|

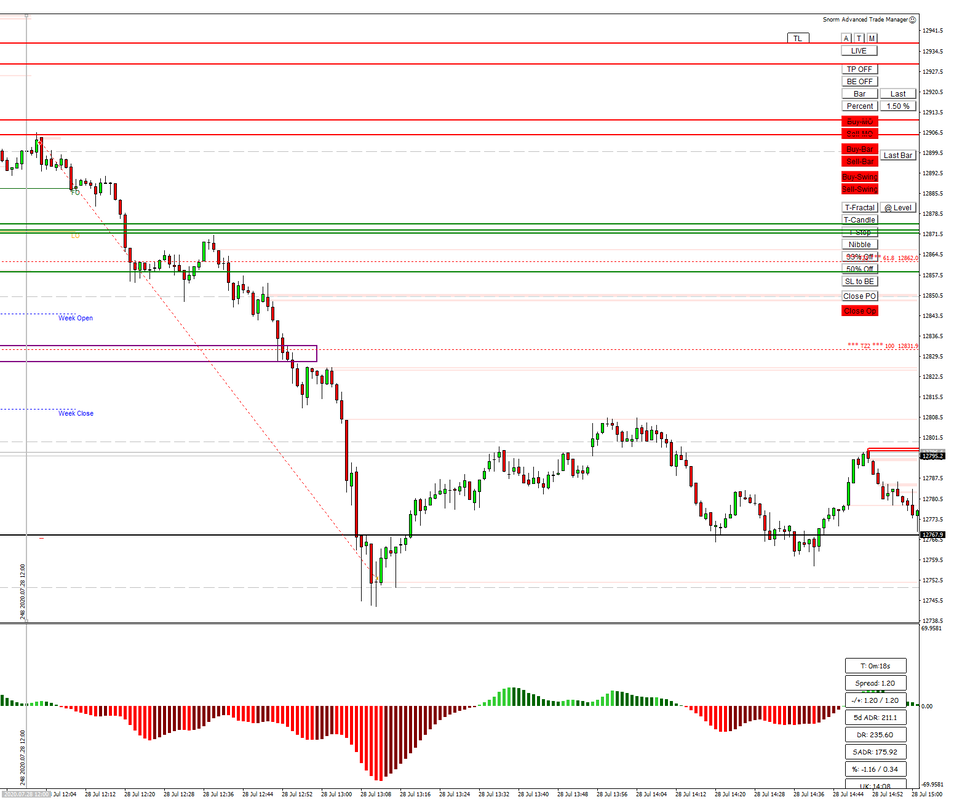

One of my trading friends in Australia had terrific end to the week, trading DAX M1. I thought this worth sharing, just to show what can be achieved with a clean chart and a simple approach to price action trading. eWavesHarmonics signalled a W4 TLB (shown below by the green bomb symbol). A pending order long trade was placed: one-click using ATM, risking just 1% with automatic stop loss placement. There was a second chance to enter when price corrected, to trade what we call the TLBT – that would have reduced the pip-risk and increased the lot size slightly, for a greater return. When the trade was 1% in profit, my friend pressed the ATM T-Frac button and went to bed (it was rather late in Australia). As you might imagine, he was rather pleased to see the 7.6% return when he woke up in the morning :) Moves like this don’t happen that often, so I was extremely happy to see that at least one of my trading friends caught this move. Trade the simple setups consistently– and this one was a perfect example – you’ll be substantially rewarded when the big moves happen. There was another W4 TLB trade that preceded the big move. Price went to the predicted TZ1 level and ATM closed the trade using the T-Candle function. The combined trades gave more than 120 pips return. There are loads of W4 TLB trades, on all time frames and all instruments. They are easy to trade, usually offer a relatively low pip-risk and a good reward, when price goes to the TZ1 or TZ2 levels. If you're struggling with your trading then perhaps you should give eWavesHarmonics a go - pick the best setups and be disciplined in your trade management. With ATM, you can even do some of it in your sleep ;)

1 Comment

Darren Messenger

7/5/2017 01:13:46 pm

Just shows what can happen when you are not expecting it too!

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

May 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed