|

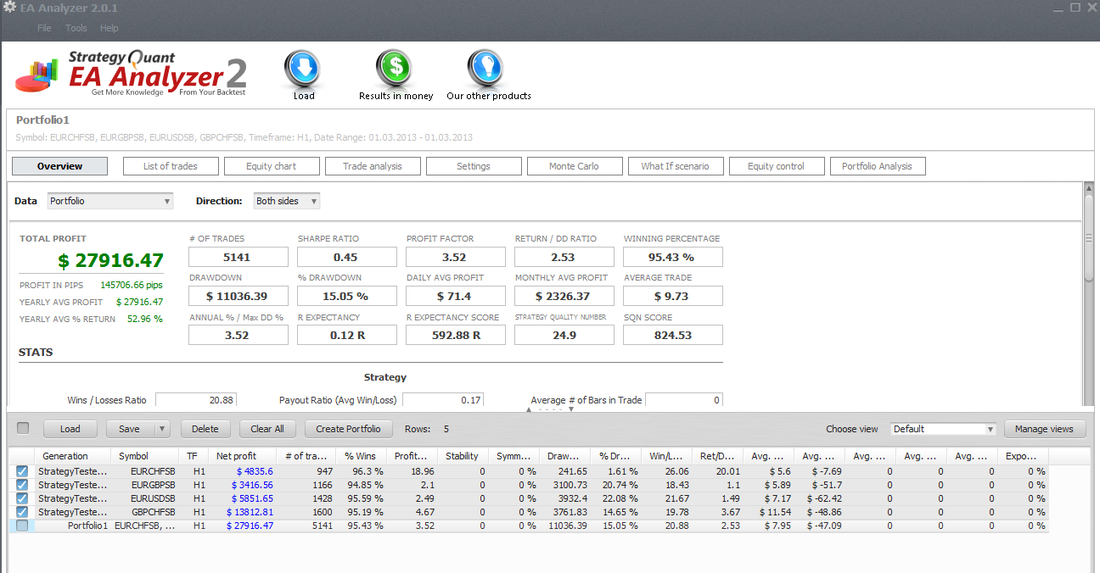

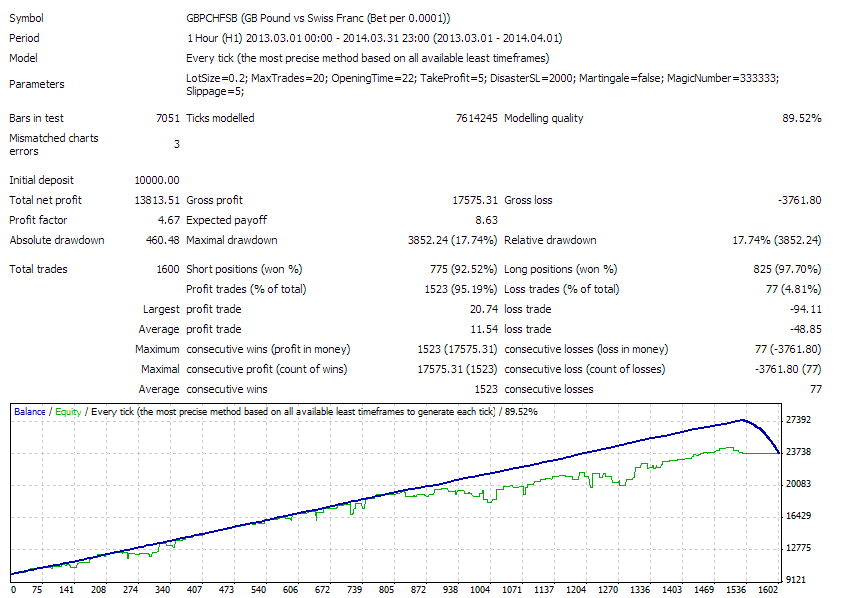

I’ve been writing and testing grid EAs, over the last few weeks (hence the lack of updates to the blog) with some rather surprising results; surprisingly good results, I might add. One EA on a portfolio of four pairs run through the MetaTrader Strategy Tester, for one year (March 2013 to March 2014), generated nearly 150,000 pips, tripling the account with a very small lot size and relatively low drawdown. You could turn a £10k account into £2.4m in just five years, at that rate. If it sounds too good to be true, it probably is … but here are the Strat’ Tester results … And here is the most profitable from the above portfolio ... (the drop off at the end is from the premature closure of trades when the tester date range ended) This particular EA works on the principle that price tends to range during the quiet periods. A simple concept and clearly a very profitable one; or is it? Well, my research so far, with my own and commercial EAs, is that a grid EA will more than likely blow your account, eventually – something that few of the commercial grid EA authors are particularly open about. Another EA is based on the idea that price will, sooner or later, retrace by a fair number of pips. This uses the dreaded Martingale approach, doubling-up on each trade (an even greater risk of blowing the account) but by setting a max number of trades to ten (and hence limiting the aggregate Martingale multiplier), the results were reasonably good and drawdown limited, though profitability not coming close to the first EA: about 15% return in a three-year period of testing. The Martingale factor significantly hampers the ability to increase the initial lot size, to benefit from the account growth, so I’ll be parking this EA for now. Here is an example for AUDJPY though. Other EAs that I’ve been working on are less likely to blow your account: trading like a professional trader might (or should): mostly price action off support and resistance, with logical profit targets and stop losses, plus various forms of trade management. It’s early days yet but, like the grid EAs, results are promising and I am encouraged to continue development.

One of the great things about developing EAs and indicators is the opportunity to test some of the commercial systems out there. I have had the pleasure / displeasure of working with some very well-known traders, who are easily found with a Google of 'Forex'. Some systems are beyond my coding ability (largely due to time required to code them), I have no shame in admitting. Some have proven to be the biggest load of crap with the system sellers being complete crooks. Some, however, renew my faith in humanity - there are a few, very genuine, full-time traders out there, willing to share their skills and experience for a relatively small fee. I will publish some of their names on this website in due course. One very nice ‘coach/mentor’, that I’ve had dealings with, was very strong minded in his opinions of EAs: adamant that they will never be profitable in the long-term; an opinion you will see quite often while web browsing. I couldn’t disagree more. Where there are logical rules, based on technical analysis, for trade entry, management and exit, there is definitely an opportunity for complete automation; I’ll never be convinced otherwise. Give me a shout if you want to automate your profitable trading system but please don’t ask if you just have ideas (I get many such requests). I’d ideally like to see at least three months’ worth of trades, using your unambiguous trading rules. If you can’t trade it manually, it will unlikely make for a good EA; unless it’s a grid EA that trades whilst you’re sleeping of course ;)

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed