|

As all traders know, there are several order types. For the avoidance of doubt, I’ll define them : -

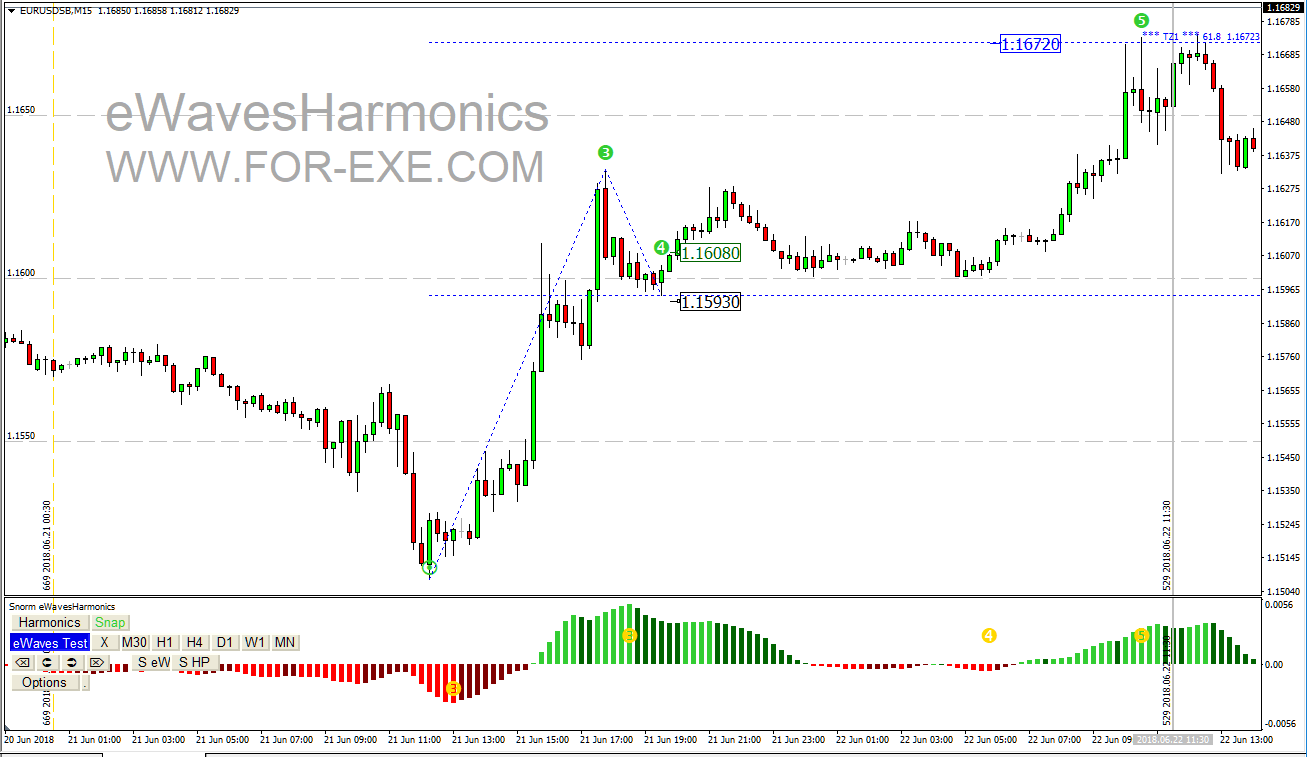

Here’s a quick reference ..… Most of the traders that I communicate with will say they prefer stop orders – they find a trade setup and place buy stop orders just above a key bar; or sell stop orders just below that bar. The goal here is to minimise the number of losing trades by making sure that price really is moving in the favoured direction. There is nothing wrong with that approach; I do it a lot as well. There is however a drawback in that you’ll be reducing the potential risk:reward on a trade. Let’s look at a great eWave4 to eWave 5 TZ1 trade, on EU M15, in June (spread is not factored in the prices quoted). A typical buy stop entry would have been at 1.16080. The stop loss would have been placed at 1.15930 and target price set at 1.16720 (or perhaps a few pips below). Risk is 1.16080 - 1.15930 = 15 pips. Reward is 1.6720 – 1.16080 = 64 pips That’s a healthy R:R of 4.27:1 – a pretty good trade. Of course, if you’d waited for the high of eWave 3 to be broken, at 1.16330, your R:R would have been less than 1 – that’s definitely not a good trade. On many occasions (I won’t quote stats that I can’t back up but it could be around 50% of the time), an impulsive move will retrace to where it originated– back to the supply or demand zone. You can see that it happened at the start of the eWave 3 – that only took 2 bars; and it happened at the start of the eWave 5 – that took about 20 bars and was tested again later before the price really moved. This is why eWavesHarmonics (eWH) draws the zones relatively quickly, rather than wait for them to be confirmed in the traditional sense. Knowing that these zones are often tested (an SD bounce) or can be reversed and tested (an SD flip) we can anticipate where price is likely to go and place limit orders; or, if we’re quick, we can place market orders. Using the same EU example but this time placing a market order (note the BRN confluence for entry) … Risk is 1.16020 - 1.15930 = 9 pips.

Reward is 1.6720 – 1.16020 = 70 pips That’s a healthy R:R of 7.8 to 1 … not far off double your profit. by improving your entry by a mere 6 pips; assuming that your lot size is calculated as a percentage of account divided by pip risk. If you just did a fixed lot size on every trade (not a recommended approach), you’d be risking much less and making a little extra profit, which is not to be sneezed at. There will be times when you could increase your returns by many times more than that – a typical 2:1 trade could easily be 15:1, for example, by waiting for the best possible entry; or much much more. Yes, you risk having more losing trades by using limit or market orders. The upside though, speaks for itself. If you can be getting triple your normal returns, on average, you can afford to have a few more losing trades. Perhaps you might want to mix your order types: a pending order as usual followed by a limit order should price retrace on itself. That way you’ll be covering it both ways, in case price doesn’t come back. Don’t get stuck in a rut with how you place trade orders. Always look for the best possible returns on your investment by being adept with your order types. See the Trader Training course to learn how we trade with eWH, as in the above example.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2024

|

|

Website design by Snorm

|

RSS Feed

RSS Feed