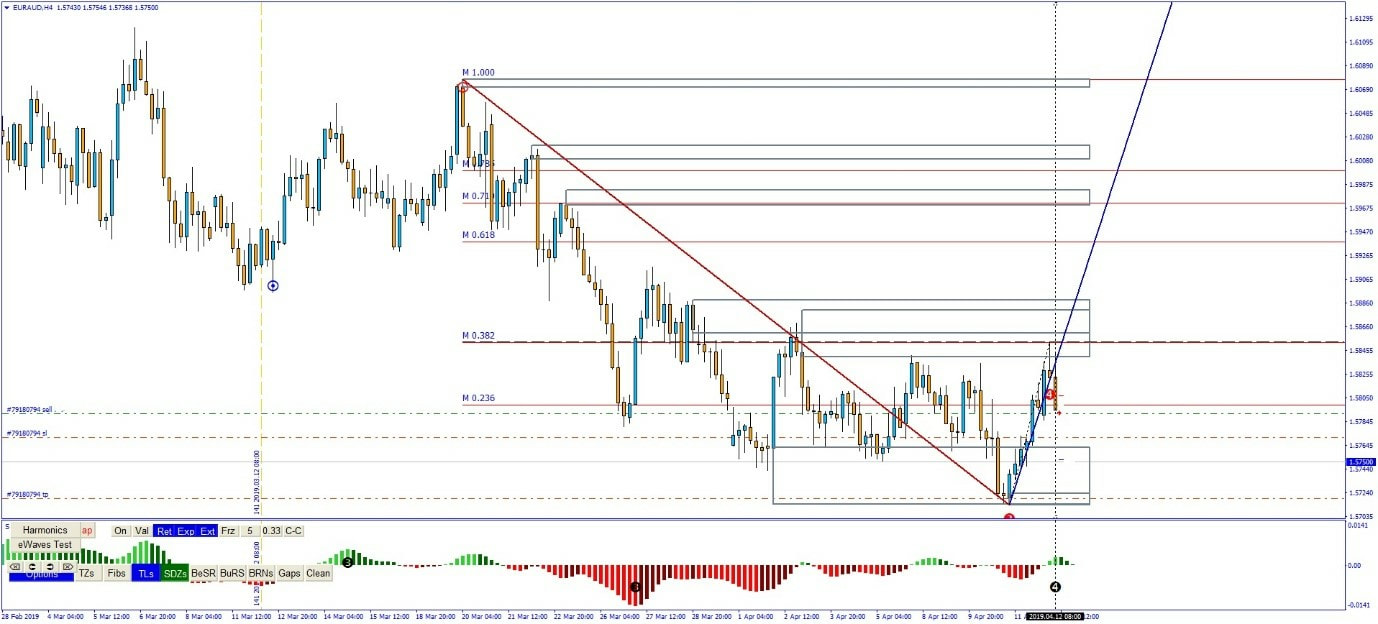

Chris has been using eWavesHarmonics and the Advanced Trade Manager for about two years and has enjoyed the Trader Training Course. I hope that you'll get some inspiration from seeing how others are trading with eWH and what they've learned from the course.. Please send me an email if you would like to contribute as well - it's always a pleasure to read and share the many success stories. Many thanks for your contribution , Chris. We all did it or are still doing it… jumping from one trading strategy to another looking for the ‘Holy Grail’ and believe me I’m the guiltiest of them all trying to find that winning strategy. Sometimes the best strategy has been staring you in the face for months or even years and you’ve totally disregarded it. One of the best strategies around and one which I have been back testing and trading over the last few months is the TLB (Trendline Break) I’ve found the TLB especially on the higher timeframes to be an excellent strategy to have in your arsenal. eWavesHarmonics makes trading the TLB easier with its automatically drawn trendlines, supply and demand zones, TLB alerts and KEEP function. Below are a couple of examples of TLB’s that I traded from Wednesday last week. XAUUSD – H4 TLB Price has broken the W4 Trendline at a Supply zone and 38.2% Fib retracement on the 4hr timeframe. We edit the name of the trendline to include ‘KEEP’ and switch to the 1HR timeframe looking for the re-test, once re-tested we place a SELL stop order below the candles after the trendline. I’m targeting TZ1 on the 4hr timeframe for my TP moving my Stop along the way, with an initial R: R of 4.4:1 This is how it’s played out so far, I think there will be more downside to come and I fully expect it to hit my TP however, if not, I’ve banked profits so I’m happy. EURAUD - H4 TLB The same trade as XAUUSD above. Price has broken the W4 Trendline at a Supply zone and 38.2% Fib retracement in addition we also have a shooting star candle further rejecting the supply zone on the 4hr timeframe. (The below screenshot may look a little strange as my stop is already below the sell price however I forgot to screenshot this trade and I’m using the Candle Hider indicator (another For-exe.com goody) Again, we edit the name of the trendline to include ‘KEEP’ and switch to the 1HR timeframe looking for the re-test, once re-tested we place a SELL stop order below the candles after the trendline. The only difference with this one is price only really re-tested the supply zone as the breakout was a big bearish candle. I’m targeting the demand zone for my TP moving my Stop along the way, with an initial R: R of 4.6:1 This is how it’s played out so far, again I think there will be more downside to come and I fully expect it to hit my TP, as before profits already banked 😊 In summary, even if you think a strategy is not working keep at it and keep back testing making tweaks along the way, if you keep changing your strategy you are basically having to start the learning process over again. Master your strategy and the trades will become second nature to you and your success rate will improve dramatically. The two trades above were taken over two days, RINSE and REPEAT!!

6 Comments

Spyros

14/4/2019 04:35:28 pm

Could not have said it better myself.

Reply

Steve

14/4/2019 04:44:02 pm

Looking forward to having you back with us during the day - we've all missed you, Spyros :)

Reply

Gerrit

14/4/2019 08:57:29 pm

Great examples Chris,

Reply

Chris

14/4/2019 10:28:03 pm

No worries Gerrit glad you found it helpful. I find putting a sell stop here generally makes it a better chance of being a winning trade, sometimes I’ll split my risk and put a TP at the next support/resistance and another at TZ1 or supply/demand. Good luck !

Reply

Chris

15/4/2019 01:44:07 pm

TZ1 hit on the 4hr for my XAUUSD trade in the blog post.. 219 pips banked :-)

Reply

Steve

15/4/2019 02:53:13 pm

Great stuff, Chris - well done :)

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed