|

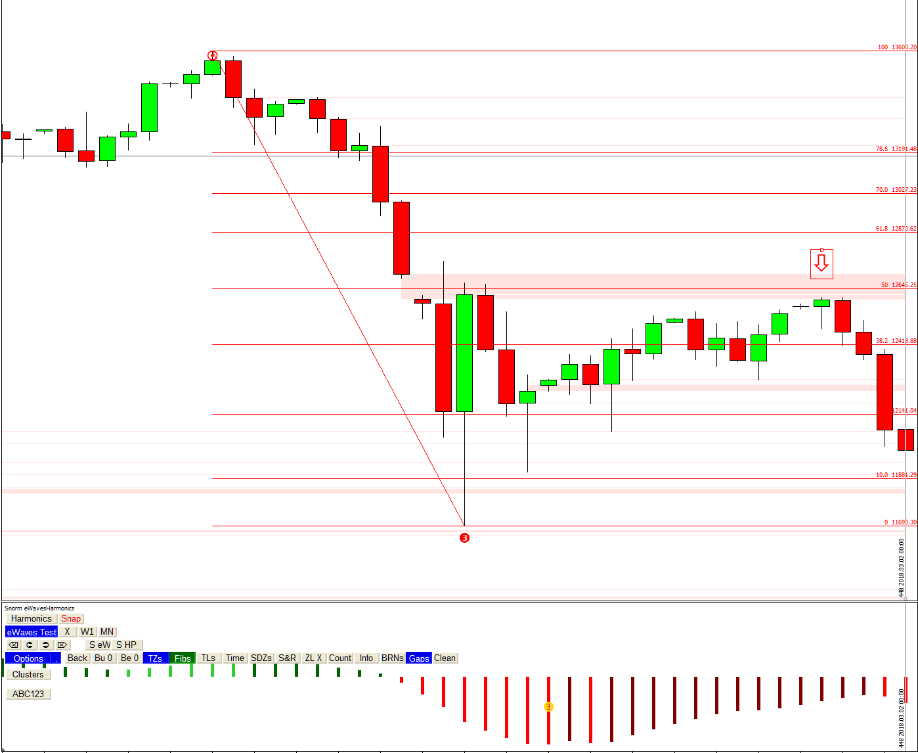

What is a ‘trade setup’? It’s a point in time where price has done something, perhaps at some level, perhaps with a combination of indicators, that tells a trader it’s a good time to buy or sell an instrument. We’ll just call them setups, for the purpose of this article, regardless of how they were derived. There are an infinite number of different setups and, in isolation, you might find that most of them work (lead to a profitable trade) at best, 50% of the time. Of course, the definition of ‘work’ will very much depend on the skill of the trader, in determining where to place a stop loss, how to manage the open trade and when to close it; and, deciding whether or not to trade it in the first place. From what I know of most traders, they seek trades with a very one-dimensional view – staring at a chart on one timeframe and waiting for the setup to tell them to trade. Pop-up alert, place trade, pray for a favourable outcome. That might work for some lucky traders but, going by the percentage of retail traders who fail, it’s clearly not a good approach for the majority. The thing about most buy-sell indicators is that they are usually even more one-dimensional than the rookie trader. They don’t consider how price got to where it did: the path it took; the time it took; how the price bars looked before the setup; key support & resistance levels; supply and demand; etc. etc. A buy setup might actually be a good sell setup, when the many factors are considered, instead of the singular thing. Take this candle, for example: - However, when you look at it in context, it’s really telling you that now might be a good time to sell; in fact, there were four good reasons why it was a good time to sell, just from the one timeframe, can you see them? One of our favourite so-called setups, using eWavesHarmonics, is the W4 TLB – a way of identifying the possible end of a corrective move. However, as I was discussing with one of my trading friends, in our Skype Trading Group, a W4 TLB isn’t a buy/sell signal on its own. There are other things to consider: -

You should be using setups as a means to get into a trade, with sufficient R:R, in the direction you had already discerned as being favourable, towards a target price that you had already determined to be most likely. You don’t want to be using setups to randomly trade in any direction without a price target already in mind. It’s not as complicated as it sounds – our brains can look at these things in microseconds and draw the right conclusions. All is covered in the Free Trader Training Course, if you have no idea what I’m talking about .

2 Comments

Rob Montgomery

7/12/2019 01:20:00 pm

A nice, succinct statement of how to truly discern a trading opportunity.

Reply

Steve

7/12/2019 01:40:03 pm

Hey Rob - thanks for sharing your wise thoughts. Absolutely right, of course,fear and greed is the ruin of many an otherwise good trader.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed