|

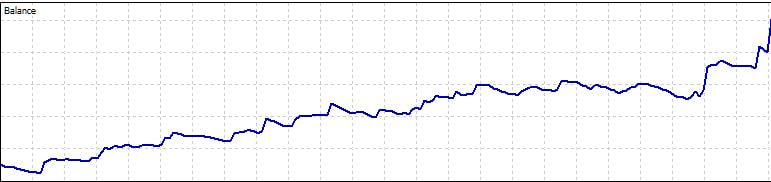

I set myself a challenge, at the start of September, to see if I could double a trading account in one month, with the fewest trades that I could get away with: I did that yesterday, a few trading days ahead of schedule.

This isn't a" blah blah look what I can do blog post" (ok, perhaps it is just a little) - there are a few key points that I wanted to make, as discussed in our Skype Trading Group. I used my Trade Copier for this account - taking my usual trades on my primary account and copying them to a second account. Why? So that I can switch off the copier when my targets for the day had been done, in terms of profits or losses. I had a few user and technical glitches as I was working on the copy code, which have since been fixed, so there were more trades than I would have liked, but the end-result was still good. The most important point is that this is conservative trading (with a consistent 1% risk), so when I felt I'd had a good trade or session, I switched off the Trade Copier. The idea is to average a 5% return per day - the ideal approach to doubling your account in a month. If I did that 5% and a trade was still open, I'd switch off the copier and lock in tight with a manual trailing stop. I'd also switch off if I had a few losses in a session - some sessions can be complete shit, no matter how good a trader you are. There were many days where my gains on the copy account were much less than my main; some days the reverse was true. 5% a day, or 5R, really isn't that hard to do when you're getting your entries on the M1 timeframe but targeting a higher timeframe price magnet. The key, as always, is waiting for the AAA+ setups, to buy the dip or sell the rally, to get you going to your desired price target. It's an even easier thing to accomplish if you're only taking trades that offer a minimum of 5R, as is the golden rule in our trading group. A key point that needs stressing: at no time did I take partial profits. I know many yet-to-be-successful traders who do that – it’s really not a good idea. Manage your stop losses with logic, not fear of loss. Don't let the naysayers tell you that retail traders can't make terrific profits because the big dogs can only do 10% a year. Master your discipline and the trading will take care of itself. All trades were on DAX and DOW in the London morning session; DOW and NASD in the London afternoon (NY morning) session.

2 Comments

Kiwi

28/9/2022 10:03:12 am

Superb achievement and shows what can be achived with simple target and LPR optimisation, learning the art of doing nothing is a trading must. great to tag along for the ride

Reply

Steve

28/9/2022 10:52:30 am

Cheers Ray - good trading with you and glad you've been able to do many of the trades that I did; and sometimes more.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed