|

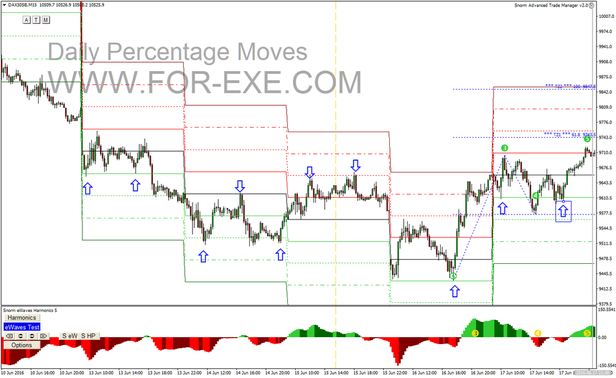

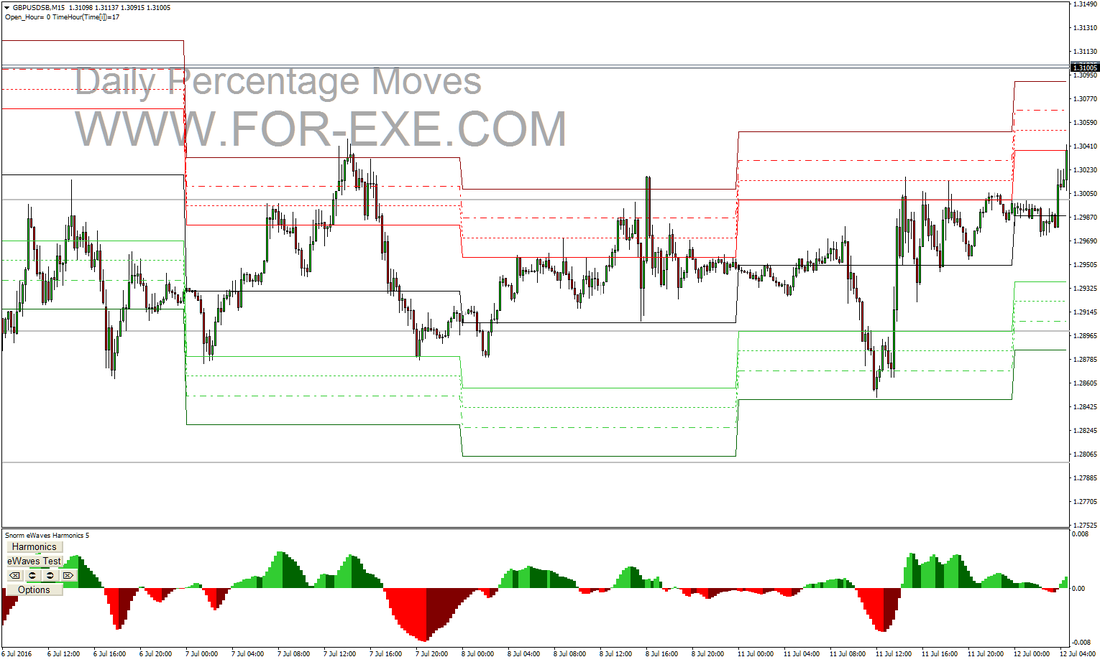

When you listen to the news, be it national TV or specialist channels such as Bloomberg, you will usually hear that a particular instrument - be it an index, commodity, forex pair, etc. – has gone up or down by x percent on the day. Percentage gains and losses are easy to understand whereas pips can be relatively meaningless, if you don’t know the price of the instrument and what its typical daily movements are. So it’s rather surprising that I never hear any retail traders refer to percentage moves on the day. The percent levels probably act as well as pivot levels in terms of support and resistance. A gain or loss of just half or one percent, from the opening price, can be quite significant and prove to be the ceiling or floor of that day’s move. With the help of an indicator to plot the percentage levels and some basic candle analysis, a trader can find some nice trading opportunities, as this example shows (a random period on Dax M15 with just some of the possible quick trades). Just for the fun of it, I thought I’d see how fib-based percentage moves might look. Here is a period on GBPUSD with 38.6, 50, 61.8 and 78.6 percent levels. It’s easy to check what the typical daily percentage moves are on any instrument, using the ‘History Centre’ in MetaTrader. Select the instrument and daily timeframe; ‘export’ to a csv file; add your own excel calculations to get the percentage difference of high and low from the open. With the help of a pivot table you can quickly see, for example (using 1,555 bars), that 62% of the time, the high and low on the Dax is at least half a percent from the open. About 34% of the time, the high and low will be one percent or more. Only nine percent of the time there has been two percent or more gain but twelve percent of the time there has been a two or more percent drop. You’re more than welcome to have a play with the percent level indicator – just download it from the Free Indicators tab. This isn’t some magical indicator that will necessarily guarantee improved trading results but you might find it of some use. It has the option to work with yesterday's close price, today’s open or the market open hour of your choosing. You can of course customise the percent levels as you prefer. The main thing is that percentage moves on any instrument are something to be mindful of. Would you go long on the Dax when it has already moved one percent up on the day, knowing that, according to history, there is only a 1 in 3 chance of price going higher?

2 Comments

Spyros

30/8/2016 07:15:57 pm

Nice info as always Steve.

Reply

Steve

30/8/2016 07:38:11 pm

χάρη Σπύρος

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed